For today’s trading news, we’re looking at are three altcoins that might breakout showing bullish trends in the charts.

1. Ripple (XRP)

Ripple is a real-time gross settlement system, currency exchange, and remittance network created by Ripple Labs Inc., a US-based technology company.

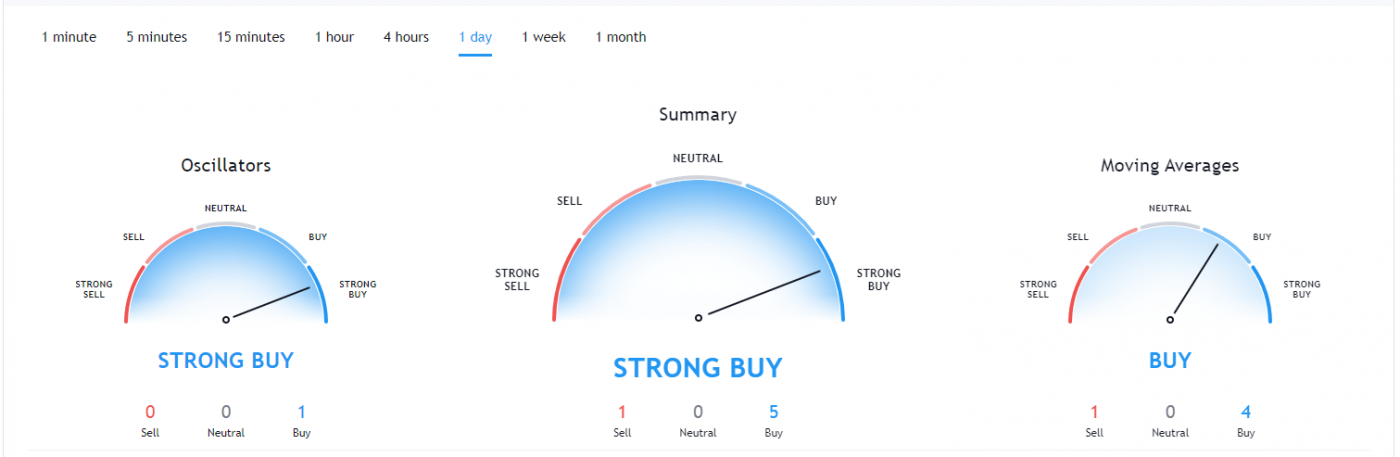

XRP Price Analysis

At the time of writing, XRP is ranked 3rd cryptocurrency globally and the current price is $0.8109 AUD. Let’s take a look at the chart below for price analysis.

If we see the above 1-hour candle chart, we are moving in a symmetrical triangle, just tested the lower support line of this triangle, and we can expect the movement to the upper resistance line.

if we breakout from this triangle, XRP might start a new bullish trend.

“A symmetrical triangle is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Trend lines that are converging at unequal slopes are referred to as a rising wedge, falling wedge, ascending triangle, or descending triangle.”

2. Cardano (ADA)

Cardano is a proof-of-stake blockchain platform that says its goal is to allow “changemakers, innovators and visionaries” to bring about positive global change.

