Cryptocurrencies are now a major topic of the Davos 2021 Agenda, which started yesterday and will last until January 29. Top institutional leaders from the World Economic Forum are set to discuss a series of issues regarding the global economy and the use of digital assets and blockchain technology. During the conversation panel, the CEO of Silver Lake addressed Janet Yellen’s statements on Bitcoin used as “terrorist financing“.

In the first session of the Davos 2021 event, Glenn Hutchins —CEO of the technology investment company Silver Lake— share his thoughts on the topic of cryptocurrencies, referring to U.S. Treasury Secretary Janet Yellen’s statements about Bitcoin:

“In the US, 80-90% of $100 dollar bills are used for organised crime and tax evasion and there’s a very good reason for that – they’re untraceable and fungible. Bitcoin, however, leaves a permanent, unalterable record, hence why almost all criminals using it are caught. It is fundamentally wrong to say that Bitcoin is mostly used for crime.”

Stated Hutchins for Finextra at the Davos Summit

Institutions Are “Ignorant” to Blockchain Technology

Hutchins added that traditional financial institutions are overlooking digital assets and blockchain technology without weighing the benefits they can provide for the economy. The CEO stated that this view over Bitcoin and other cryptos is ignorant and it undermines the benefits that the blockchain network can bring to the financial system.

Janet Yellen’s speech regarding cryptocurrencies was multiform, as she considers them as a “particular concern” to the economy — leading to illegal activities such as financing terrorism and tax evasion. But it seems that the Secretary also has a good view of cryptos, calling the benefits they can bring to the economy.

However, under the Biden Administration, the Secretary plans to curtail the use of cryptocurrencies, exploring “new methods” to regulate and, ultimately, eliminating those “crime channels”.

The Outrage Of The Crypto Community

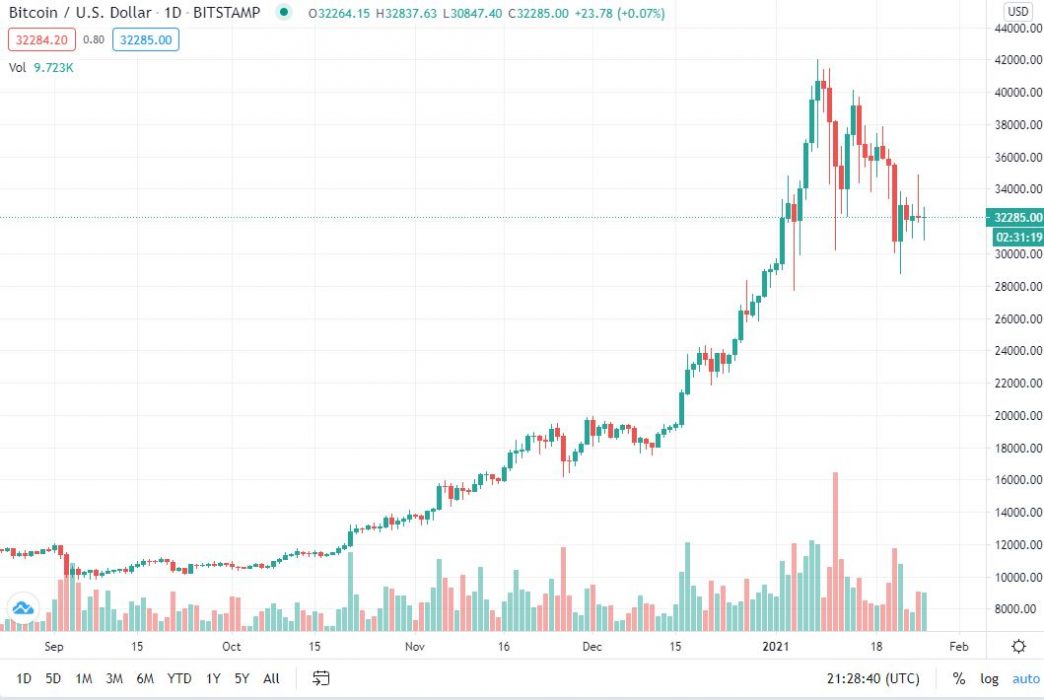

Not surprisingly, this sparked outrage from the crypto-community, pumping fear during trading sessions as well at the end of last week.

