Over the past week, Bitcoin (BTC), the largest digital currency by market capitalization, has surged past US$50,000 to currently US$54,000 (AU$71,000). This does not come as a shock due to the massive demand from institutions.

As recently as March 8, Crypto News announced that Chinese software company, Meitu as the latest corporate Bitcoin investor. The company allocated US$17.9 million in Bitcoin. Aside from the growing lists of Bitcoin buys, recent data from Glassnode, a crypto analytics platform, showed that the Bitcoin futures perpetual funding rate is rising again. This signals that traders are betting big on the cryptocurrency via leverage.

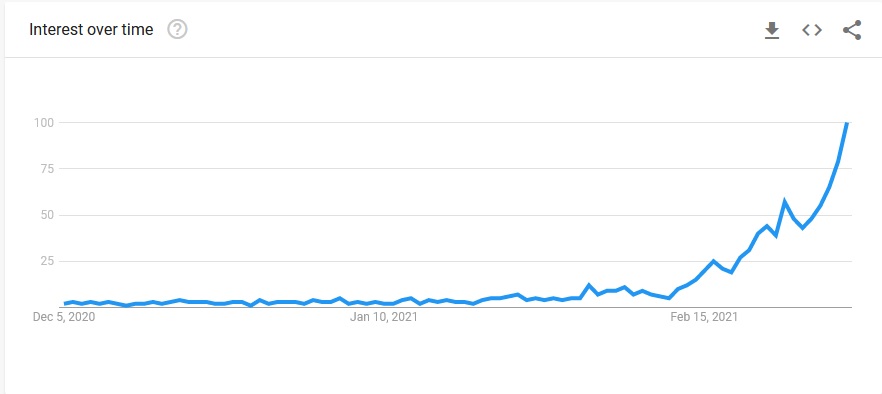

BTC Funding Rate is Gradually Rising

As seen in the diagram above, the Bitcoin futures perpetual funding rate across all exchanges is nearing 0.06 percent. This is obviously not the same levels recorded in February; however, a Bitcoin futures perpetual funding rate above 0.01 percent usually indicates that traders are overextending their bullish trades.

The increasing trades in the futures market become more evident as there is currently an uptick in the open interest in Bitcoin futures across all derivative trading platforms. During press time, there was 349.27K BTC worth of open interest (about US$15.9 billion) across all exchanges, which represented a 13.25 percent increase on a 24-hour count, according to the market data from ByBt, a digital currency tracking platform.

Binance holds the lion’s share of the market as it saw about US$3.41 billion open interest in BTC futures during the time of writing. Bybit, OKEx, and CME follow the list with US$3.04 billion, US$2.65 billion, and US$2.26 billion in open interest, respectively.