Vitalik Buterin has donated at least US$ 60 million worth of Ethereum (ETH), after dumping massive amounts of three dog-theme coins: SHIBA, AKITA, and DOGELON.

SHIBA Developers Gifted Vitalik The Coins

The SHIBA developers, who are also behind the other dog-theme tokens (AKITA and ELON), had a rather unusual distribution strategy. Presumably, they sent large amounts of SHIB, AKITA, and ELON to Vitalik’s public address. Their idea was to present Buterin as a SHIBA supporter and that a self-made Billionaire like him wouldn’t need them. It seems to have worked as the SHIBA coin soared over 700%.

Shiba Inu’s website stated that the tokens sent were “burned,” so everyone had to buy them on the open market. Despite their plans, it seems Vitalik had a better idea.

Only a few hours later, he sold the tokens in Uniswap in exchange for ETH, selling 660 billion SHIB, 140 billion AKITA, and 43 billion ELON, totalling 15,719 ETH, around US$ 63 million.

Vitalik Sent the Funds to Charity

Vitalik sent the funds in batches to various non-profit organisations, donating the dog-themed tokens and even some of the ETH he made in the sale.

India’s Crypto Covid Relief Fund received 500 ETH and 50 trillion SHIB tokens. The Methuselah Foundation, a non-profit organisation that focuses on making people live longer, received 1,000 ETH and 430 billion ELON tokens, worth US$ 215,000.

The largest batch was sent to Givewell, an American assessment organization, which received 13,292 ETH, around US$ 50 million.

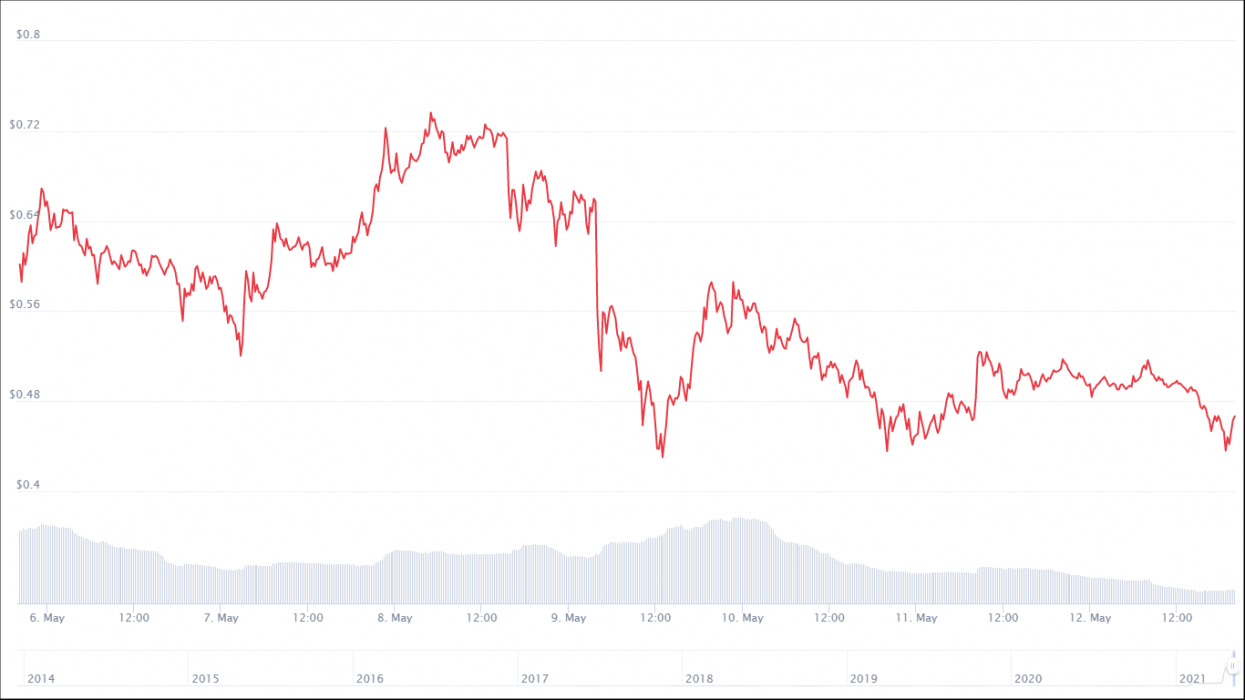

After the move, the three dog-theme coins suffered harsh price drops —around 30% for each— and Vitalik got praised by the crypto community, who called him a role model for everyone in the crypto space.