Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Binance Coin (BNB)

BNB is the cryptocurrency of the Binance platform. It is a trading platform exclusively for cryptocurrencies. The name “Binance” is a combination of binary and finance. The cryptocurrency currently has a daily trading volume of 1.5 billion – 2 billion US dollars and is still increasing. In total, there will only be 200 million BNBs.

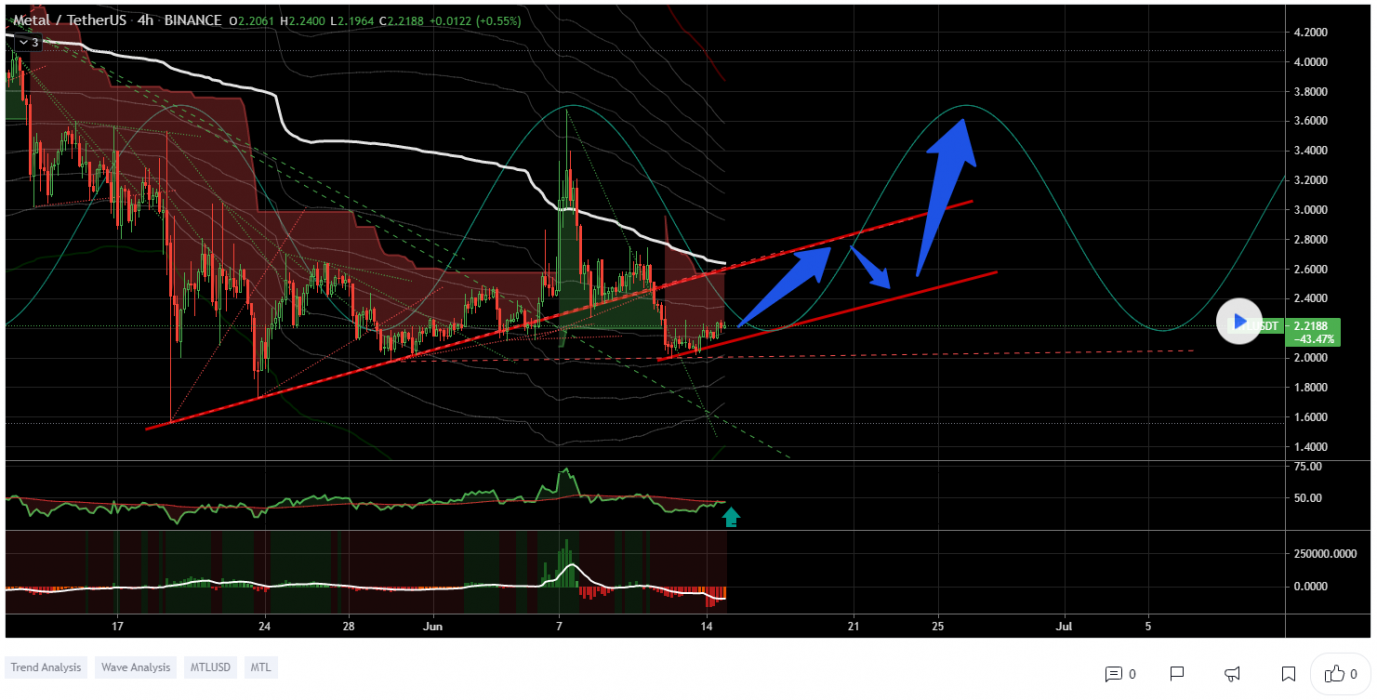

BNB Price Analysis

At the time of writing, BNB is ranked the 4th cryptocurrency globally and the current price is A$430.07. Let’s take a look at the chart below for price analysis:

After dropping nearly 70% in less than two weeks, BNB found a low just above the monthly gap near A$282.79. Since then, the price has been consolidating in a range between A$578.41 and A$282.79.

The weekly level near A$388.55 may continue to provide support during a run on the local swing lows. The monthly gap beginning near A$280.79 will likely give the next higher-timeframe support if this level fails.

The price is currently chewing into potentially strong resistance near A$437.50. A sweep of the relatively equal highs near A$456.85, and a daily close above this level could signal a move to the next set of relatively equal highs near A$507.05.

Just above these highs, probable resistance rests near A$525.96, which may cap the price until the market moves out of consolidation. However, any significant bullish shift in market conditions during the next few weeks could help bulls reach the swing high near A$578.41, running stops into probable resistance near A$616.71.

2. Freeway Token (FWT)

FWT are the native utility tokens for AuBit Freeway – a ground-breaking new asset management platform built for greater total returns on the world’s top investment products with no additional risk.

FWT Price Analysis

At the time of writing, FWT is ranked the 488th cryptocurrency globally and the current price is A$0.0118. Let’s take a look at the chart below for price analysis:

FWT accompanied the rest of the market in the mid-Q2 drop, falling nearly 83% from its mid-May high until it found a low late in June.

