Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. VeChain (VET)

VeChain VET is a blockchain-powered supply chain platform. VeChain aims to use distributed governance and Internet of Things (IoT) technology to create an ecosystem that solves some of the major problems with supply chain management.

VET Price Analysis

At the time of writing, VET is ranked the 23rd cryptocurrency globally and the current price is A$0.09351. Let’s take a look at the chart below for price analysis:

During July, VET has consolidated under the July monthly open inside an approximately 25% range. This consolidation could point to accumulation.

Bulls immediately bought up dips to support at a weekly level near A$0.08749 and a monthly level near A$0.1057, showing substantial buyer interest.

A cluster of relatively equal daily lows around A$0.08544 provides an attractive target for a stop run, creating a potentially excellent entry for bulls. More aggressive bulls could enter on dips to the closer support beginning at A$0.07951

If Bitcoin tumbles, a more pronounced dip could reach as low as the equal lows near A$0.07352, running stops into support beginning at A$0.07015. This move would give a good risk/reward entry for bulls targeting the high below resistance starting at A$0.1162, the relatively equal highs near A$0.1492, and the June high near A$0.1917.

2. MyNeighborAlice (ALICE)

ALICE is a multiplayer builder game, where anyone can buy and own virtual islands, collect and build exciting items and meet new friends. Inspired by successful games such as Animal Crossing, the game combines the best of the two worlds – a fun narrative for regular players who want to enjoy the gameplay experience as well as an ecosystem for players who want to collect and trade Non-Fungible Tokens (NFTs).

ALICE Price Analysis

At the time of writing, ALICE is ranked the 187th cryptocurrency globally and the current price is A$10.61. Let’s take a look at the chart below for price analysis:

After accumulating under the July monthly open, ALICE rallied 129% in a week before retracing to support near A$9.55.

Buyers continue to snatch up dips under the weekly open, suggesting that accumulation is still taking place.

Bulls could look for entries in this region while being conscious of a potential stop run below the cluster of lows at A$8.82. Two areas of support, beginning near A$8.57 and A$8.29, provide probable buys if the price dips this low.

The equal highs near A$12.63 provide a first reasonable bullish target. If the price takes this target and penetrates the surrounding resistance, the next probable resistance begins near A$14.66. Possible targets include the old highs just above this resistance near A$19.83, A$21.46, and A$24.39.

3. Shiba Inu (SHIB)

Shiba Inu SHIB coin was created anonymously in August 2020 under the pseudonym “Ryoshi.” The meme coin quickly gained speed and value as a community of investors was drawn in by the cute charm of the coin paired with headlines and Tweets from personalities like Elon Musk and Vitalik Buterin.

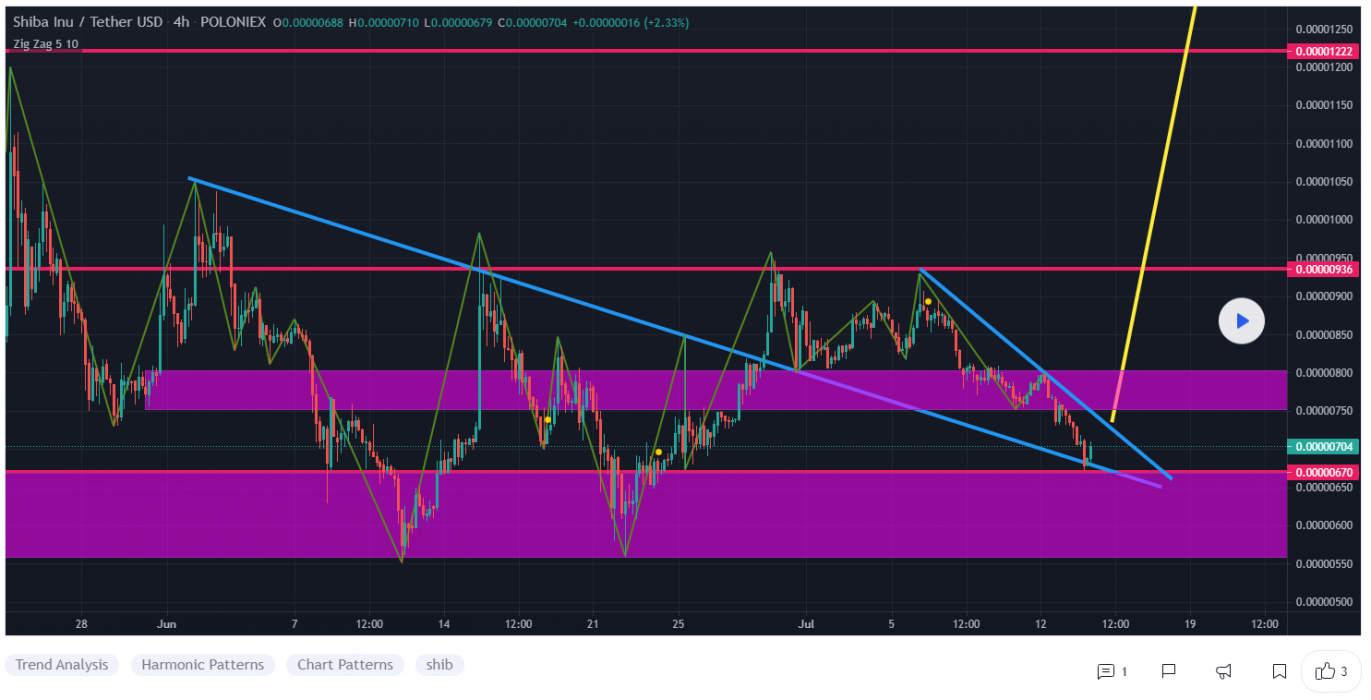

SHIB Price Analysis

At the time of writing, SHIB is ranked the 34th cryptocurrency globally and the current price is A$0.000009329. Let’s take a look at the chart below for price analysis:

SHIB wasted no time during June, rocketing upward over 85% from the last week of the month into the resistance near A$0.000015829.

For the last several days, the price has consolidated sideways and appears to be flipping old resistance near A$0.000011829 to support. If this level breaks – perhaps due to the tempting daily equal lows below – the next support begins near A$0.000008529.

Bulls entering at these levels could set their first target near the previous resistance near A$0.000012159. Beyond this level, probable targets include the old highs near A$0.000013529 and the resistance above near A$0.000013929.

A break of this resistance later this month could continue to the highs near A$0.000015229 and A$0.000015829.

Where to Buy or Trade Altcoins?

These three coins have the high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.