Aussie investment bank Macquarie recently stated in a research note that the slow and cautious approach to Central Bank Digital Currencies (CBDCs) could end up costing central banks in the long run.

Potential Foothold By Cryptocurrencies May Soon Become Insurmountable

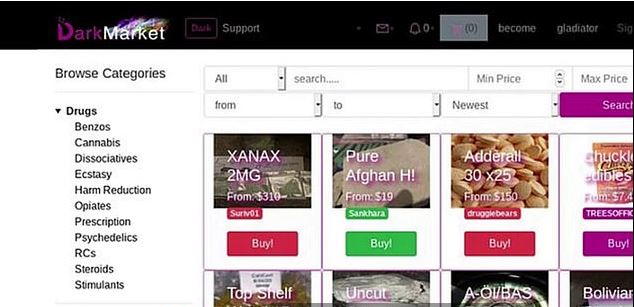

Although the European Central Bank, (ECB), the U.S. Federal Reserve, the Reserve Bank of Australia (RBA), and China are all in various stages of researching and even testing CBDCs, Macquarie fears that by the time any of these institutions actually get around to launching a CBDC, the market share in eCommerce occupied by well-known private cryptocurrencies may prove an insurmountable obstacle for central banks.

“The central bank digital currency landscape in free markets is lagging the pace of crypto adoption – it is still unclear how entrenched private cryptos will become before CBDCs become a viable alternative for more efficient transactions. We think the use cases for private crypto could come to fruition if commerce becomes too accustomed to private crypto use prior to a CBDC alternative launching as a stable, legitimate alternative. And fiat debasing could also in fact help demand stick.”

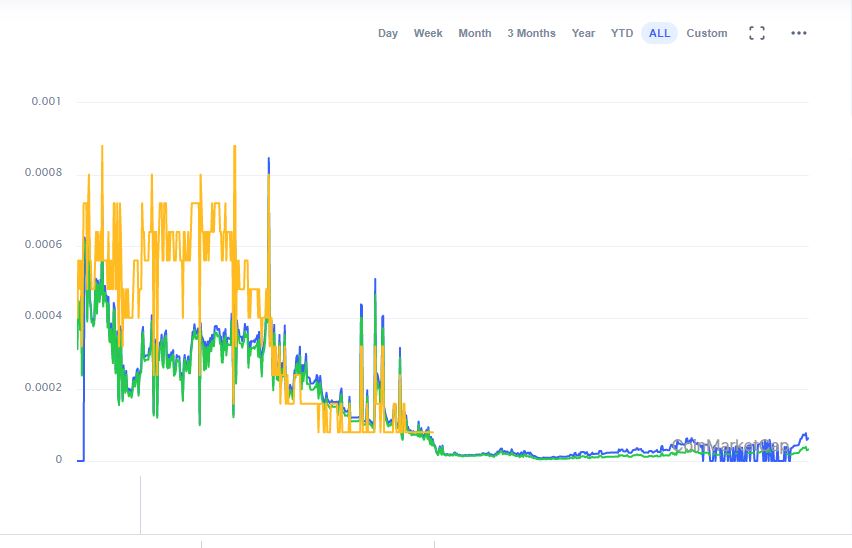

Indeed, cryptocurrencies geared towards electronic commerce – such as Cardano (ADA) are only getting stronger, despite the uncertainty of the market in recent times. Not only that, but even many retailers and even small-time shops worldwide now accept BTC and ETH as payment, along with regular old cash.

However, the report also stated that with the right amount of expediency in development, government-backed cryptocurrencies could eventually overtake private cryptocurrencies. The report goes on to say that this could help prevent speculation – although whether buying certain cryptocurrencies known to pump randomly counts as speculation is a matter up for debate.

Whatever the outcome of the CBDC debate will be, it’s worth watching what the Federal Reserve will do – since US economic institutions still wield a significant amount of power in the crypto space, as recently seen with Ripple.