According to a report by Reuters, the Central Bank of the Russian Federation (CBR) is looking to ban crypto investments. In a directive issued earlier this week, the bank has also barred mutual funds from investing in digital currency.

Russia Rebels Against Crypto

The Russian Federation, which has long argued against cryptos – citing concerns of risks to financial stability, money laundering, and possible financial terrorism – has yet again spoken its mind.

After issuing concerns over the security implications associated with cryptos, the federation eventually gave them legal status in 2020 but banned their use as a means of payment. Following this, the central bank is now in talks with market players and experts regarding a possible overall ban on cryptos.

Should a ban be approved by lawmakers, it would apply to new purchases of crypto assets but not those made in the past. Russia’s current stance amounts to a “complete rejection” of all cryptos, a source close to the bank has said.

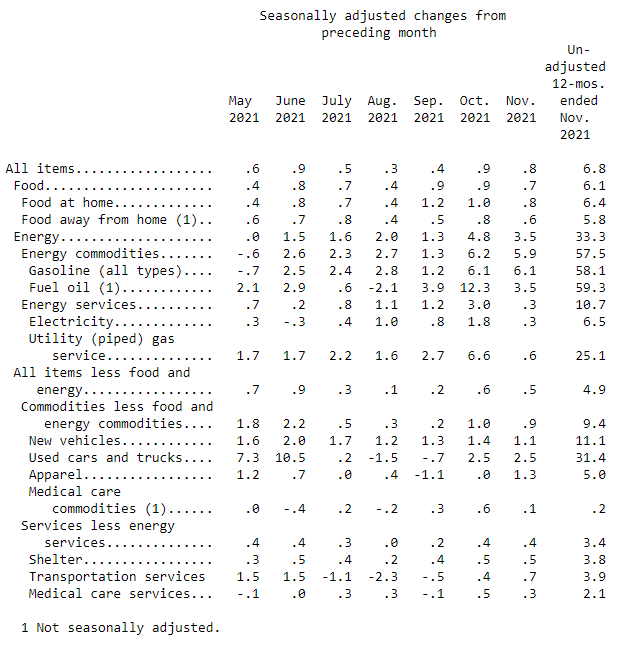

According to the bank, the annual volume of crypto transactions conducted by Russians amounts to about US$5 billion, with CBR first deputy governor Ksenia Yudaeva claiming the use of cryptos lowered the efficiency of monetary policy. According to Yudaeva, “The situation in developed market countries more and more resembles the so-called shadow financial system.”

CBR Seeks to Ban Mutual Funds from Investing in Crypto

Adding to the bad news for investors, Russia has issued a directive that prohibits Russian mutual funds from directly or indirectly investing in crypto assets.

According to the CBR, funds cannot invest in digital currencies or in “financial instruments, the value of which depends on the price of digital currencies”. The proposal issued by the CBR, in line with its hard stance on decentralised digital money, comes after the regulator urged stock exchanges to avoid trading securities tied to cryptocurrencies in July 2021.

Despite its firm stance against cryptos, Russia is currently working on a Ruble-backed central bank digital currency (CBDC). A pilot program was set for launch this month, but the deadline has been moved with a prototype expected to be created in “early 2022”.

Hacking a Cause of Concern for Russia

Hacking has become a hot topic in the crypto world as the incidence continues to rise. Of particular concern is the involvement of Russian-based hackers. In October, Google’s Threat Analysis Group (TAG) spent a good deal of time fending off hackers attacking the accounts of YouTubers to hijack and repurpose them to run ads for crypto scams. TAG had found that the perpetrators of the campaign were recruiting hackers from a “Russian-speaking forum”.

Last month, the US Department of Justice announced charges against a REvil ransomware affiliate responsible for the hack against the Kaseya MSP platform in which ransom demands totalled US$767 million. Law enforcement has also impounded an additional US$6.1 million from another REvil ransomware affiliate, Russian national Yevgeniy Polyanin, who remains at large.