The city of Bogotá in Colombia has recently announced the “Hub Blockchain Bogotá” project, which aims to assist 100 companies in developing blockchain solutions.

Claudia Hernández, Mayor of Bogotá, Colombia’s capital city, announced that four financing programs totalling US$8.8 billion have been made available for companies to apply to, one of which is specifically aimed at companies using/developing blockchain technology.

The 100 companies selected by the Hub Blockchain Bogotá project will receive $2.8 billion in direct funding, logistical support, as well as the formation of a Blockchain academy to improve blockchain knowledge and skills.

Each venture, each company, will be able to receive from the Fund for Innovation, Technology and Creative Industries of Bogotá [FITIC] between $10 [million] and up to $50 million in capital to be able to take their idea forward, but also in support for strategic resources, whatever each entrepreneur needs, and also in markets.

Claudia López, Bogotá mayor

Official applications to FITIC were to be received from June 25 and the names of the winners announced on August 20.

Bogotá’s Push For a Smart City

The larger initiative, of which Hub Blockchain Bogotá is a part, is looking to help businesses and entrepreneurs through innovation and technology, keeping a broader focus on the environment and green technology to help solve problems faced by the city and businesses confronting the fourth industrial revolution.

We want to make Bogotá a benchmark in innovation and a smart city. With these four FITIC programs we will help those companies and entrepreneurs who are looking for new solutions to respond to current and future challenges, as well as those generated by the fourth industrial revolution.

Claudia López, Bogotá mayor

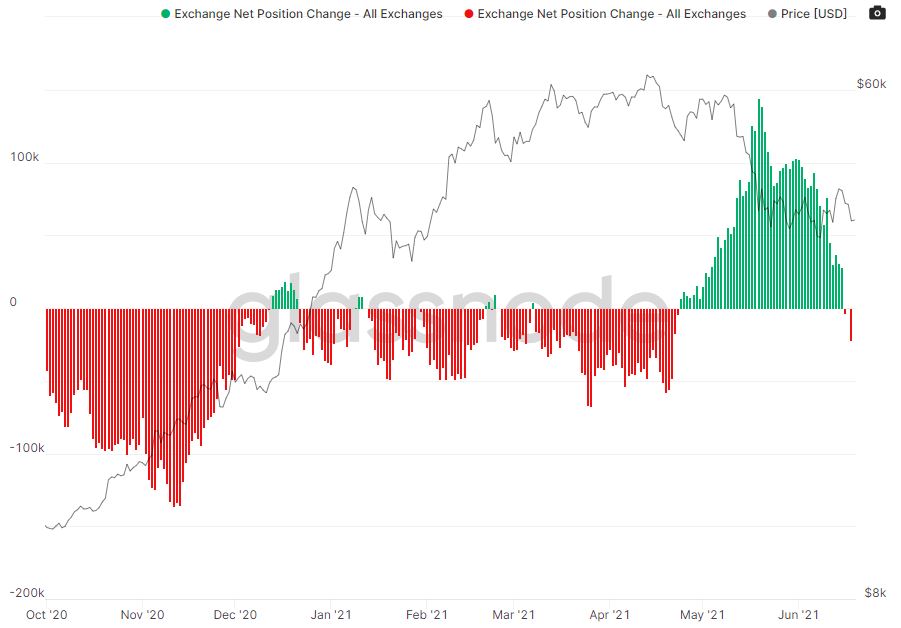

Colombia is Already Deep in Crypto

Colombia’s financial regulator launched a cryptocurrency sandbox earlier this year allowing banks to explore business models associated with handling crypto assets. The government is also working with the World Economic Forum (WEF) on a blockchain-based solution to track government contracts transparently.

The country is emerging as one of the fastest-growing crypto markets in the South American region, second only to Venezuela, according to the Chainalysis 2020 global crypto adoption index. Colombia has ranked ninth in the index, only three places behind the US. Peer-to-peer marketplace LocalBitcoins reported that Colombia accounted for 11.3% of its global trading volume throughout the year, the third-largest market globally by trading volume.