According to data from Chainalysis, cryptocurrency use amid terrorist organizations only accounted for 0.34 in the market. Not only U.S. Dollars account for most illicit activities, but at least 16 banks from Australia and Southeast Asia were accused of laundering at least $400,000,000 in a joint scheme with South American drug cartels.

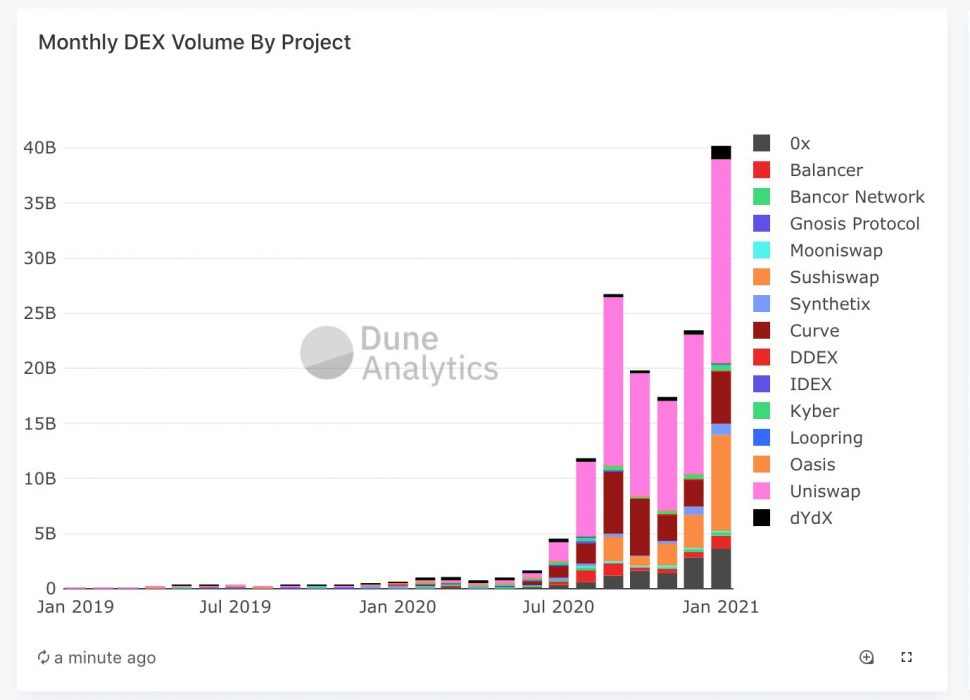

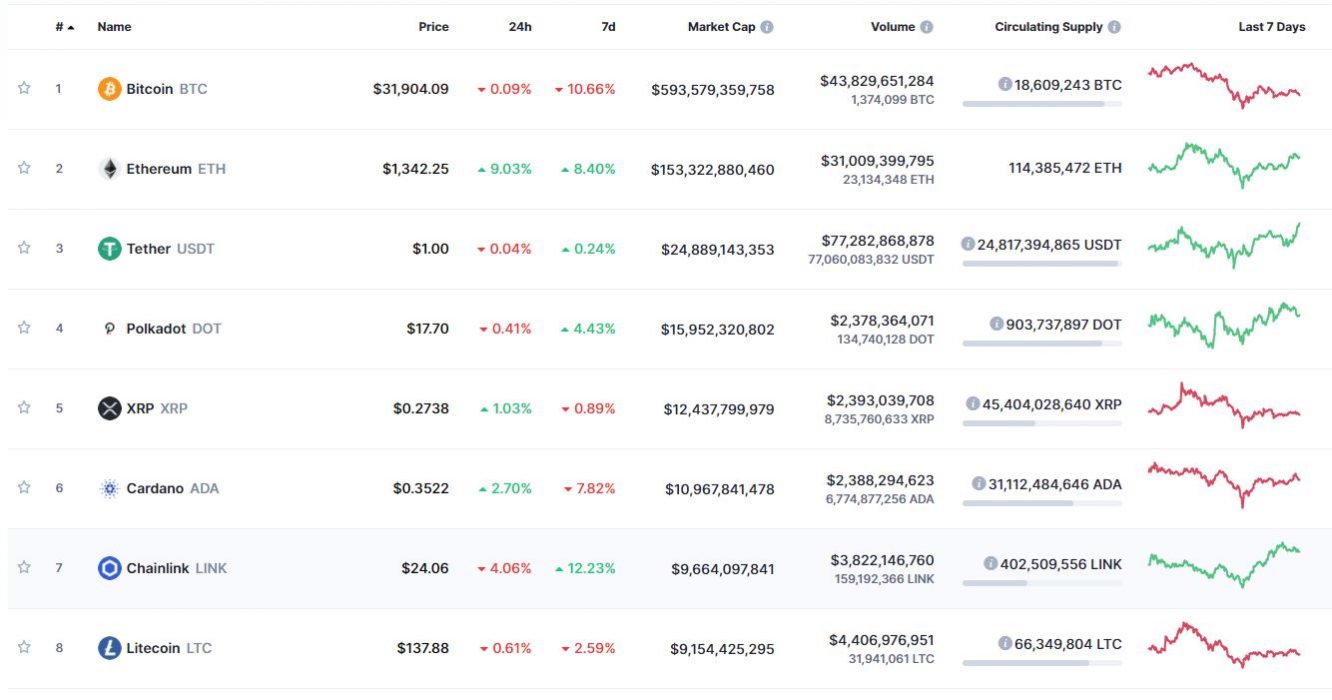

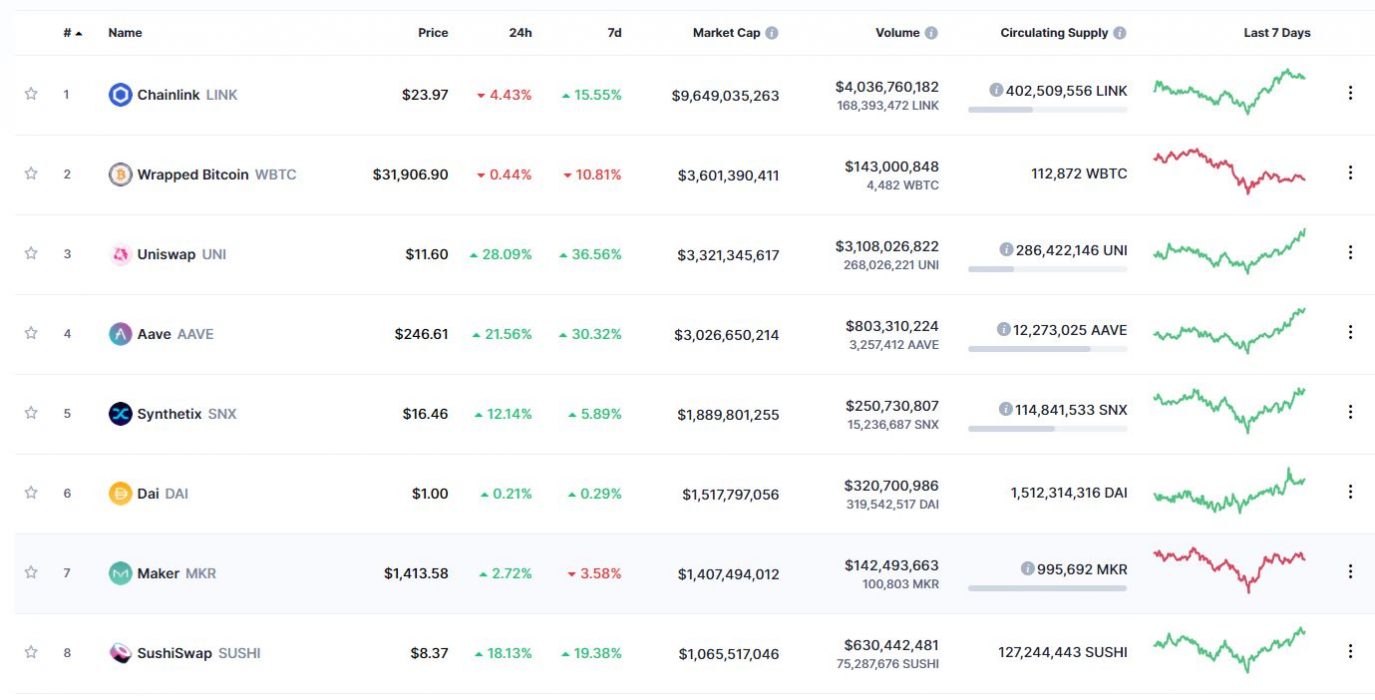

