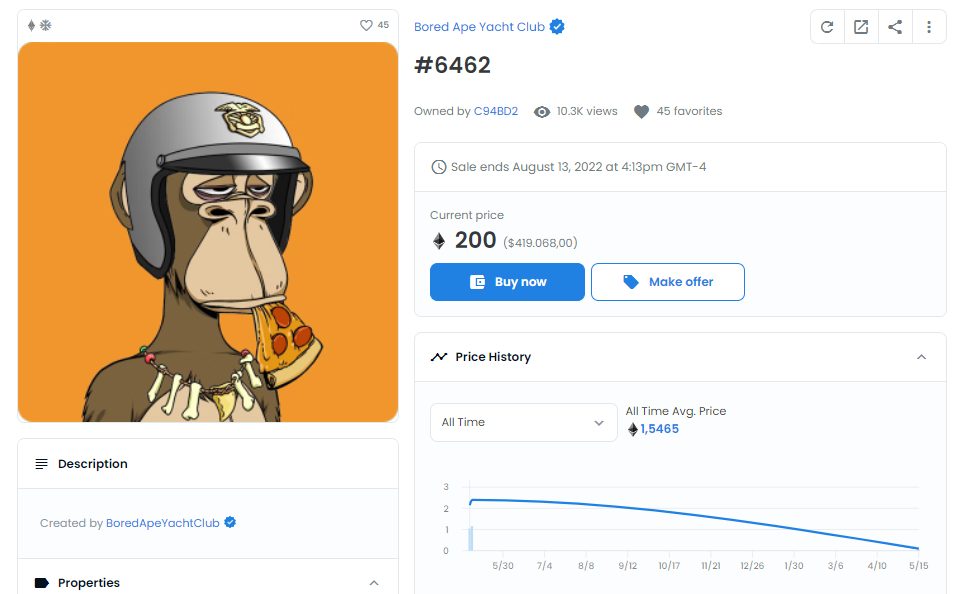

Another Bored Ape NFT has been undersold, this time for just US$200. The crypto community now believes this has become a common practice to evade capital gains taxes.

A Twitter account that reports Bored Ape NFT sales shared the news of Ape #6462 being purchased for only 200 USDC. This NFT has some of the rarest traits in the Bored Ape Yacht Club (BAYC) market, and is currently priced on OpenSea at 101.75 ETH, or US$206,000:

Transaction History Inspires Suspicion

While some in the NFT community say this is just another costly mistake, most believe it was a tax evasion manoeuvre. They based this on the transaction history, which shows the buyer’s account was created this month and that the offer for Ape #6462 was accepted minutes after being listed. It also has been transferred five times between different wallets since its mint date:

Whether tax evasion or just a mistake, this is not the first time a Bored Ape NT has sold for much less than its original value. A month ago, Crypto News Australia reported that a US$350,000 Bored Ape had been sold for just US$115, raising suspicions in the crypto community.

What was more intriguing is that the owner accepted a bid of only 115 DAI – an Ethereum-based stablecoin – for his NFT. Again, most in the NFT community believed the reason behind this was tax-loss harvesting.

Genuine mistakes occur, however. Five months ago, Twitter handle Manaut.eth made a rookie error by misplacing a decimal point in pricing his NFT at 0.75 ETH instead of 75 ETH.