Dr Craig Wright, the self-proclaimed inventor of Bitcoin, has claimed victory in a defamation lawsuit against popular British Bitcoin podcaster Peter McCormack. “Faketoshi”, as he is known in Bitcoin circles, was awarded £1 for advancing “deliberately false evidence”:

Evidence Found to be False

The host of the What Bitcoin Did podcast was sued for his comments in which he described Wright as a “fraud” and “liar” in relation to persistent claims that he was indeed the founder of Bitcoin.

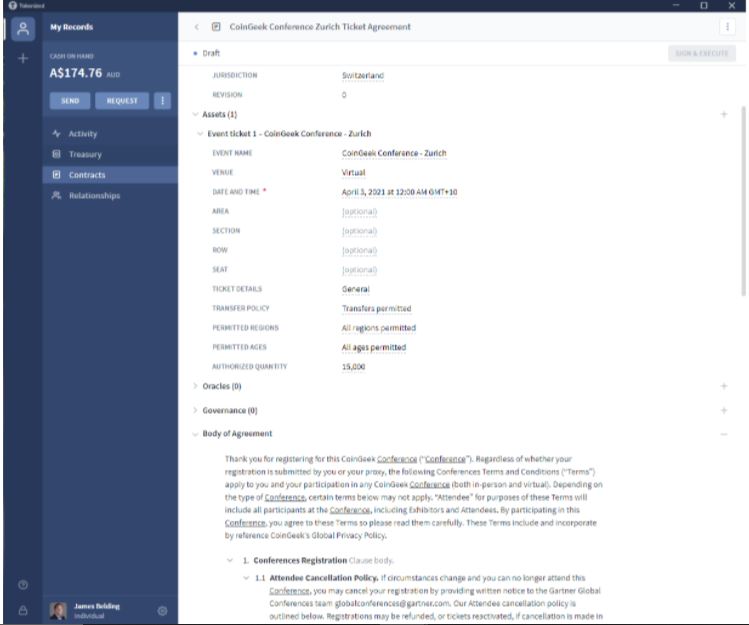

UK High Court Judge Martin Chamberlain ruled against McCormack, finding that the podcaster had caused “serious harm” to Wright’s reputation since he was apparently disinvited to speak at various events and conferences.

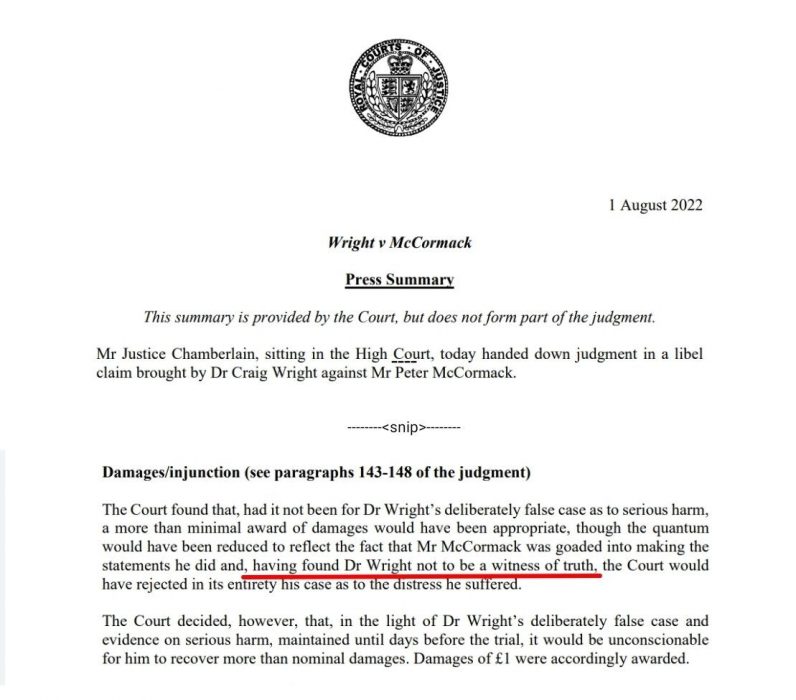

The judge, however, determined that since Wright had “advanced a deliberately false case and put forward deliberately false evidence until days before trial, he [would] recover only nominal damages”. On that basis, the court found that there would be “no injustice” in awarding the paltry sum of sum of £1:

Not the End for Wright

In a statement distributed by his lawyers, Wright said: “I intend to appeal the adverse findings of the judgment in which my evidence was clearly misunderstood.”

Australian-born Wright remains a constant source of derision and controversy within the Bitcoin community. Last year, he won a copyright lawsuit over the Bitcoin whitepaper and later sued a former partner over claims he was entitled to Satoshi’s 1.1 million bitcoins.

McCormack took to Twitter to celebrate the result, saying:

As some of you will now have seen, the judgment in my trial v Dr Craig Wright has now been handed down. I want to thank my lawyers for their diligent work on the case. I also want to thank Justice Chamberlain for this result. We are very pleased with his findings. Please do note that the process is not complete and therefore I will not be commenting further on this. Once the entire process is complete, there will be others I will be thanking.

Peter McCormack, host, What Bitcoin Did podcast

The Bitcoin community celebrated the favourable result, pointing to Wright’s history of plagiarism, forgery and false evidence:

This comes at a time where his hard forked token BSV has less than 2 percent of bitcoin’s market capitalisation and has been delisted from most exchanges due to a lack of security:

With several other cases on the go and an appeal imminent, litigious Wright will likely remain in the headlines for the foreseeable future.