Last Sunday marked 12 years since bitcoin was first traded for real-world goods when on May 22, 2010, pioneering Bitcoin developer Laszlo Hanyecz paid 10,000 BTC for two pizzas.

That remarkable moment led to May 22 becoming known as Bitcoin Pizza Day by crypto enthusiasts around the world, many of whom celebrate by ordering pizza with friends and paying with bitcoin if possible:

First BTC Transaction Reminds Us How Far Crypto Has Come

The transaction, which is preserved on the Bitcoin Talk forum, makes for interesting reading. On May 18, 2010, programmer Laszlo Hanyecz asks if anyone is interested in receiving bitcoin for bringing him two pizzas, which he says could be either home-made or store-bought. He goes on to articulate his tastes:

I like things like onions, peppers, sausage, mushrooms, tomatoes, pepperoni, etc … just standard stuff, no weird fish topping or anything like that. I also like regular cheese pizzas which may be cheaper to prepare or otherwise acquire. If you’re interested, please let me know and we can work out a deal.

Laszlo Hanyecz, programmer and bitcoin trader/developer

One fellow forum member named ender_x made the now almost comical observation: “10,000 … that’s quite a bit … you could sell those on bitcoinmarket.com for $41USD right now … good luck on getting your free pizza.”

That 10,000 BTC is worth around US$300 million today – not quite what most people would describe as “free pizza”.

After a lack of interest in his initial post, a few days later Laszlo asked: “So nobody wants to buy me pizza? Is the bitcoin amount I’m offering too low?”

Eventually, on May 22, 2010, Laszlo did get his pizzas, going on to say the offer was open. In total, he paid 40,000 BTC for eight pizzas over a period of a few months. He finally stopped offering bitcoin for pizzas on August 4, 2010 when he posted to say he couldn’t afford it anymore as he could no longer generate thousands of coins a day.

Transaction Key Part of Bitcoin’s ‘Ethical Launch’

The 2010 transaction is widely seen as a huge milestone in bitcoin’s journey from obscure internet curiosity to genuine store of value, as it marks the first time it was used in a real-world sense where it functioned to transfer actual economic value.

According to high-profile investor Michael Saylor, this transaction was also a crucial part of Bitcoin’s “ethical launch”, which he considers to have been completed when the currency’s pseudonymous “inventor” Satoshi Nakamoto disappeared on December 13, 2010:

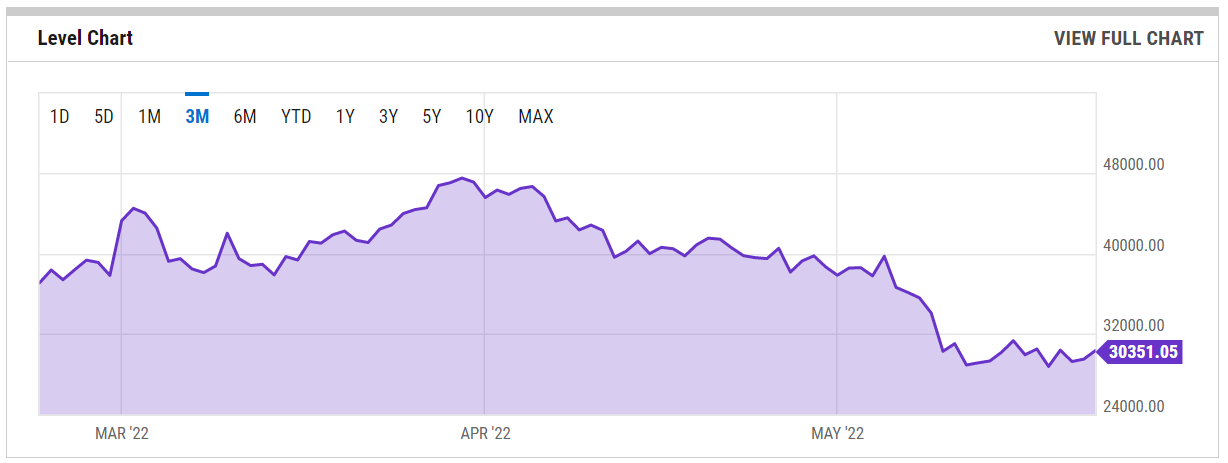

Since those experimental early days, bitcoin has come a long way. It’s currently valued at just over US$30,000, more than 90 percent of its supply has now been issued, its mining difficulty is around 29 trillion and its hashrate is about 200 exahashes/second. At the time Laszlo Hanyecz purchased his famous pizzas, bitcoin mining difficulty was 11 and the hashrate was around 100 megahashes/second.