While Bitcoin is breaking price barriers and hovering above US$63,000, the second-largest cryptocurrency by market cap, Ethereum, surpassed the US$4,000 mark for the first time since May 14 and briefly surged past its previous all-time high, reaching US$4,360.

The ETH rally started on October 20 by surging 5 percent, reaching the US$4,100 mark on the Binance exchange and at the time of writing, is up 47 percent over the past 30 days. Despite a correction following the new all-time high, ETH remains up over 12 percent over the past week.

The ETH bull run coincided with Bitcoin’s dramatic market boost of 30 percent in a month, breaking a record price of US$67,016 on October 20.

Additional data from Crypto Watch shows a 30-day correlation between Bitcoin and Ether of 0.82 – an 82 percent linear positive correlation between both cryptocurrencies. This means that as Bitcoin enters price discovery, ETH could follow and settle to even higher highs.

ETH and BTC Frontrunning Crypto Scene

Ether had a volatile rally throughout Q2 2021, bouncing back and forth from 3k to 2k. It was on August 4 that ETH reclaimed and held steady its 3k position, reaffirming its market dominance with the launch of DeFi protocols and NFT projects.

Several factors are driving the current ETH bull run, among them the massive popularity of non-fungible tokens (NFTs), the emergence of new and innovative DeFi protocols, and the US’ first Bitcoin futures ETF.

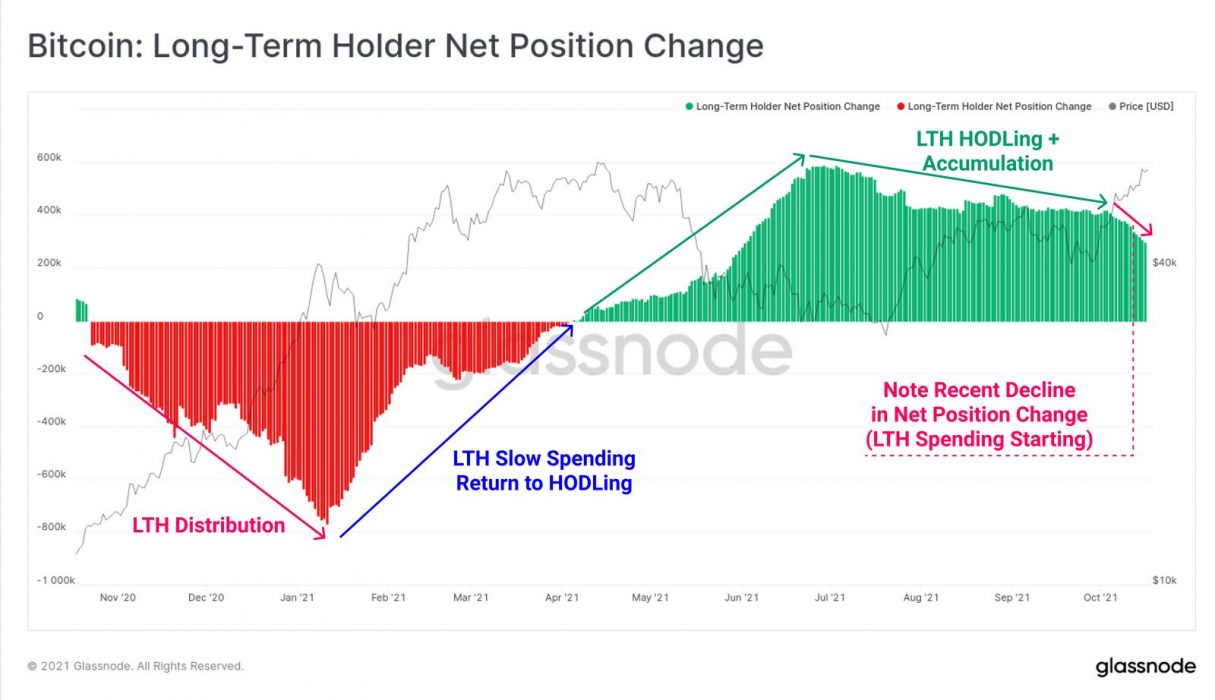

The Bitcoin futures fund recorded astronomical trading volumes: around US$500k in just an hour after going live, and over $1 billion a day after. The institutional demand has been so high that the BTC ETF is on risk to breach a limit on the number of futures contracts it is permitted to hold on the Chicago Mercantile Exchange, as per data compiled by Bloomberg.