Dapper Labs, a leading platform for digital collectibles and games on the Ethereum (ETH) blockchain, has partnered with Google Cloud services to help the Canadian start-up scale. As a direct result, the FLOW token has seen an increase of nearly 20 percent.

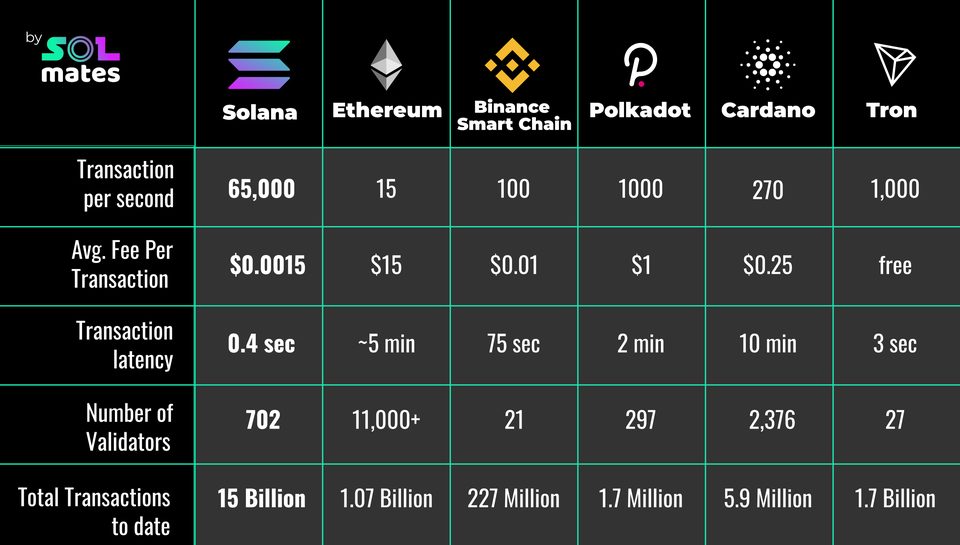

Dapper Labs has its own blockchain, Flow, which helps users scale apps and games. Google will improve on the product by acting as a network operator, providing developers on the Flow network with digital infrastructure that can process high transaction volumes at greater speed.

With Google’s help, Dapper Labs hopes to scale NBA Top Shot and other NFT lines running on Flow to billions of users.

NFT Platforms Still Performing Well

Dapper Labs products are some of the most used platforms on the Ethereum blockchain, with between 500,000 and one million transactions per week. NBA Top Shot, its flagship invention, has recorded over US$700 million in total sales and has been the leading collectible Dapp by users and volume (US$3.05 million) for the past 30 days, according to industry data site DappRadar.

Following news of the partnership, FLOW‘s price spiked 15.5 percent in 24 hours to highs of US$24.13, while daily transaction volume stands at US$150 million, bouncing back after this month’s major dip.

Also earlier this month, another Dapper Labs product, CryptoKitties, sold more than US$7 million worth of NFTs in 24 hours as growing interest in non-fungible artworks boosted sales.

Warner Music partnered with the company via a strategic investment deal announced the same day, while Dapper Labs further revealed that Ubisoft, known for developing games such as Far Cry and Assassin’s Creed, would function as an adviser on Flow.

Blockchain technology is becoming more and more mainstream. So companies like Dapper need scalable, secure infrastructure to grow their business and, even more importantly, support their networks.

Janet Kennedy, vice-president, Google Cloud North America

Google Dabbling in Blockchain

After it recently lifted an advertising ban on cryptocurrencies, Google’s latest partnership suggests it could venture into infrastructure building for Web 3.0.

Google’s cloud services do not currently offer mining cryptocurrency, but Janet Kennedy, vice-president of Google Cloud North America, has said developers will be able to choose regions that power their platforms based on their energy consumption.

Dapper Labs CEO and co-founder Roham Gharegozlou tweeted that he was “amped to welcome Google to Flow Blockchain”.