Price action in late June formed a weekly support level near A$0.011, which has so far held up the price. The most recent swing low inside this range, near A$0.010, might be the target for any future stop runs. After this low, the swing low near A$0.0072 and the gap beginning near A$0.0071 marks possible higher-timeframe support.

The price is currently battling with significant higher-timeframe resistance levels, with the closest probable resistance resting near A$0.012, just over the July monthly open. A sweep of the relatively equal highs above this resistance might find sellers near A$0.013 – but could reach as high as A$0.016.

3. Kava.io (KAVA)

Kava is a cross-chain DeFi lending platform that allows users to borrow USDX stablecoins and deposit a variety of cryptocurrencies to begin earning a yield. The Kava DeFi hub operates like a decentralised bank for digital assets, allowing users to access a range of decentralised financial services, including its native USD-pegged stablecoin USDX, as well as synthetics and derivatives. Through Kava, users are able to borrow USDX tokens by depositing collateral, effectively leveraging their exposure to crypto assets.

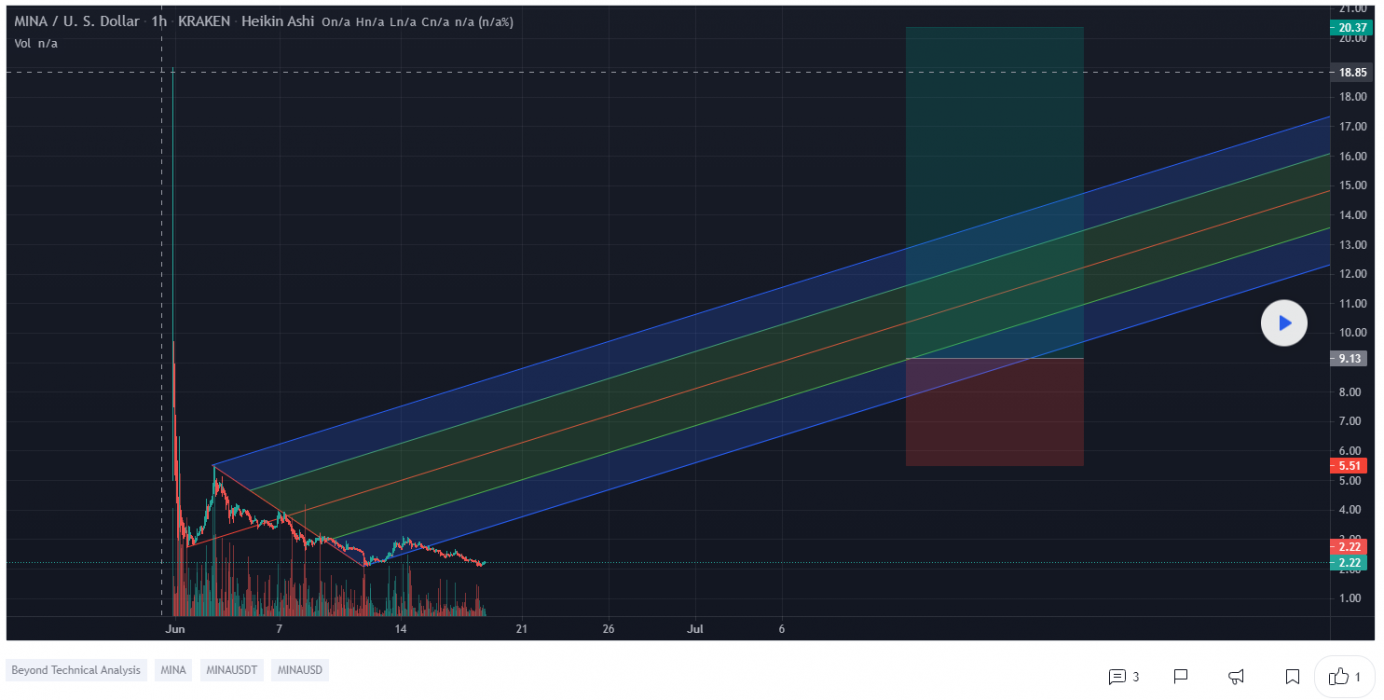

KAVA Price Analysis

KAVA is ranked the 124th cryptocurrency globally and the current price is A$$5.83. Let’s take a look at the chart below for price analysis:

KAVA has been trading through a massive range since April, with the price showing mild bullishness during July.

The breaks of the swing highs at A$5.46 and A$6.02 led to support forming near A$5.55. Some bulls will likely wait for a more favourable entry on a potential stop run that could reach near A$4.74.

If the support near A$5.55 continues to hold, the recent swing high at $4.9845 is likely the next short-term target. This potential bullish swing might end with a run on short stops up to A$7.61 and A$7.88.

Higher-timeframe resistance between A$7.59 and A$8.12 may cap any move upwards until the overall market becomes more bullish. However, any significant bearish move in Bitcoin will likely push the price down toward the low and possible support near A$2.82.

Where to Buy or Trade Altcoins?

These three coins have the high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.