Axie Infinity (AXS) is trading in an uptrend, like many other Altcoins. The cryptocurrency AXS just went up +42% in a single day by breaking a falling wedge pattern with strong buying volume and surges over +85% in a week.

What is AXS?

Axie Infinity AXS is a blockchain-based trading and battling game that is partially owned and operated by its players. The Axie Infinity ecosystem also has its own unique governance token, known as Axie Infinity Shards (AXS). These are used to participate in key governance votes and will give holders a say in how funds in the Axie Community Treasury are spent.

AXS Price Analysis

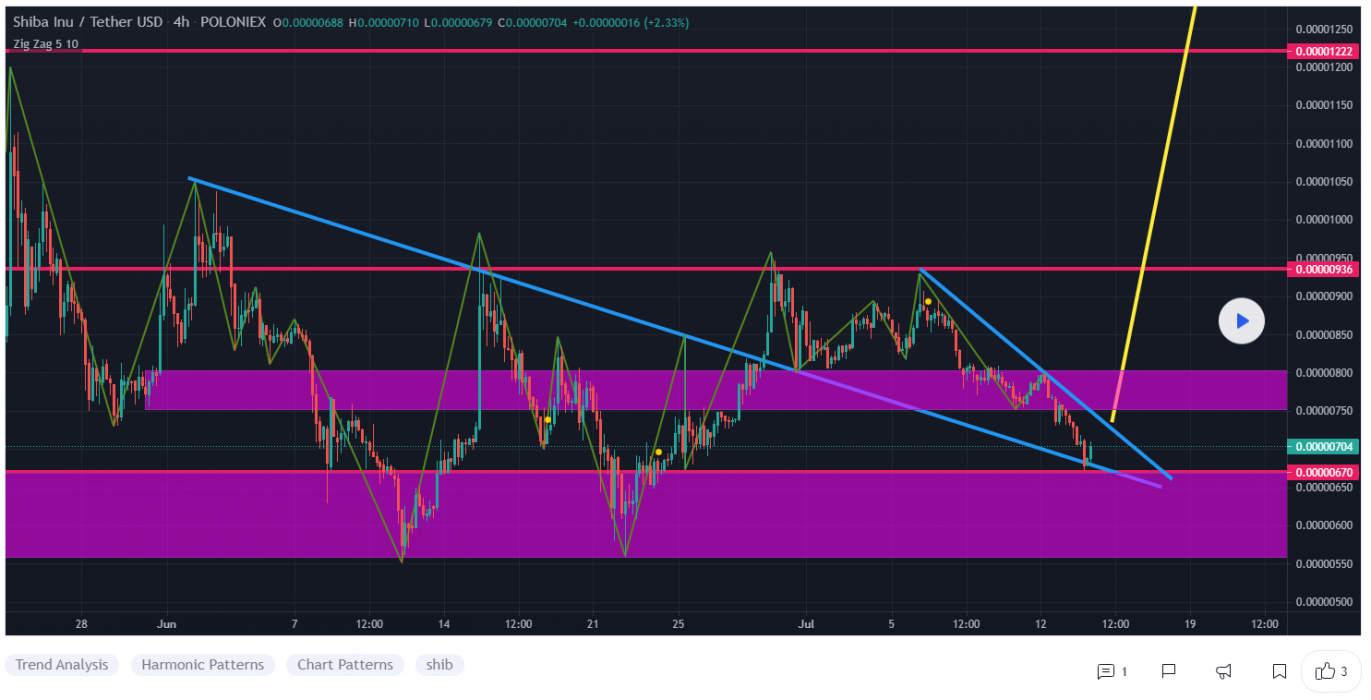

At the time of writing, AXS is ranked 54th cryptocurrency globally and the current price is A$32.79. This is a +85% increase since 16th July 2021 (7 days ago) as shown in the chart below.

After looking at the above 1-Day candle chart, we can clearly see that AXS was trading inside the falling wedge pattern on the AXS/USDT pair. The first resistance was on the A$24.87 price levels which AXS broke with a strong bullish trend buying volume and is now heading towards the all-time high price in AUD. Seeing that many Altcoins are holding a strong position this week after the recent bitcoin crash recovery, AXS might continue to increase in the uptrend if the traders keep buying with high volume.

“The Falling Wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. This price action forms a cone that slopes down as the reaction highs and reaction lows converge.”

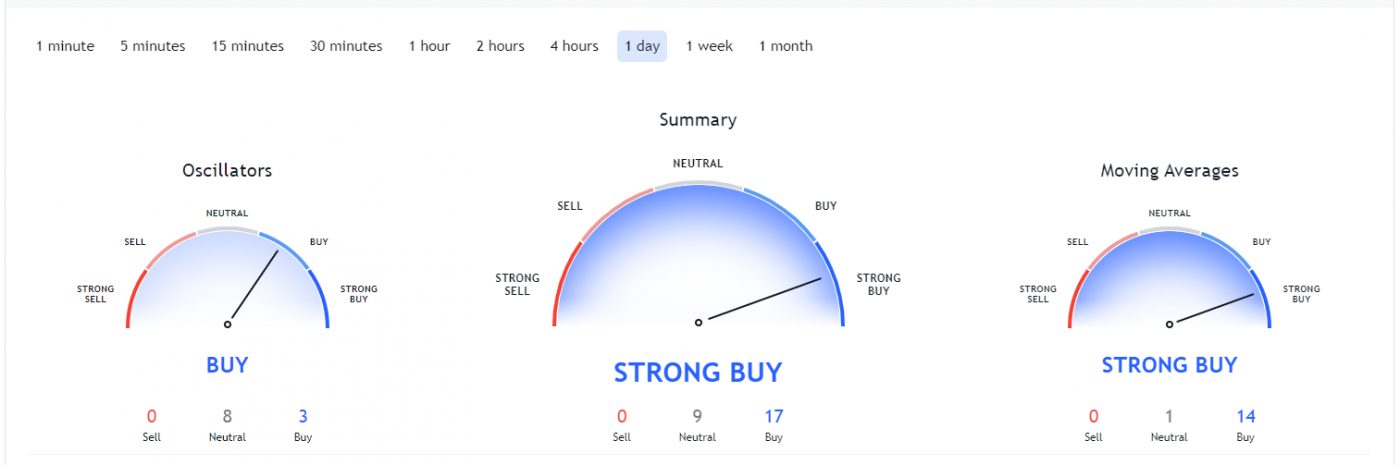

What Do The Technical Indicators Say?

TradingView indicators (on the 1 day window) mainly suggest AXS as a strong buy, except the Oscillators which indicate AXS as a Buy.

So Why Did AXS Breakout?

General market sentiment seems to suggest cryptos are hopefully turning back bull run season after recent massive price corrections. Another reason for this sudden pump in price could be whales secretly buying AXS for the next Altcoins rally. Recent news was also announced regarding Axie Podcast action.

There was also a 60% increase in new players who joined the Crypto & this massive increase is pushing AXS coin to reach its all-time high price very soon.

Where to Buy or Trade AXS?

Axie Infinity has high liquidity on the Binance exchange which could help for trading AXS/BTC or AXS/USDT pairs. Instead, if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is a popular choice in Australia.