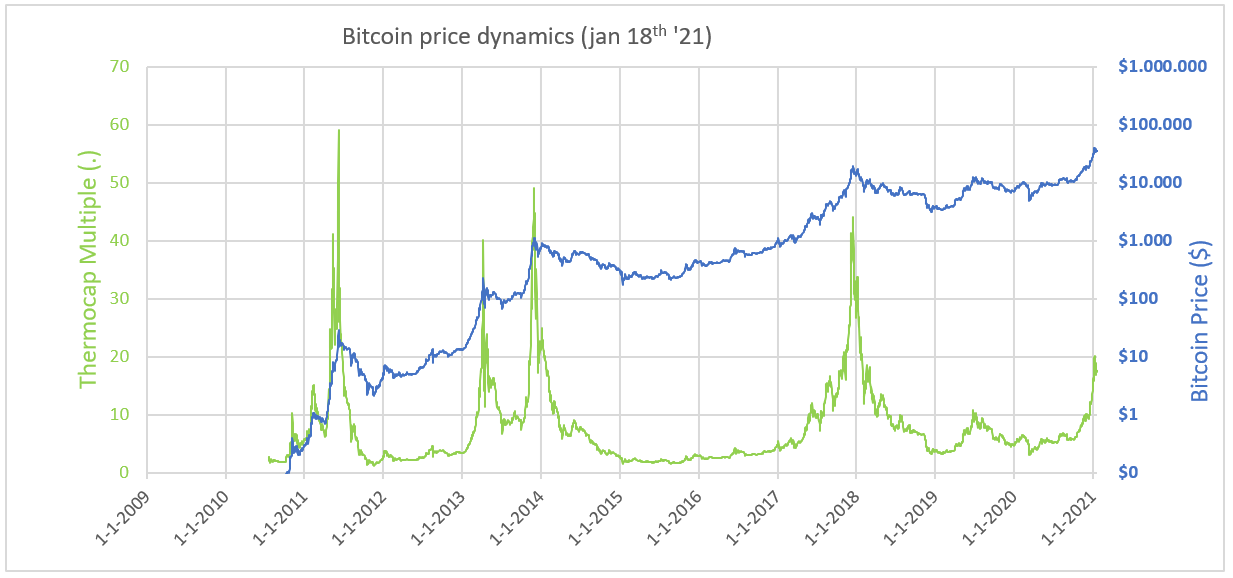

Following Hutchins’s statements, Bitcoin only gained a few pips, but the charts show that we still are in a consolidation zone, while other DeFi tokens are outperforming BTC in the market.