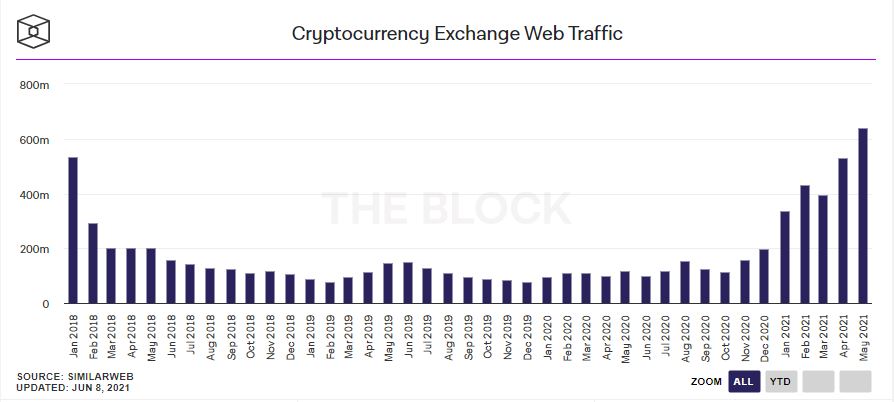

The crypto space has been turbulent during the past few months but according to new evidence, crypto exchange web traffic hit an all-time high in May.

According to data compiled by The Block, web traffic to cryptocurrency exchanges reached a record high of visits, with exchanges recording a total of 638.23 million visits in May. This represents a 20.4 percent increase compared to April and a 33 percent increase from March.

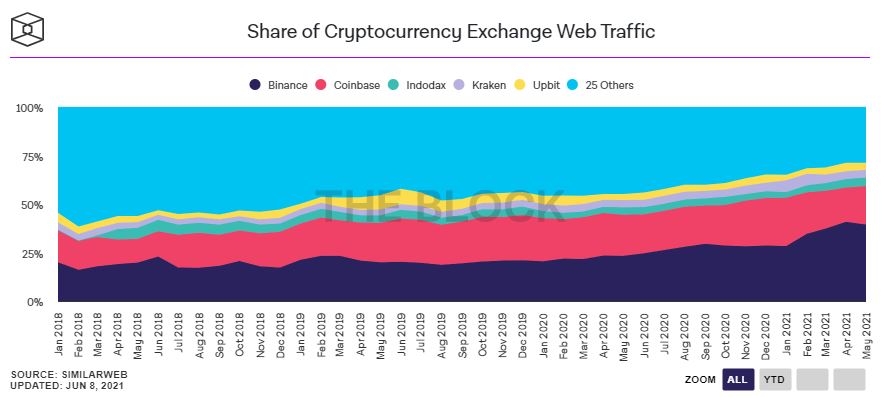

The most visited crypto exchange during May was Binance, with 39.4 percent of the traffic, followed by Coinbase with 19.9 percent.

Binance Is Growing Fastest in 2021

Coinbase, one of the major US crypto exchanges, does not deal exclusively in crypto whereas Binance is a crypto-only exchange. Among the crypto-exclusive exchanges, Binance has by far the biggest market share with 72 percent in this category.

Binance looks to be dominating almost all research metrics relating to crypto exchange usage.

Cryptos Piquing Aussie Interest

At the same time, the number of Australians embracing crypto is clear when looking at who uses exchanges and related technology. Earlier this year, Binance Australia saw record growth in Q1 2021 and Swyft also saw record growth due to crypto’s massive increase in popularity and mainstream media coverage in Australia.

There has also been an increase in crypto-related searches on Google for Bitcoin (BTC) and NFTs, and an all-time high number of searches for Ethereum (ETH) in the past four months. Additionally, the volume of Aussies looking at cryptocurrencies on TradingView is up 132 percent since July 2020.

Looking at the information, it’s clear there is keen interest in cryptocurrencies and that people are more active on exchanges than ever. Whether it’s buying or selling, there’s lots going on.