The Swedish government has had to pay a convicted felon US$1.6 million upon release thanks to the increasing value of bitcoin (BTC) and a slip-up on the part of the prosecutor.

According to a report from Swedish news source Sveriges Radio, Swedish law enforcement has found itself in a rather unusual situation where it has to pay out roughly US$1.6 million to a released convict. The authorities are being forced to pay the man 33 BTC after his illegally obtained bitcoin appreciated while behind bars.

Appreciating Bitcoin Makes a Nice Get-Out-of-Jail Present

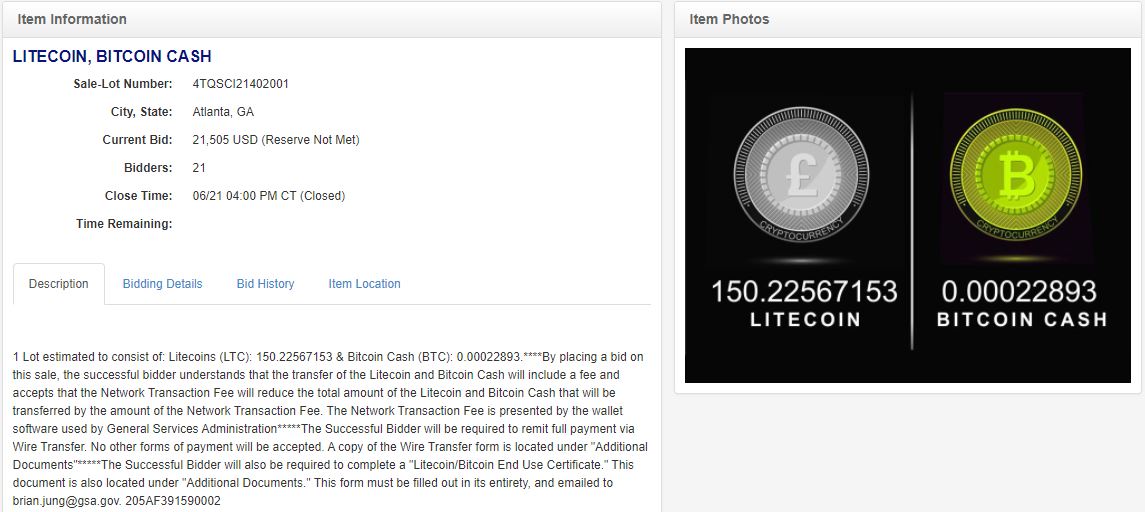

Two years ago, Swedish law enforcement arrested a man who was operating an illegal online drug shop, earning himself 36 BTC, or about U$136,000 at the time.

While he’s been locked up, the price of bitcoin has risen and as of August 20 was trading at around US$48,978 per coin, pushing the value of his 36 BTC to more than US$1.6 million.

By the time the convicted drug dealer was released, to satisfy the court’s original settlement of US$100,000 the Swedish Enforcement Authority needed to sell off just 3 BTC. This left the dealer with 33 BTC worth US$1.6 million in his wallet of ill-gotten gains.

An Unfortunate Turn of Events For the Prosecutor

Tove Kullberg, the prosecutor in the case, had reported the illegal funds in dollars instead of crypto. Kullberg admitted that in retrospect it was a mistake not taking into account how much the value of bitcoin would increase.

It is unfortunate in many ways. It has led to consequences I was not able to foresee at the time […] The lesson to be learned from this is to keep the value in bitcoin. The profit from the crime should be 36 bitcoin, regardless of what value the bitcoin has at the time.

Tove Kullberg, Swedish prosecutor

Since this was one of the first crypto-related cases that the department had to deal with, there was no established protocol or precedent to follow. Kullberg added: “I think we should probably invest in internal education in the [prosecution] authority, as cryptocurrency will be a factor we’ll be dealing with to a much greater extent than we are today.”

With the increase in crypto crimes, law enforcement is facing new crypto-related cases it hasn’t seen before.

On a related note, earlier this year we saw an Australian couple charged for running DarkMarket, a dark net marketplace.