Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Monero (XMR)

Monero XMR allows transactions to take place privately and with anonymity. Even though it’s commonly thought that BTC can conceal a person’s identity, it’s often easy to trace payments back to their original source because blockchains are transparent. On the other hand, XMR is designed to obscure senders and recipients alike through the use of advanced cryptography. The team behind Monero says privacy and security are its biggest priorities, with ease of use and efficiency coming second. It aims to provide protection to all users, irrespective of how technologically competent they are.

XMR Price Analysis

At the time of writing, XMR is ranked the 28th cryptocurrency globally and the current price is US$151.23. Let’s take a look at the chart below for price analysis:

XMR is rallying to fill in pockets of inefficient trading left during its June decline. The closest resistance is at $172.80. This area of inefficient trading on the weekly and daily charts is near the 61.8% retracement of June’s move. It rejected the price on August 7, but the price is rechallenging it.

If it breaks, the next pocket of inefficient trading from $179.60 to $183.10 may be the following target. This zone is also near the high of inefficient trading on the weekly and the 78.6% retracement of June’s move.

In the longer term, bulls could be targeting bears’ stops above the significant weekly swing high near $206.50. This zone also shows inefficient trading on the monthly chart. If this resistance breaks, the next bullish target may be another area of inefficient trading on the weekly chart from $232.50 to $227.80.

The closest support could be near the current price, from $160.40 to $150.03. This area is at the end of July’s accumulation high. If this level breaks, a drop under the August monthly open may find more buyers near $142.30. This area shows accumulation, would run bulls’ stops under recent swing lows, and fill in a tiny pocket of inefficient trading. It also has confluence with the high of previous inefficient trading on the weekly chart.

A steeper drop may reach inefficient trading on the weekly chart, from $134.70 to $125.80. This zone is also near the bottom of previous inefficient trading from June and lines up with old swing lows from Q1 2022.

2. Zilliqa (ZIL)

Zilliqa ZIL is a public, permissionless blockchain designed to offer high throughput with the ability to complete thousands of transactions per second. It seeks to solve the issue of blockchain scalability and speed by employing sharding as a second-layer scaling solution. The platform is home to many decentralised applications, and it also allows for staking and yield farming. The native utility token of Zilliqa, ZIL, is used to process transactions on the network and execute smart contracts.

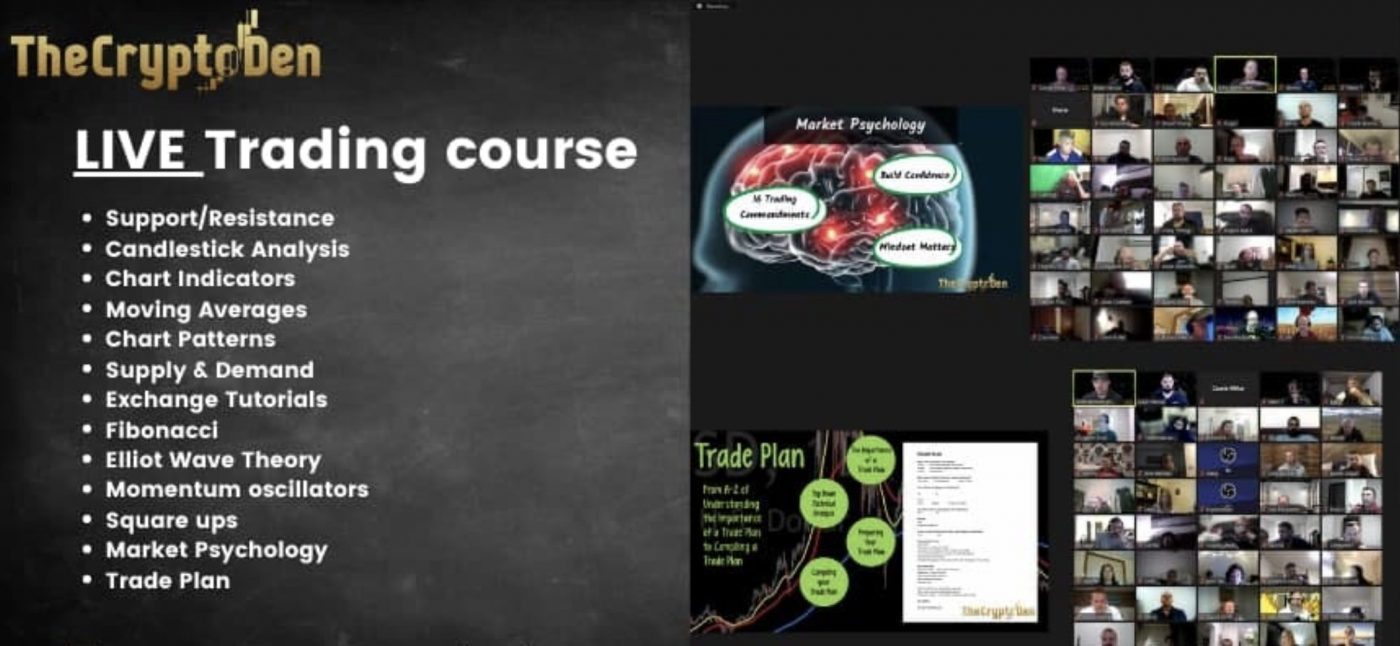

ZIL Price Analysis

At the time of writing, ZIL is ranked the 77th cryptocurrency globally and the current price is US$0.03883. Let’s take a look at the chart below for price analysis:

ZIL‘s 85% drop found a low near $0.03168 before closing over a weekly high around $0.04382. This daily close over the high could signal a shift in market structure that may reach probable resistance near $0.04732.

