The International Monetary Fund (IMF) has released a set of policy recommendations for crypto regulation to stave off financial stability challenges amid the global adoption of crypto.

As rightly stated in the IMF blog, “As crypto assets take hold, regulators need to step up.” As the use of blockchain and volume in the crypto industry increase, there have been pleas for more regulation to act as a guiding light for individuals and companies in the space.

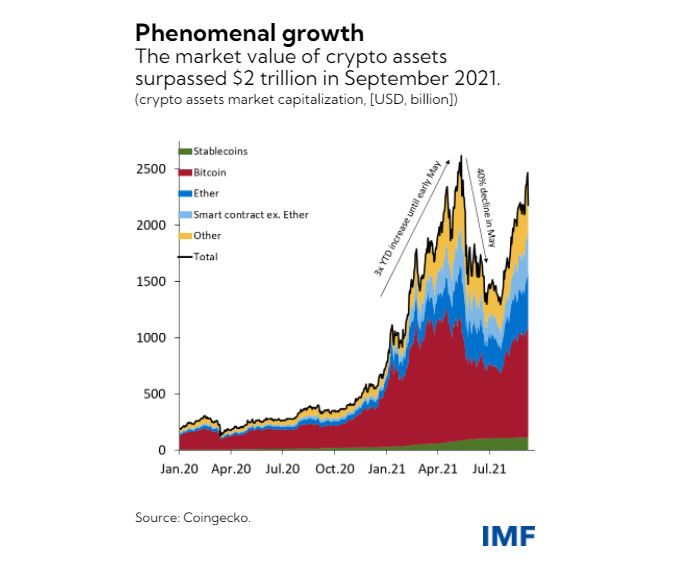

The total market value of all crypto assets surpassed US$2 trillion as of September 2021, a tenfold increase since early 2020. Stablecoin supply in particular has quadrupled throughout 2021 to reach US$120 billion.

As ecosystems fill up with more decentralised exchanges (DEXs), wallets, and a plethora of dApps, it seems crypto assets are seeping into the mainstream. The use of this new technology has many benefits as far as innovative financial services go, but as the impacts and risks on financial stability and wider economy become apparent, bridges need to be built to protect consumers.

