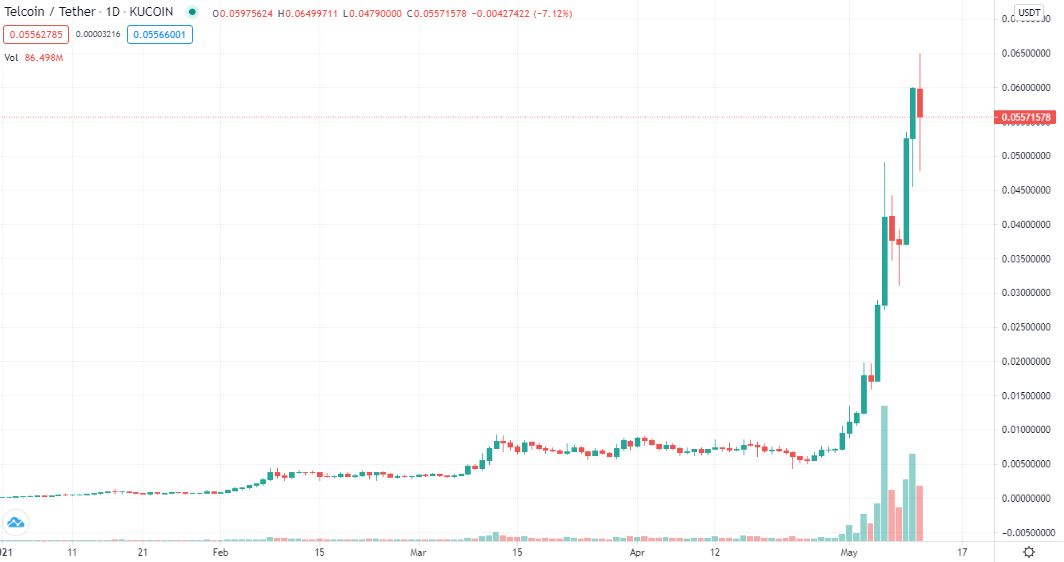

Japanese cryptocurrency Telcoin (TEL) has made significant gains this 2021, surging over 260% in a week following recent liquidity integrations.

TEL has surged more than 4,000% since February 1, now trading at $0.054 USD at the time of writing, having recorded over $110 million USD in 24-trading volume.

Global Remittance Services With Telcoin

The recent surge in price follows the launch of V2, an upgrade that enables Telcoin remittance services between the Philippines and Canada, being the North American country the first of four initial sending markets for fiat remittances, with Australia, the United States and Singapore to follow.

The project has called the crypto community’s attention since its CEO, Paul Neuner, appeared before the Nebraska Legislature on February 23 to talk about how the state could benefit from making legislation geared toward turning the state into a decentralised finance hub.

A Brief Explanation of Telcoin

Telcoin is an Ethereum-based platform that bridges mobile money platforms to decentralised finance systems.

The protocol allows users to make instant transfers with their phones or PCs by leveraging blockchain technology to transfer money worldwide in seconds instead of making long lines to send remittances.

TEL can be bought on several centralised and decentralised exchanges, including Kucoin, Uniswap and Quickswap.