A sustained bullish move could target the swing high at $0.05620. If this stop run occurs, a run beyond the high into probable resistance near $0.06184 and $0.06745 is possible.

Bulls could buy a retracement to possible support near $0.03528, just above the weekly open. A bearish turn in the marketplace may propel the price toward possible support near $0.03126.

However, relatively equal lows near $0.02914 and $0.02854 provide an attractive target for bears if the market resumes its bearish trend. A run on these lows may find support between $0.02715 and $0.02569.

3. IoTeX (IOTX)

IoTeX IOTX has built a decentralised platform with the aim of empowering the open economics for machines – an open ecosystem where people and machines can interact with guaranteed trust, free will, and under properly designed economic incentives. IoTeX is the decentralised backbone for machine economics, which serves machines ranging from smart home devices to autonomous vehicles.

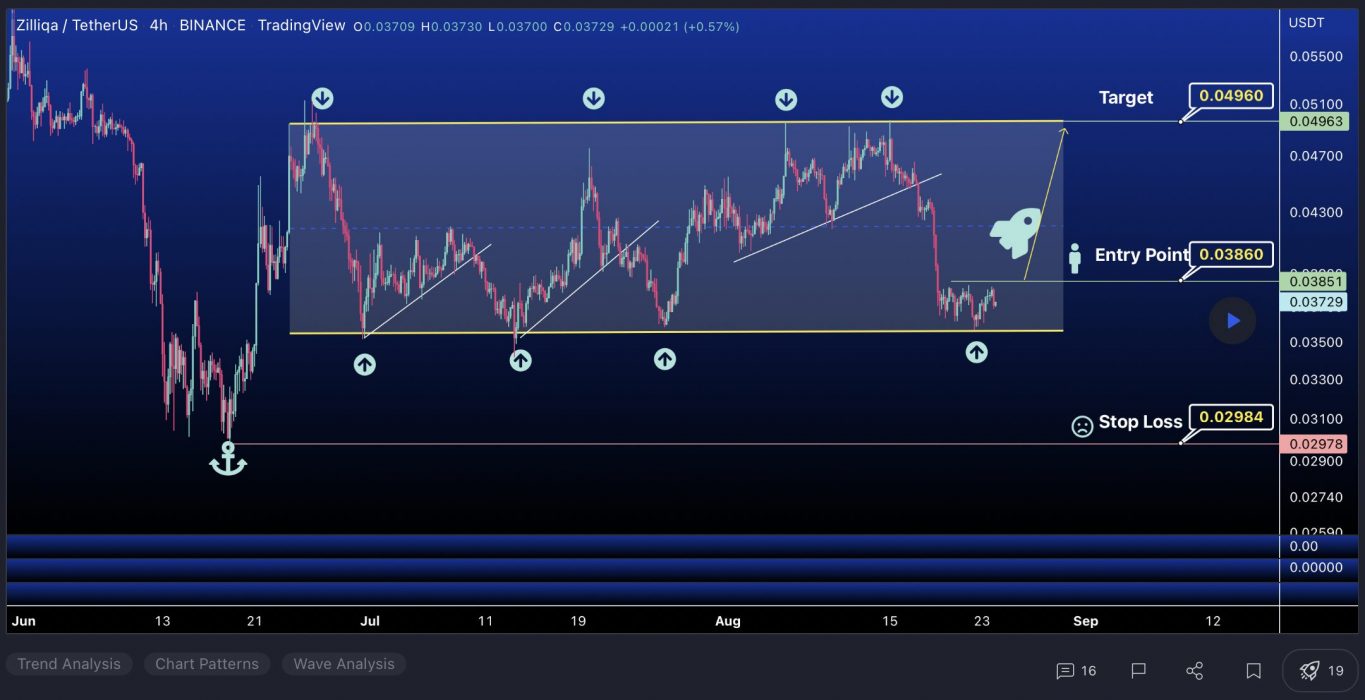

IOTX Price Analysis

At the time of writing, IOTX is ranked the 108th cryptocurrency globally and the current price is US$0.03144. Let’s take a look at the chart below for price analysis:

By late Q2, IOTX had retraced 80% from its November high as it created relatively equal lows near $0.02506. Just above these lows, the price is testing possible support near $0.03145. This level saw accumulation in early August and could support at least a short move upward.

If this level instead breaks and the price drops, bears could be aiming for an inefficiently traded area between $0.02915 and $0.02827. This area is under multiple relatively equal lows that have been in place since late Q3 2021, providing an appealing target for bears.

However, a move into probable resistance near $0.03825 could occur first, even if the price later breaks down. This level is a range high for a significant amount of trading during Q1 2022.

If this resistance breaks, the price could reach the next probable resistance near $0.04516, where it consolidated before mid-Q2’s breakdown.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.