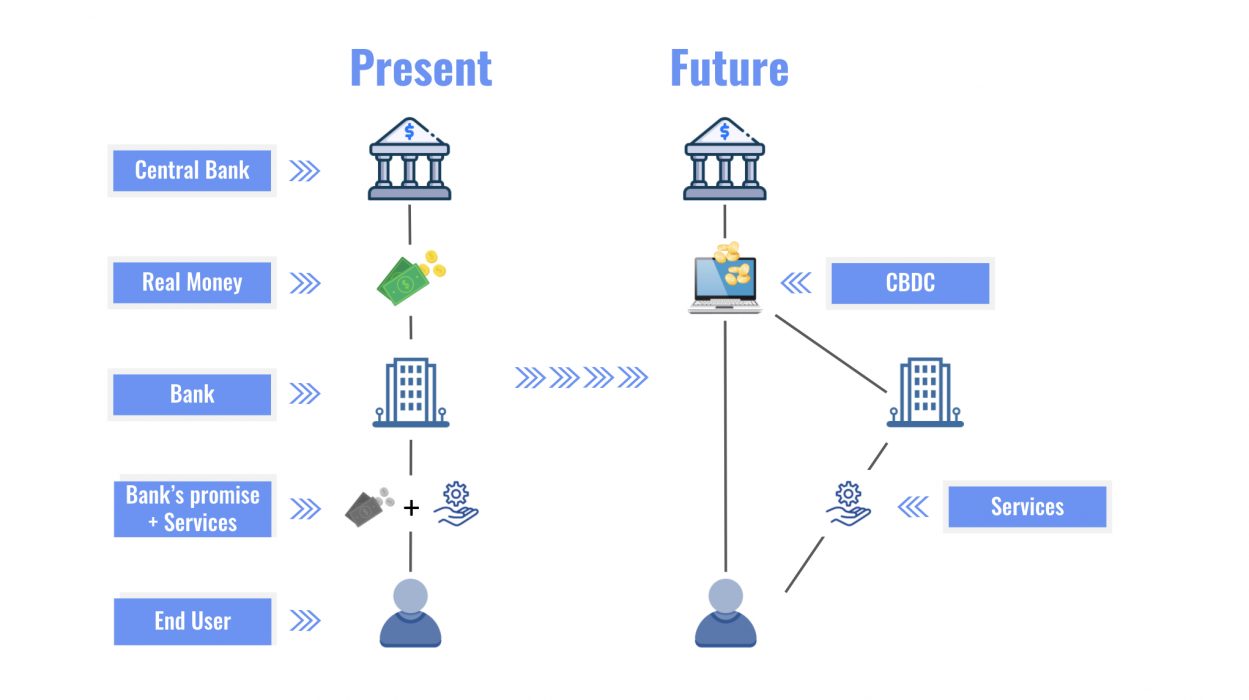

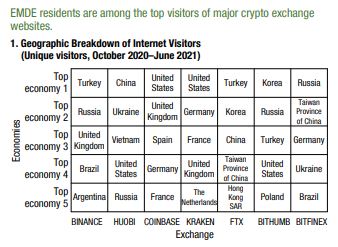

Cryptoisation is much like dollarisation, where residents start using crypto assets instead of the local currency. This phenomenon can reduce the ability of central banks to effectively implement monetary policy. It could also create financial stability risks, such as through funding and solvency risks arising from currency mismatches. Increased demand for crypto assets could also facilitate capital outflows that impact the foreign exchange market.

Policymakers should implement global standards for crypto assets and enhance their ability to monitor the crypto ecosystem by addressing data gaps. Emerging markets faced with cryptoisation risks should strengthen macroeconomic policies and consider the benefits of issuing central bank digital currencies.

IMF

IMF Policy Recommendations

In the document curated by the IMF, one of the main points is that regulators and supervisors need to monitor developments in the fast-evolving crypto ecosystem, with the ability for “cross-border coordination to minimise the risks of regulatory arbitrage and ensure effective supervision and enforcement”.

On a national level, regulators also need to prioritise the implementation of global standards. However, at the moment they are mainly focused on money laundering and proposals regarding bank exposures. These need to be extended to “areas such as securities regulation, as well as payments, clearing and settlements may also be applicable and need attention”.

In developing countries, “cryptoisation can be driven by weak central bank credibility, vulnerable banking systems, inefficiencies in payment systems and limited access to financial services”; this inadvertently leads to the use of digital assets and DeFi, due to low barriers for entry and use.

The decentralised finance (DeFi) sector grew from US$15 billion at the end of 2020 to about $110 billion as of September 2021, with the lion’s share of volume coming from countries with historically the largest institutional and professional markets.

Authorities should prioritise strengthening macroeconomic policies and consider the benefits of issuing central bank digital currencies and improving payment systems. CBDCs may help reduce cryptoisation pressures if they help satisfy a need for better payment technologies.

IMF

In addition to CBDC implementation, de-dollarisation policies will help governments tackle macro-financial risks, and as the role of stablecoins grows, regulations should be proportionate to the risks they pose and the economic functions they serve.

Since the development of blockchain and related technologies doesn’t seem to be slowing down, regulators need to act swiftly to address vulnerabilities to ensure users’ safety.

Digital Assets Comparable to Mainstream Benchmarks

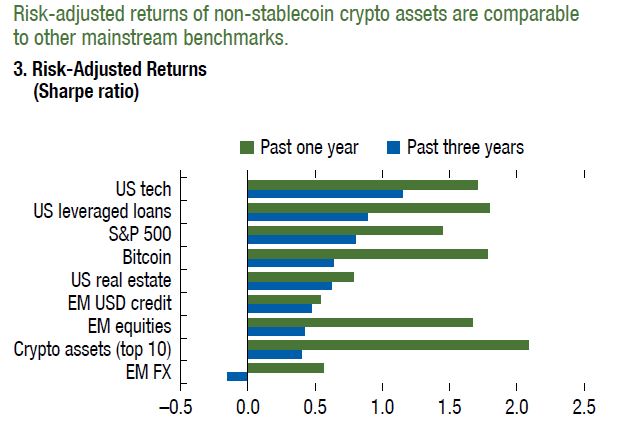

Three years of IMF data suggests that risk-adjusted returns of non-stablecoin crypto assets like Bitcoin are comparable to other mainstream benchmarks such as the S&P 500.

During the past three years, an exceptional amount of money has flown into digital assets, both creating and destroying wealth. As adoption increases, more people are exposed to these technologies and their exponential growth could have major consequences.

The IMF report stated that “financial stability risks are not yet systemic, but risks should be closely monitored given the global implications and the inadequate operational and regulatory frameworks in most jurisdictions”.