After the launch of Graph on Binance Launchpad today, GRT took a strong Breakout with +502% gains in a single day. Let’s take a quick look at GRT, price analysis, and possible reasons for the recent breakout.

What is Graph?

The Graph is an indexing protocol and global API for organizing blockchain data and making it easily accessible with GraphQL. Developers can use Graph Explorer to search, find, and publish all the public data they need to build decentralized applications. The Graph Network makes it possible to build serverless Decentralized Apps that run entirely on public infrastructure.

Graph Quick Stats

| SYMBOL: | GRT |

| Global rank: | 71 |

| Market cap: | $296,431,814 AUD |

| Current price: | $0.3519 AUD |

| All-time high price: | $0.4670 AUD |

| 1 day: | +502.26% |

| 7 day: | +527.70% |

| 1 year: | +527.70% |

Graph Price Analysis

At the time of writing, GRT is ranked 71st cryptocurrency globally and the current price is $0.3519 AUD. This is a +502.26% increase since the launch of its ICO at Binance Launchpad today (18th December 2020). Have a look at the chart below for price analysis.

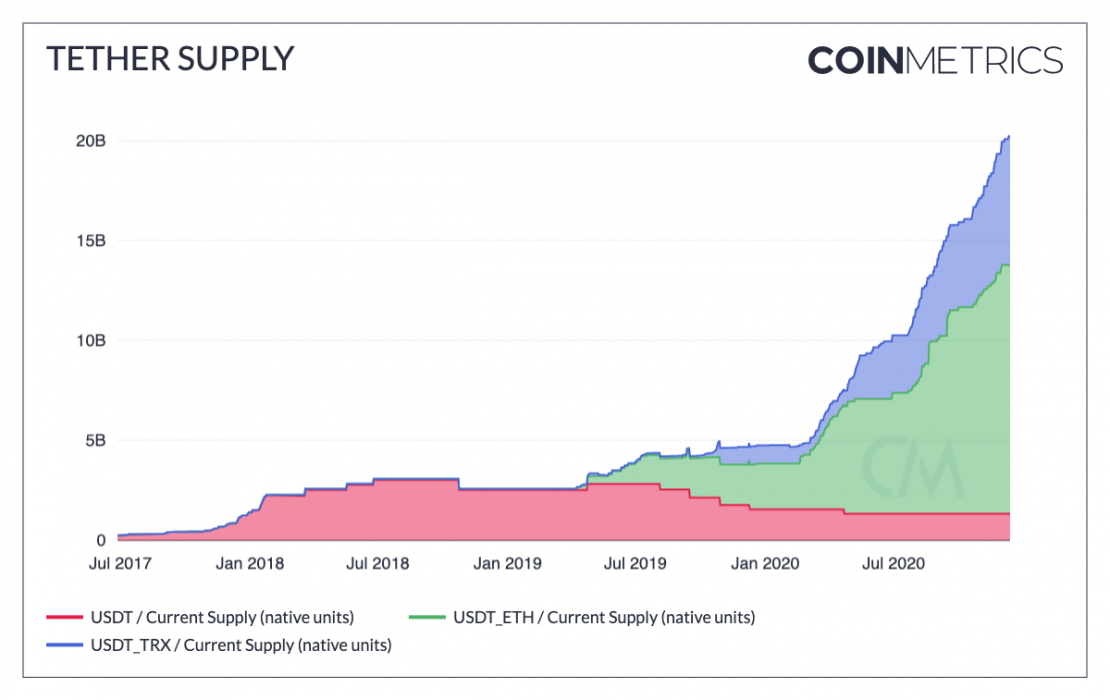

After the launch of Graph on Binance Launchpad, It pumped up to $0.4670 AUD having +502% gains in just a few hours and the initial opening price of GRT was $0.0813 AUD at Binance Exchange with many different trading pairs like GRT/BTC, GRT/USDT, and GRT/ETH.

Currently, GRT is trading at $0.3519 AUD price levels after breaking out the squeeze resistance in its sideways trend & now heading towards its all-time high price.

What do the technical indicators say?

