Wall Street is buzzing as the largest U.S. crypto platform is setting up for its debut on a traditional exchange on Wednesday. As Bitcoin and other cryptocurrencies rise to record levels ahead of the direct offering there has been varied speculation about the listing price.

The Nasdaq on Tuesday night set a reference price for the company at $250 per share, meaning the company is can be valued at around $49.19 billion USD. Should Coinbase hit the public market around its latest private market valuation of $100 billion, taking into account a fully diluted share count, it would instantly be one of the 85 most valuable U.S. companies. Nearly 115 million Coinbase shares will be put on the market to start.

The opening public price will be determined based on buy and sell orders in the opening auction on Nasdaq.

Nasdaq

Varying Expectations of The Listing

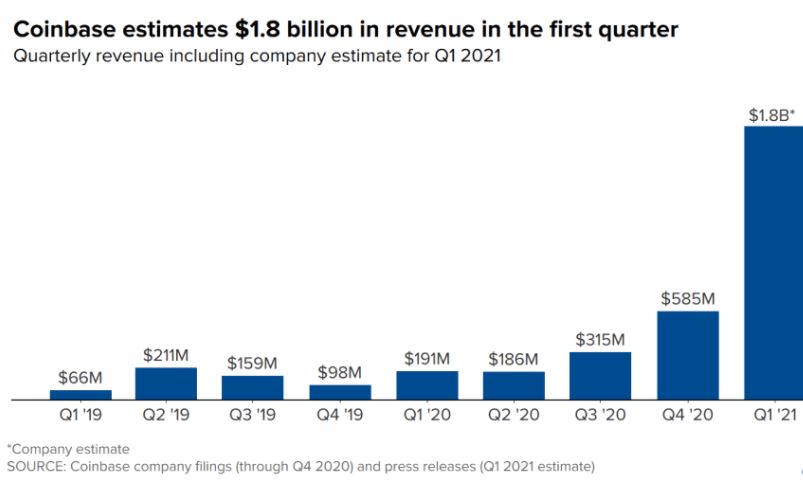

Investors expect that valuations could top $100 billion, since the company just published an astounding set of preliminary Q1 2021 results, with revenue jumping 9x year-over-year. In an implied valuation on Tuesday by FTX exchange, Coinbase was valued at approximately $150 billion USD.

Coinbase would be valued more than Nasdaq, which has a market cap of $25.9 billion and possibly the Intercontinental Exchange (parent company of the New York Stock Exchange), valued at more than $66.9 billion.

They make more money than any publicly listed exchange in the world. They’ll make more money than Nasdaq… Coinbase is also not the most profitable cyrpto exchange in the world.

Tom Lee, Fundstrat founder

There are positive and negative outlooks at the valuation of Coinbase, Stock research firm New Constructs stated it should be valued at $18.9 billion USD, since “the company has little-to-no-chance of meeting the future profit expectations that are baked into its ridiculously high expected valuation of $100 billion“.

On the other hand Susquehanna, a research and trading firm was considerably more optimistic stating a fair valuation would be between $96 and $108 billion USD, due to the company’s high growth.

Can Coinbase Be Consistently Profitable?

This could be a pivotal moment for the crypto currency industry however, investors need feel the need to practice caution, since the company has a dependence on the price of virtual currencies, which tend to be volatile. So the implication is that Coinbase’s revenue is correlated with the level of activity in cryptocurrency and especially Bitcoin and Ethereum. If price or volume declines, their business, operating results, and financial condition would be adversely affected.

The success of Coinbase and cryptocurrencies in general seems to have inspired competitors too. The head of the California-based cryptocurrency exchange platform Kraken told CNBC last week he hopes to take his company public next year, also via a direct listing – possibly resulting in more options for investing in digital asset exchanges.

The listing is significant in that it marks the growth of the industry and its acceptance into mainstream business.

William Cong, an associate professor of finance at Cornell University’s SC Johnson College of Business