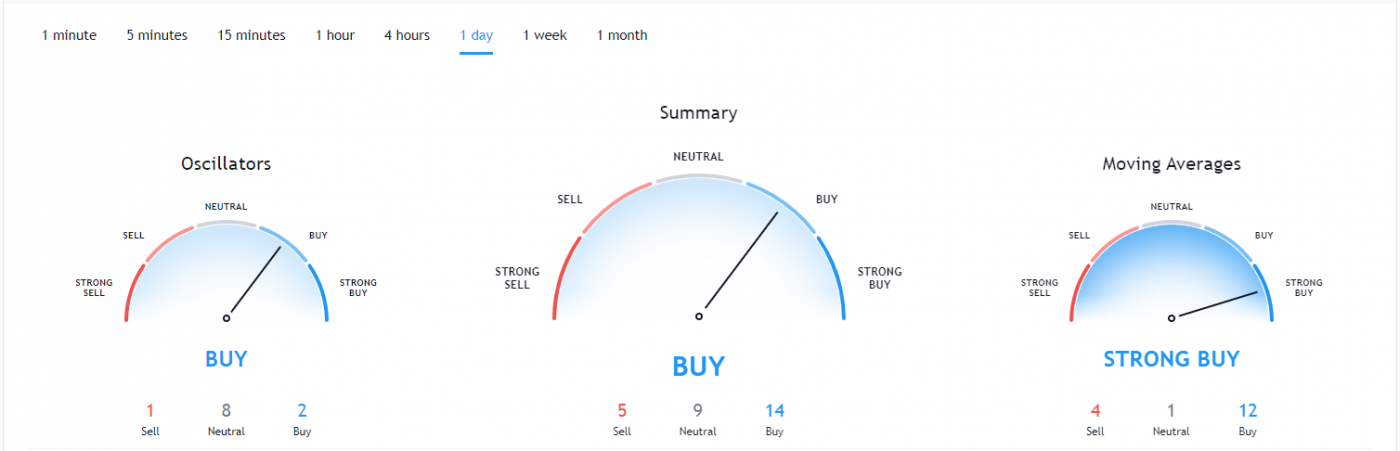

ADA Price Analysis

At the time of writing, ADA is ranked 8th cryptocurrency globally and the current price is $0.2093 AUD. Let’s take a look at the chart below for price analysis.

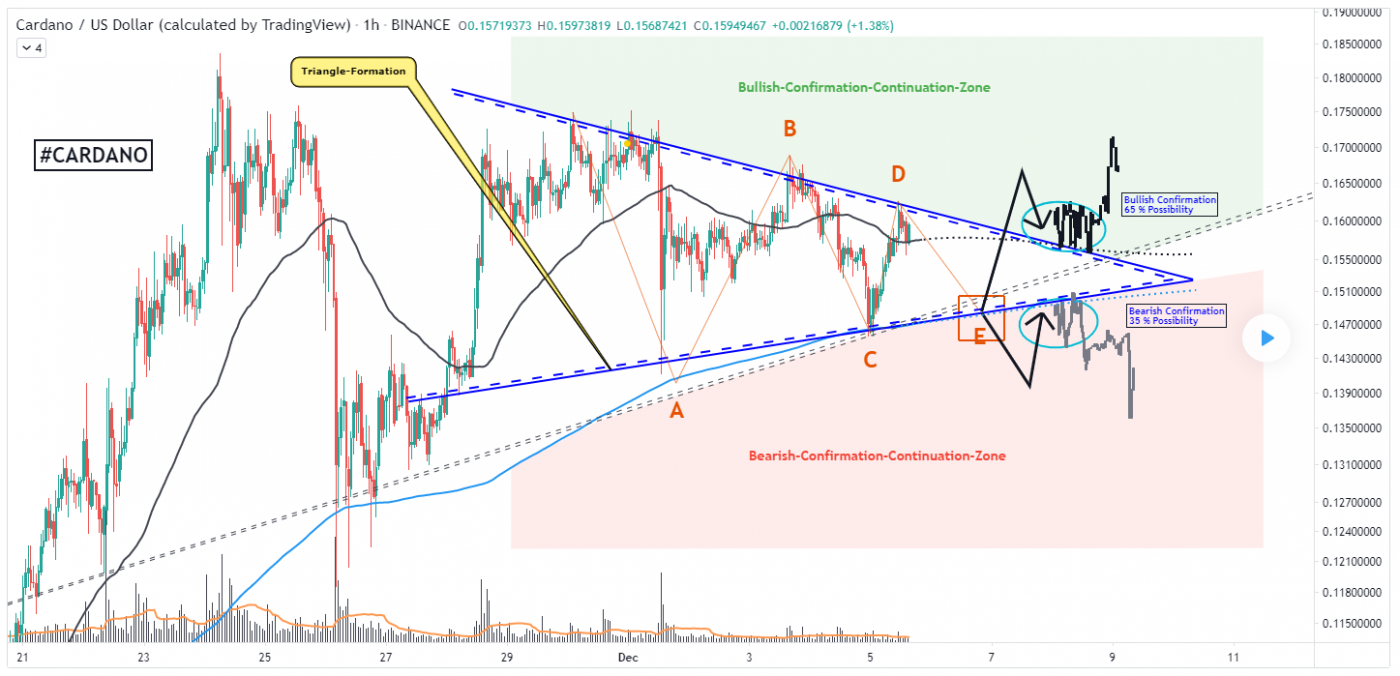

If we see the above 1-hour candle chart, Cardano ADA is forming an ABCD pattern in a Triangle Formation by making higher-highs & higher-lows in the price levels. If ADA bounces back from the E point of a Triangle Formation, It can start its new bullish trend after breaking the next resistances.

