Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Cardano (ADA)

Cardano ADA is a proof-of-stake blockchain platform that says its goal is to allow “changemakers, innovators and visionaries” to bring about positive global change. The open-source project also aims to “redistribute power from unaccountable structures to the margins to individuals”, helping to create a society that is more secure, transparent and fair. Cardano is used by agricultural companies to track fresh produce from field to fork, while other products built on the platform allow educational credentials to be stored in a tamper-proof way, and retailers to clamp down on counterfeit goods.

ADA Price Analysis

At the time of writing, ADA is ranked the 3rd cryptocurrency globally and the current price is A$4.04. Let’s take a look at the chart below for price analysis:

ADA‘s 160% rally during the last month recently swept the May highs at A$3.43. The daily close over these highs might show that bulls plan to continue the move. If so, aggressive bulls might add more to their positions near A$3.51, with A$3.29 and A$3.13 also providing possible support.

Predicting the end of the current bullish trend is impossible. Still, extensions suggest that A$3.80, A$3.98 and A$4.18 provide reasonable near-term areas to take profits.

A bearish shift in the marketplace could drive the price down much further. If so, the swing low at A$2.60 offers a tempting target. If this stop run occurs, the price could drop further into possible support at a confluence of high-timeframe levels near A$2.22.

2. Icon (ICX)

Icon ICX is a decentralised blockchain network focused on interoperability. With ICON’s “blockchain transmission protocol”, independent blockchains like Bitcoin and Ethereum can connect and transact with each other. This opens up cross-chain use cases that are impossible without an interoperability layer such as ICON. The ICON blockchain is powered by loopchain, a blockchain engine designed by IconLoop.

ICX Price Analysis

At the time of writing, ICX is ranked the 94th cryptocurrency globally and the current price is A$2.15. Let’s take a look at the chart below for price analysis:

ICX‘s recent sweep and close over the cluster of highs near A$1.86 could suggest it’s ready to kick off a new bullish trend. However, hopeful bulls should be wary of rejection near the current area that could push the price back into its three-month range.

The old highs and daily gap near A$1.88 might support the price if bulls are ready to push up from the range. The levels at A$2.06, A$2.30, A$2.58 and possibly up to A$2.97 offer reasonable areas to take profits and watch for signs of bearish reversal.

A bearish shift in the marketplace could prompt a stop run to the layered swing lows at A$1.50, A$1.39 and A$1.31. If this stop run occurs, bulls could look for support near the significant weekly zone between A$1.22 and A$1.15.

3. NewsCrypto (NWC)

The NewsCrypto token NWC is the native token of the NewsCrypto ecosystem, which offers a comprehensive set of indicators, educational resources, and entertainment for everyone from novice traders to experts in crypto. The project aims to offer everything that a crypto trader needs in one place, while also creating a community-focused ecosystem where users can learn from each other and earn NWC for posting quality content. The NWC token is used to unlock access to the online platform, which is focused on interactive education on blockchain technology and cryptocurrency trading.

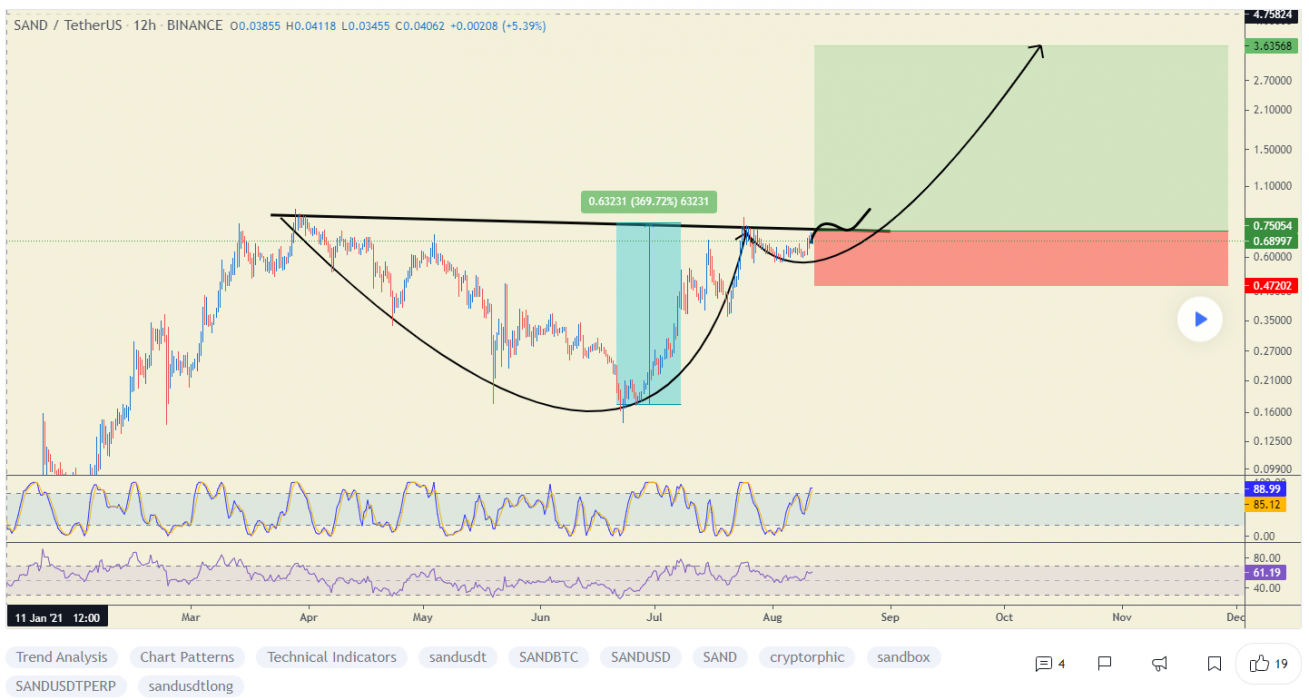

NWC Price Analysis

At the time of writing, NWC is ranked the 318th cryptocurrency globally and the current price is A$1.28. Let’s take a look at the chart below for price analysis:

NWC‘s 80% drop from May to July may have found a range low near A$0.61. The recent break and continuation through the short-term highs near A$1.05 and A$1.10 suggest some bullish strength.

Bulls are likely to take some profits near the high end of the current range. The areas near A$1.36 and A$1.55 offer some confluence for resistance. The swing high near A$1.60 might be the current target, followed by possible continuation up to A$1.86 and into resistance near A$1.89.

Aggressive bulls might bid near the last high and daily gap around A$1.14. However, a drop to possible support around A$1.02 is reasonable. A market-wide retracement could send the price down to sweep relatively equal lows near A$0.84. If this stop run occurs, the price could find support between A$0.83 and A$0.61.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.