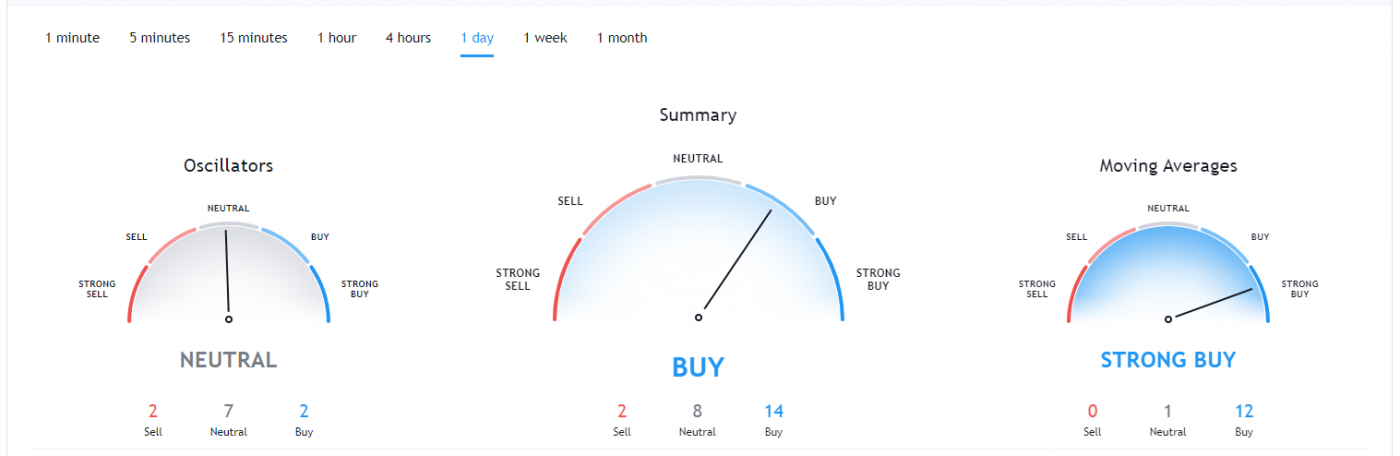

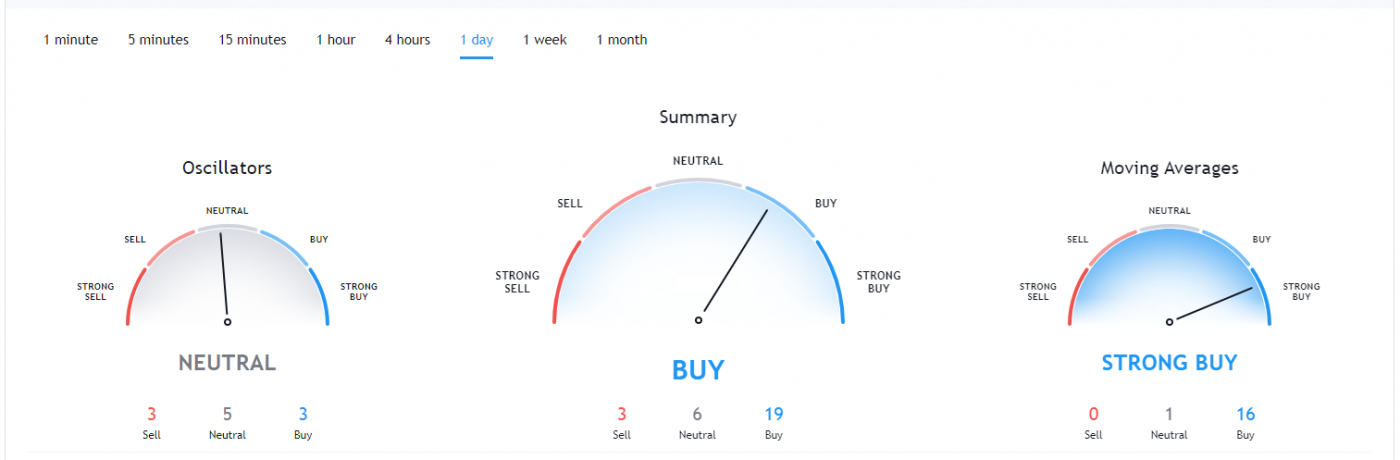

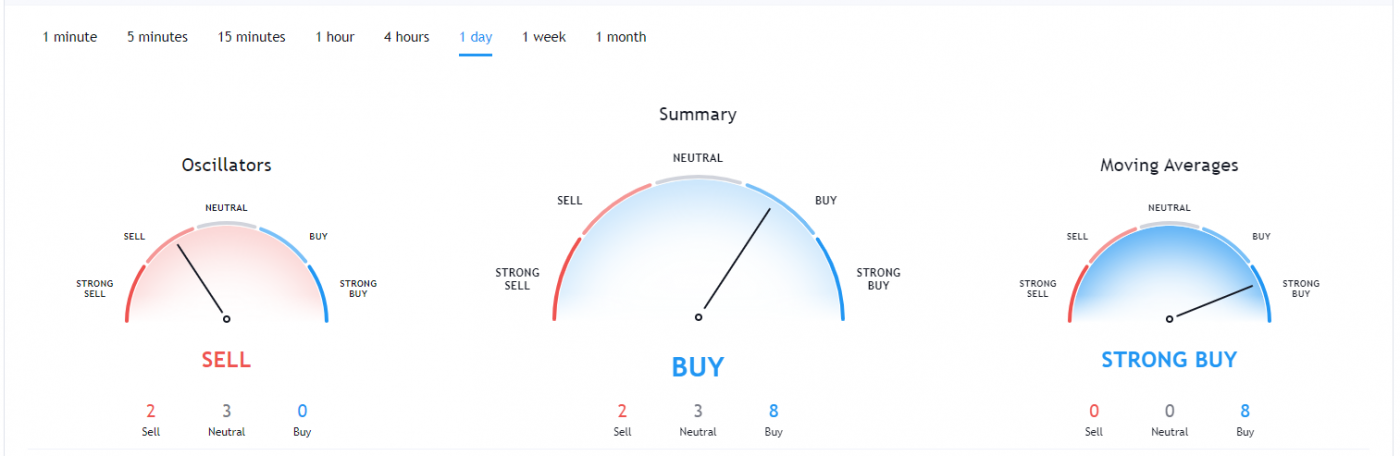

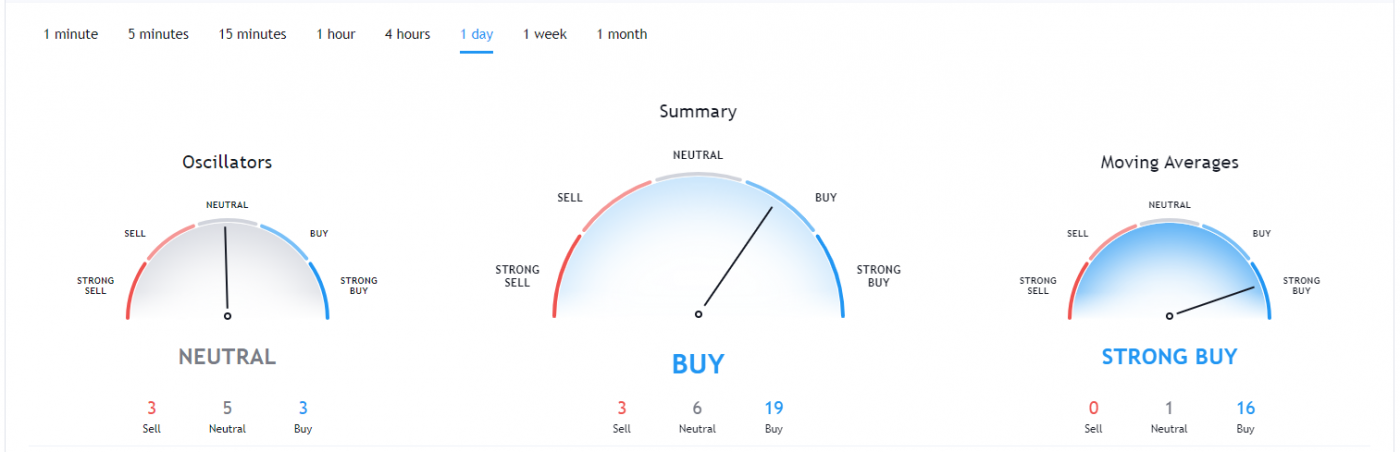

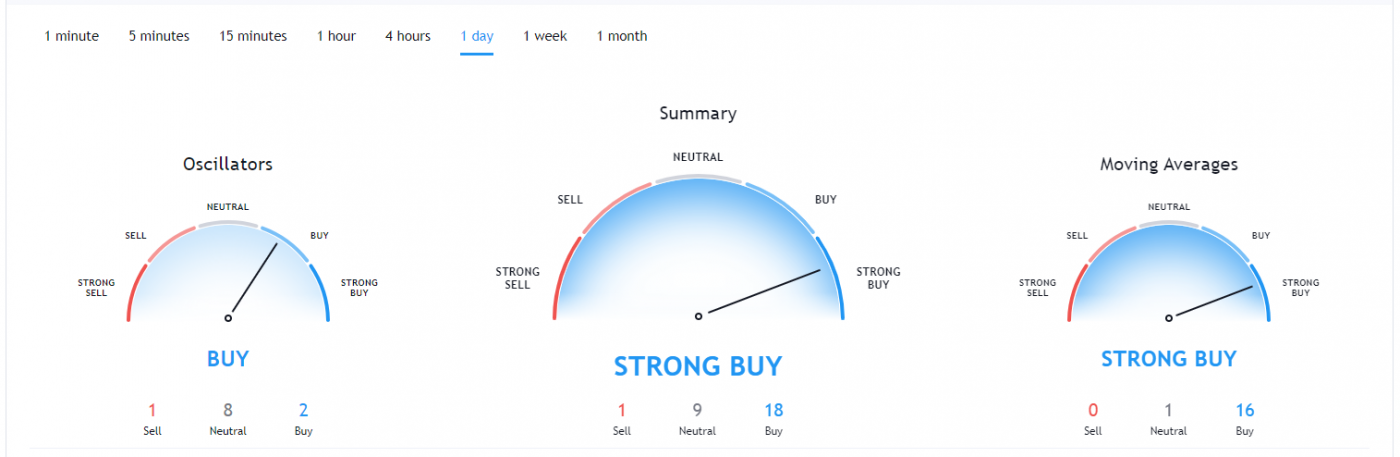

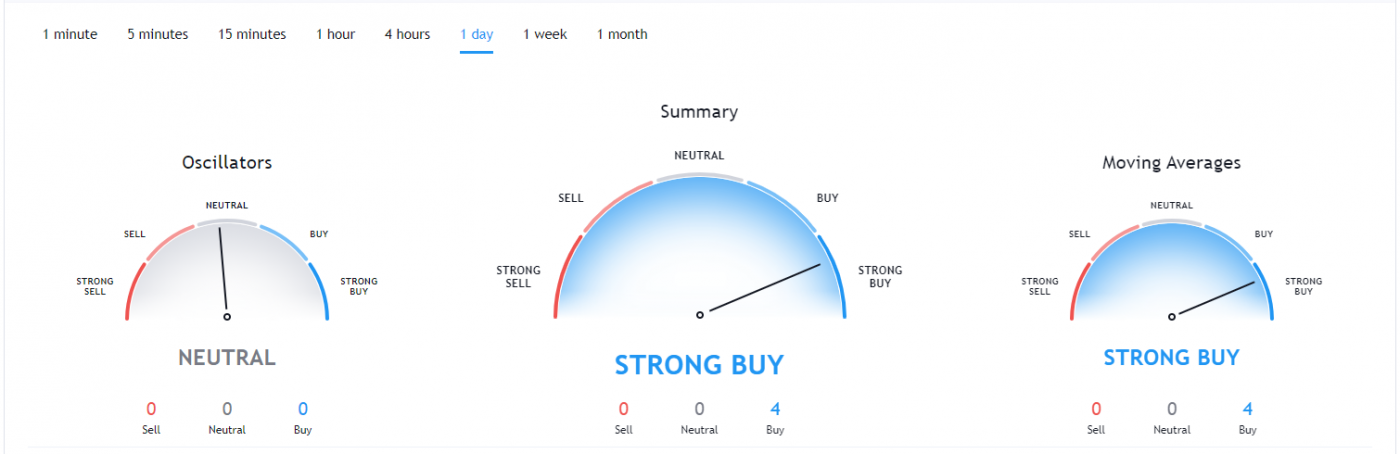

The Graph TradingView indicators (on the 1 day) mainly