When Decentralised Finance (DeFi) lending protocol Cream Finance suffered a devastating US$130 million attack two weeks ago, the team decided to compensate users for their losses in CREAM by pushing up the total supply and in return pulling down the price.

Following the hack, the Cream team moved to redistribute 1,453,415 coins from its treasury to the impacted users. In September, Cream also paid back its users for a different attack that cost the protocol US$19 million.

In terms of changes in security, Cream has tightened its token listing strategy to no longer include long-tail assets or tokens that can be wrapped/unwrapped.

Collateral Cap limits are deployed across all markets to increase security, while additional monitoring and alerting solutions are undergoing assessment and implementation.

CREAM Finance

Price Drops as Compensation Inflates Token Supply

While Cream has 9 million coins in its total supply, according to CoinMarketCap only 150,000 of those are in circulation. A rapid increase in supply was bound to have an effect on demand, and therefore the price per coin.

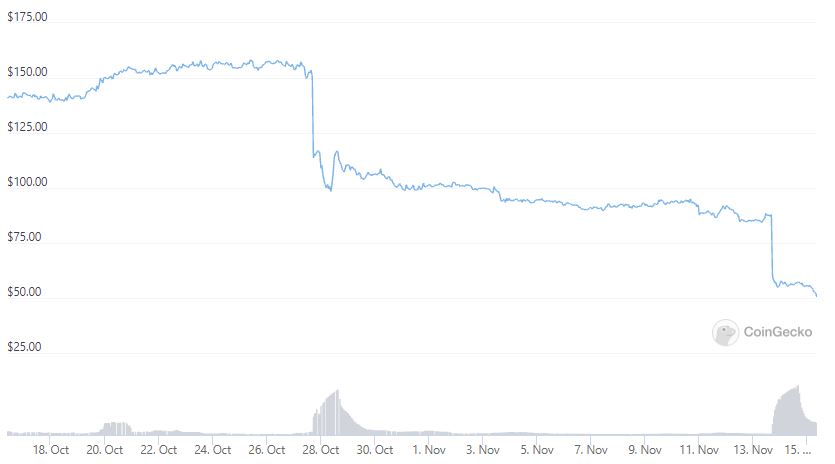

The price of the coin had fallen from around US$88 to as low as $49.80 at the time of writing – a 43 per cent drop, according to CoinGecko. Before the October 27 exploit, Cream was trading above $152, suffering a 66 per cent drop in price since then. This is now the second significant drop in price the protocol has seen in a short span of time, and the mood among users is dark:

Individuals hit by the attack seem to have divided into two camps: some of those seeking recourse also seek to undermine the effort to compensate Cream’s users, while others realise the risk of DeFi and that it’s their responsibility to do their own research and understand the risks associated with the nascent technology.

Most of the time victims of such attacks never see anything in terms of compensation, which makes Cream quite the gift-giver, having paid out its users twice after attacks.