“The ABCD pattern is an easy-to-identify chart pattern that consists of two equivalent price legs. It is a harmonic pattern that helps traders predict when the price of a stock is about to change direction. The pattern can be used to predict either a bullish or bearish reversal depending on the orientation.”

3. Tron (TRX)

TRON is a blockchain-based operating system that aims to ensure this technology is suitable for daily use. Whereas Bitcoin can handle up to six transactions per second, and Ethereum up to 25, TRON claims that its network has capacity for 2,000 TPS — 24/7.

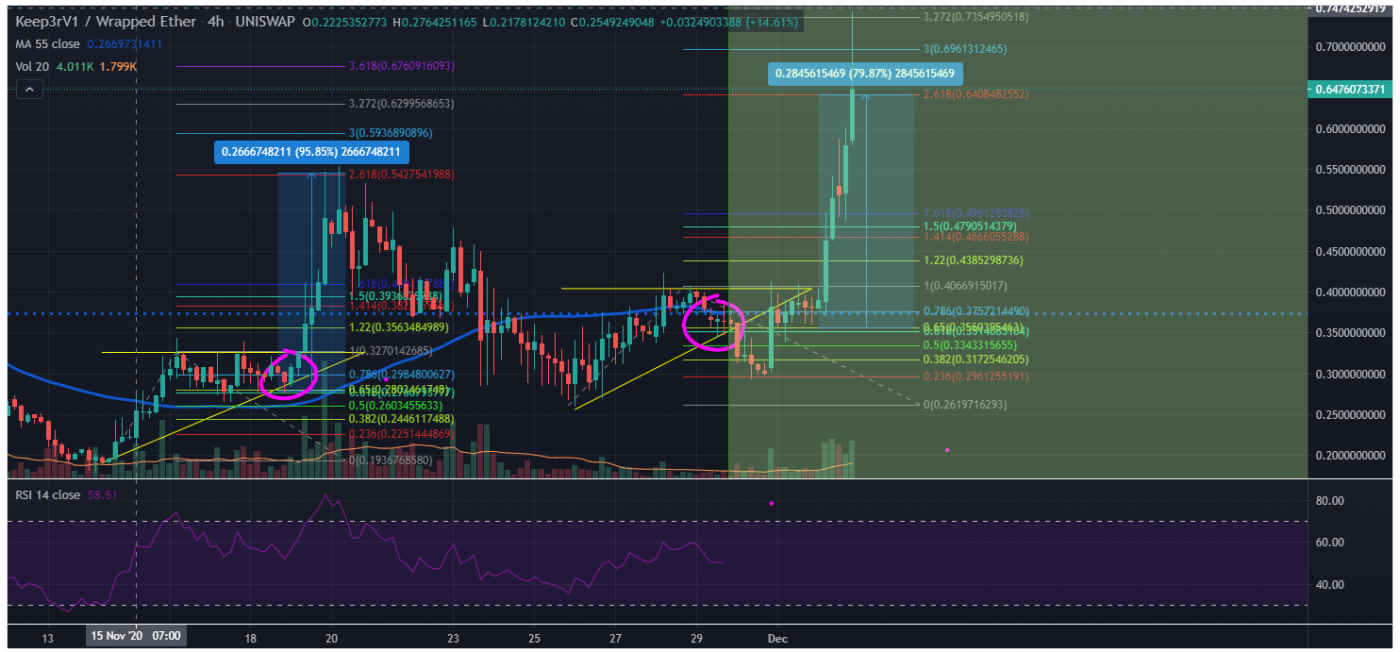

TRX Price Analysis

At the time of writing, TRX is ranked 18th cryptocurrency globally and the current price is $0.0408 AUD. Let’s take a look at the chart below for price analysis.

November brought an impressive 70% rally in TRX’s price before it encountered resistance below September’s swing high, near $0.0539 AUD.

Last week’s sweep of old highs could lead to a retest of support near the November monthly open, where equal lows make an appealing short-term target for bears.

If we see the above 4-hour candle chart, TRX is squeezing inside the symmetrical triangle and is now charging up for the strong breakout, if TRX bounces back from the support like then it might pump with a breakout.

Where to Buy or Trade Altcoins?

These 3 Altcoins have the highest liquidity on Binance Exchange so that would help for trading USDT or BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.