indicate GRT as a strong buy, except the Oscillators which indicate GRT as a neutral.

So Why did Graph Breakout?

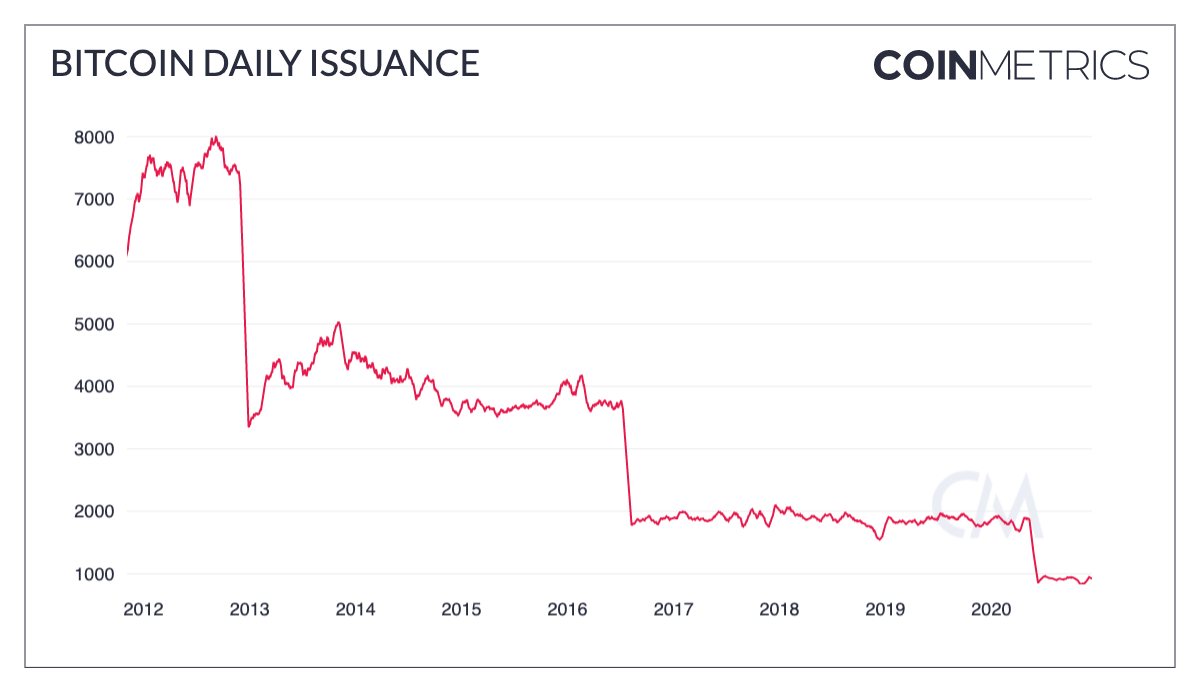

After the opening at Binance Launchpad, mostly ICO’s pumps after going live on exchange for trade and, the recent rise in Bitcoin over 100% since the halving in May and then the suggested start of the Altcoin season could have contributed to the recent breakout. It could also be contributed to some recent news of The Graph Mainnet Launch.

Recent Graph News & Events:

- 12 December 2020 – Airtable Graph Grant Program

- 14 December 2020 – The Graph Council and Grants

- 18 December 2020 – The Graph Mainnet Launch

Where to Buy or Trade Graph?

The graph has the highest liquidity on Binance Exchange so that would help for trading GRT/BTC, GRT/ETH, or GRT/USDT pairs. However, you can also buy GRT from different exchanges listed on Coinmarketcap.