One of the largest United States cryptocurrency exchange, Kraken, announced on Thursday, the single-largest expansion of its crypto-to-fiat currency trading pairs primarily for crypto users and traders in Australia and the United Kingdom.

More like a reason, the exchange mentioned that both countries have “substantial upside potential.” Hence, Kraken intends to expand its presence in both markets through the new cryptocurrency trading pairs for the Australian dollar (AUD) and the British pound (GBP).

The US exchange added a total of 26 direct trading pairs, 13 pairs each for the AUD and GBP. According to the announcement, there has been an increased trading activity on the exchange from Aussie and UK users. So, Kraken is apparently launching more trading pairs to capture more trades from the markets.

In addition to expanding the number of tradable coins available in AUD and GBP, these pairs make it easy for the users to enter and exit the market.

Aussie Market is Becoming Attractive

The supported coins for the Australian dollar include popularly-traded cryptos like Polkadot (DOT), Chainlink (LINK), DeFi token Aave (AAVE), Cardano (ADA), etc. “The cryptocurrency space isn’t just about Bitcoin, and it isn’t just about the US dollar,” the managing director of Kraken’s Europe operation, Curtis Ting, commented.

Despite the smaller available pairs, Australia became one of the fastest-growing markets in Kraken after the exchange allowed AUD funding last year, likewise the UK.

“By expanding AUD and GBP markets into a far greater number of digital assets, Kraken is doubling down on its commitment to ensuring all clients globally can more seamlessly interact with any number of the cryptocurrencies available on our exchange,” Ting added.

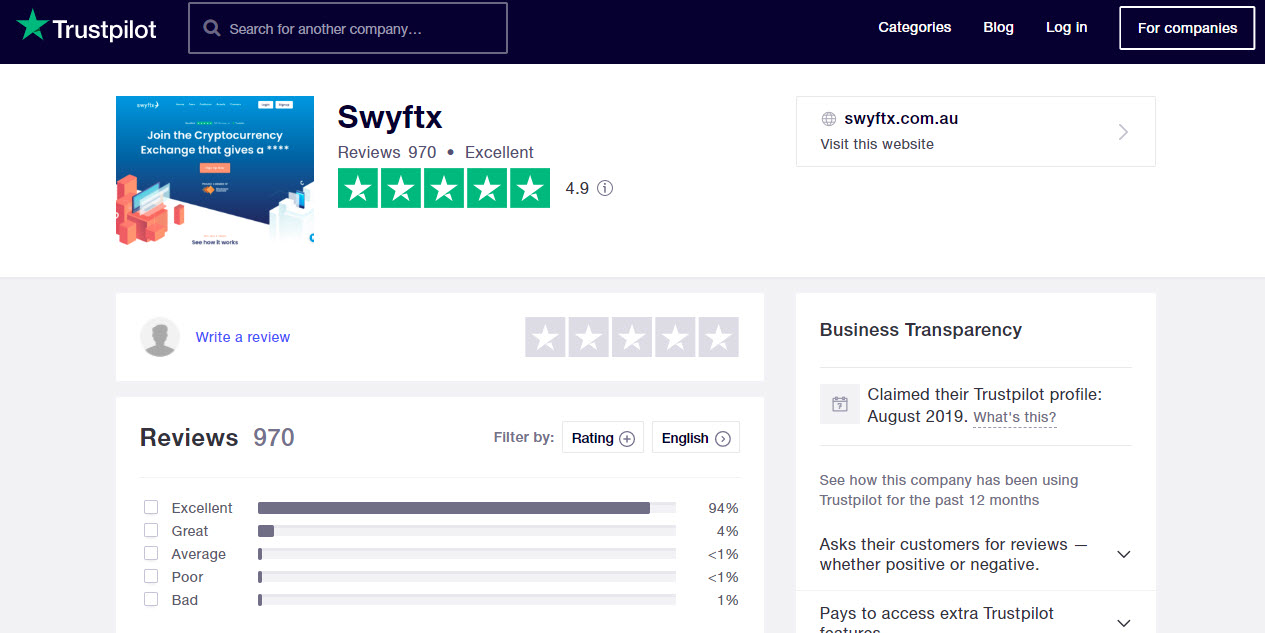

It’s no doubt that the Australian crypto market is growing rapidly. On Wednesday, Crypto News Australia reported that Swyftx, one of the leading Aussie crypto exchanges recorded a massive growth in users over the past year. Also, Binance Australia recorded about 400 percent growth in the number of users since that last quarter of 2020.