Australian investors are now choosing cryptocurrencies instead of gold, according to a new survey. Likewise, Australia has positioned itself as the second country with the most interest in crypto debit cards, surpassing the U.S. and standing behind Nigeria,

According to The Motley Fool —who also invested $5M in Bitcoin despite calling it a “terrible investment”— from 2,000 investors surveyed, at least 12.6% of them are now holding cryptocurrencies in their portfolio, while 12.1% of them are still holding precious metals like gold.

Aussies are Natural Hodlers

According to the survey, at least 51% of the interviewed stated they do not plan to sell their assets anytime soon, and at least 23% of them plan to hold their funds and sell in at least three years at best.

It seems logical that Aussies wouldn’t want to sell anytime soon, as a massive wave of FOMO —fear of missing out— kicked in at the beginning of February, with Australians buying cryptocurrencies more than ever, and just before Elon Musk announced that Tesla was investing $1.5B in Bitcoin.

“Crypto Debit Card” Spikes in Australia

Moreover, according to a report from Crypto Parrot, Australia is the second country with the most interest in Crypto Debit Cards. The term “Crypto Debit Card” in Australia has a total score of 45 Popularity Points in Google.

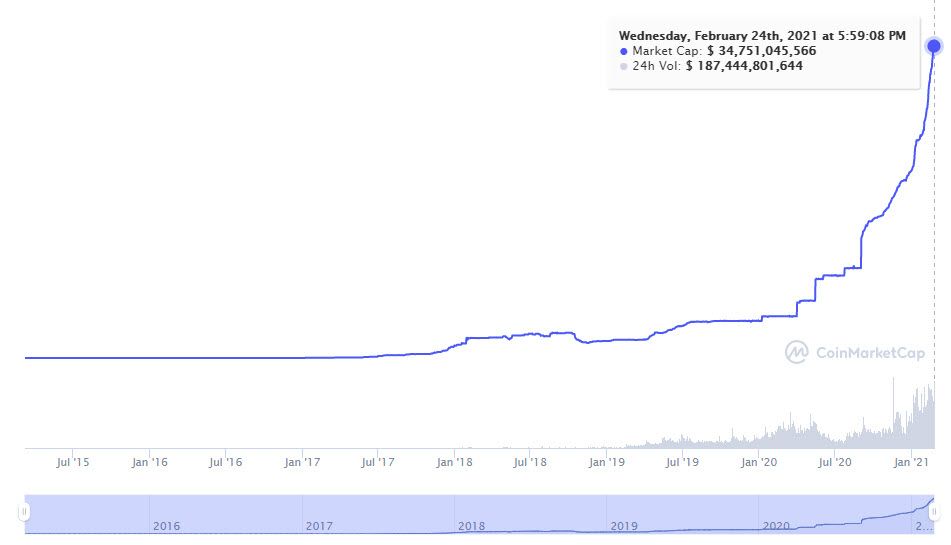

The interest in cryptos has significantly increased since March 2020, when all markets around the world crashed, and more Aussie investors —and Australians in general— were moving toward digital assets like Bitcoin.

The demand for cryptocurrencies in Australia such, that over 5,000,000 Aussies will own cryptocurrencies this year, and over 45% of Aussies are investing in Bitcoin merely because of the price increased.