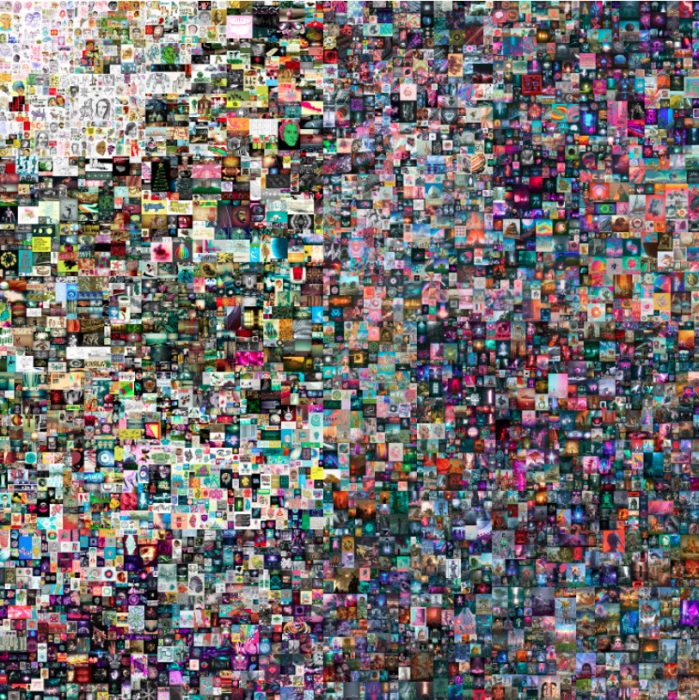

Non-fungible tokens (NFTs) are becoming the next-big trend in the cryptocurrency space. In recent days, many digital art collections were issued in the NFT marketplaces, netting fortunes for the owners and artists. Today, a popular digital artist, Beeple, bagged over US$60 million from the sales of his 5,000-day digital art collection – a figure that is way greater than what Anthony Pompliano predicted some weeks ago.

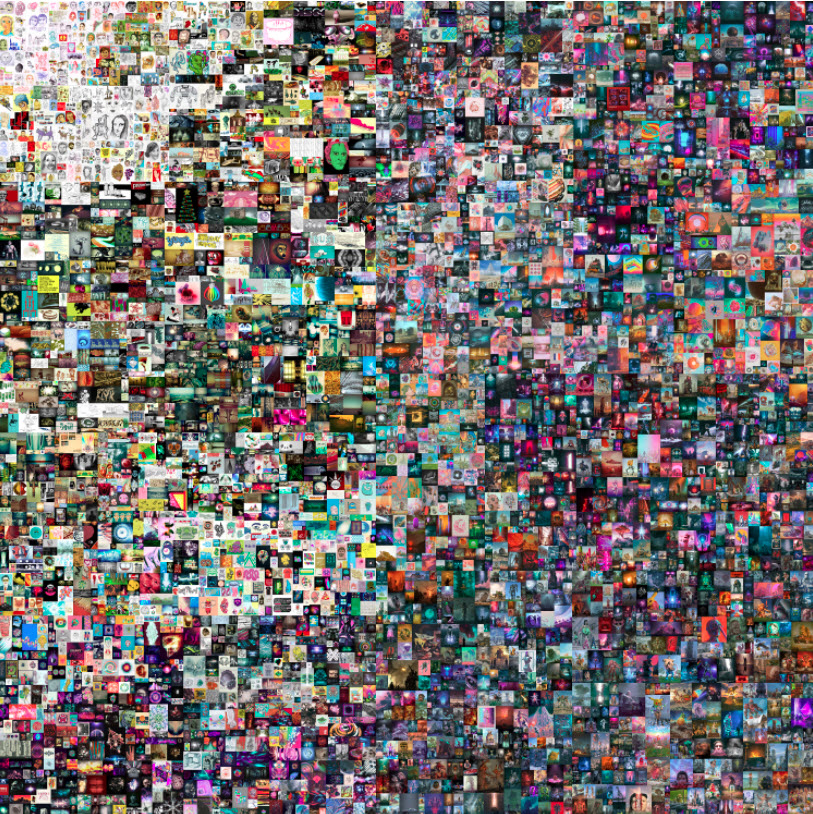

Beeple’s 5,000-day Art Sells for Over $60 Million

Beeple’s art sales marked the first time non-fungible token (NFT) collections were sold at an auction house, and also one of the highest art collections ever sold via auction. As reported, the 5,000-day collection went for a total value of US$69,346,250. However, the collections were sold for $60.25 million, with about $9 million premium, i.e., a percentage of the final price. The art was sold at Christie’s, a British auction house, with 353 bids in total.

The digital artist began making the art collection daily in May 2007, which lasted for 5,000 days straight, and of course, led to the title, “EVERYDAYS: THE FIRST 5000 DAYS.” The collection is thought to be the most unique bodies of work to emerge in the history of digital art. It initially consisted of basic drawings, but took on abstract themes, color, and form, as Beeple began working in 3D. He wrote:

“I almost look at it now like I’m a political cartoonist. Except instead of doing sketches, I’m using the most advanced 3D tools to make comments on current events, almost in real-time.”

WarNymph Sold for US$5.8 Million

On Wednesday, Crypto News Australia reported another digital art collection from Grimes dubbed “WarNymph,” which was sold as NFTs on the Ethereum blockchain for about US$5.8 million.