Welcome to the second edition of our crypto news in review. It has been a very bullish market in the last two weeks with the usual volatility, and things appearing to speed up in the crypto markets. Themes in this past week have been crypto adoption, more growth in crypto infrastructure, lots of bitcoin high numbers predicted by pundits & analysts, and some Alt coins starting to moon.

Australia’s Stories of the week

Adoption of crypto continues in Australia

- Felicity reported that an Australian online pet shop, Pet Parlour now accepts payment using the following crypto (Bitcoin, Bitcoin cash, Dai, Ethereum and Litecoin). And in a similar theme Cryptonews reported more Australian restaurants accepting crypto as a form of payment, last month.

- CoinDesk reported that West Coast Aquaculture (WCA), a company based in Australia, recently announced the completion of its initial public offering (IPO), which was mostly conducted using digital currency. The majority of the funding (about 89 percent) was conducted using the US dollar-backed stable coin, Tether (USDT). So, the company basically raised about AU$4.4 million (USD 3.2 million) using cryptocurrency.

- “A billion-dollar Australian investment management firm has gotten into bitcoin, citing that the cryptocurrency is superior to gold. Australian investment management company Pendal Group has started investing in bitcoin through futures contracts on the Chicago Mercantile Exchange, AFR publication reported Monday.” see Bitcoin news, and was quoted as saying that many of their clients are asking how to get access to bitcoin and what to do in the crypto space;

Implementation of crypto infrastructure continues at a rapid pace in Australia:

- Novatti, an Australian fintech company, has expanded and improved its payments network across 179 countries — by partnering with UnionPay, a global card payment company, wrote Jose Oramas.

- Crypto news also reported the launching of crypto payment solutions recently by the Australian Fintech Raleypayl and the European digital platform Azimo.

View more Australia crypto news

Worldwide Stories of the week

Paypal is still in the headlines with it and Cashapp reportedly buying a majority of the newly mined bitcoin last month, causing scarcity bitcoin, reported by Ibiam Wayas on Tuesday.

Bitcoin has also been in the news a lot with many different people in the finance sector reporting big bitcoin moves are coming in 2021, here are a few snapshots

- The bitcoin network reported “Tom Fitzpatrick – an analyst with Citibank – is even making the argument that bitcoin could potentially hit a price of around $318,000 by the end of next year.”

- Coinsdesk recently reported that “Hong Fang is the CEO at OKCoin, a U.S. licensed, fiat-focused cryptocurrency exchange headquartered in San Francisco” said “I think BTC is likely to hit $100,000 in the next 12 months. Significant upside has yet to play out for bitcoin”, and added that there is a reasonable path for the price of bitcoin to reach over $500,000 in the next decade”.

- Todd Gordon, founder of TradingAnalysis.com, has argued that the next price target for the flagship cryptocurrency bitcoin is about $74,000 based on the Elliott Wave theory. The adoption by Paypal and other publicly traded companies gave him the impetus to share his view, reported by the CryptoGlobe.

- And then there is this! “Speaking on the The Pomp Podcast with host Anthony Pompliano, macro investor Dan Tapiero believed that roughly $15 trillion in wealth could flow into Bitcoin and gold over the next ten years” via AMBCrypto.

Important Crypto Dates

A select list of recent and upcoming important crypto events

| Coin | Date | Event |

| Ampleforth (AMPL) | 24 November | Launched the next Geyser |

| Horizen (ZEN) | 25 November | Mainnet Fork |

| Litecoin (LTC) | 25 November | Binance options listing |

| StormX | 27 November | Staking launched |

| Digital Futures Exchange | 30 November | Rolling out a new exchange |

| Ethereum (ETH) | 1 December | Eth 2.0 Staking enabled |

There has been much talk about Ethereum 2.0 and they just recently reached their target of about 525,000 Ethereum needed to be staked by the 24 November, for developers to launch the proof of stake on 1 December, reported Bitcoin news. To participate, “32 Ethereum is what is needed to become a validator and earn a stake on the Ethereum chain. At the current exchange rate of $608 per ether, it costs close to $20k per staking validator.”

If you cannot afford 32 Eth, and perhaps have as little as 0.5 Eth, then you can still participate via the Ankr platform Stkr.io; see CryptoTiker on how to stake Ethereum 2.0 on Ankr.

Lastly, for Digibyte fans, AntumID announced in twitter that in December 2020, 11 million Belgians can log in to the government without an e-ID thanks to MyDigiPassword Platform! Powered by the DigiBytecoin and supported by the DGB Foundation.

Crypto Musings

Alt season: will we see something the likes of the November 2017 Alt season in the near future?

For the newbies, Alt season is a time period in which many of the alternative coins rise parabolically or exponentially in a short period of time. Back in late 2017 and early 2018, some Alts rose by a factor greater than 10 times, i.e. a rate of return of 1000% in a few weeks which is spectacular. Not all Alt coins had such huge gains but many did double and triple in a few days or less and this was almost a daily occurrence, and hence the term Alt season was coined.

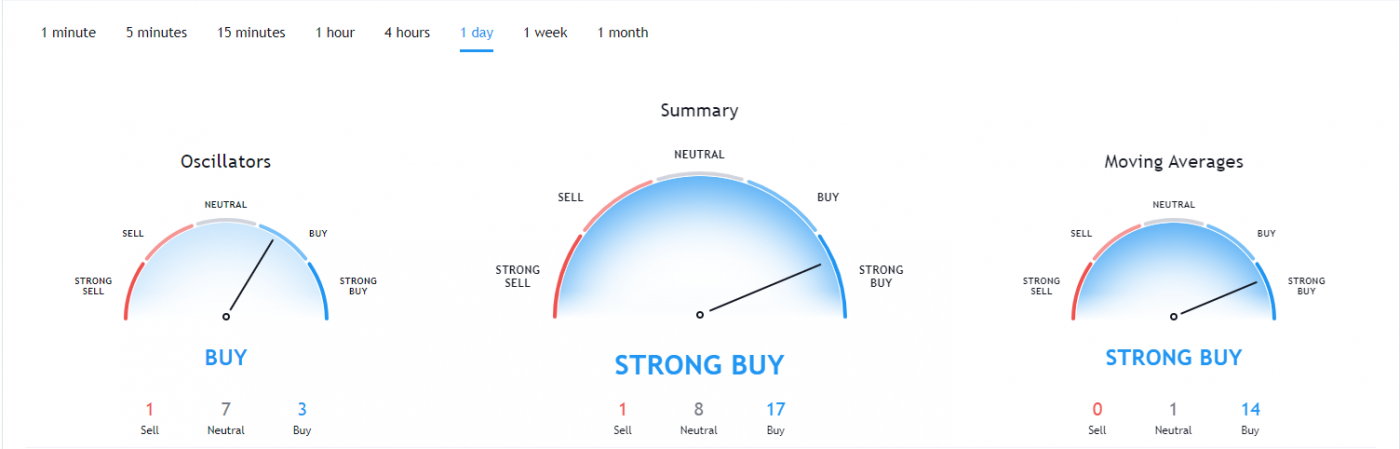

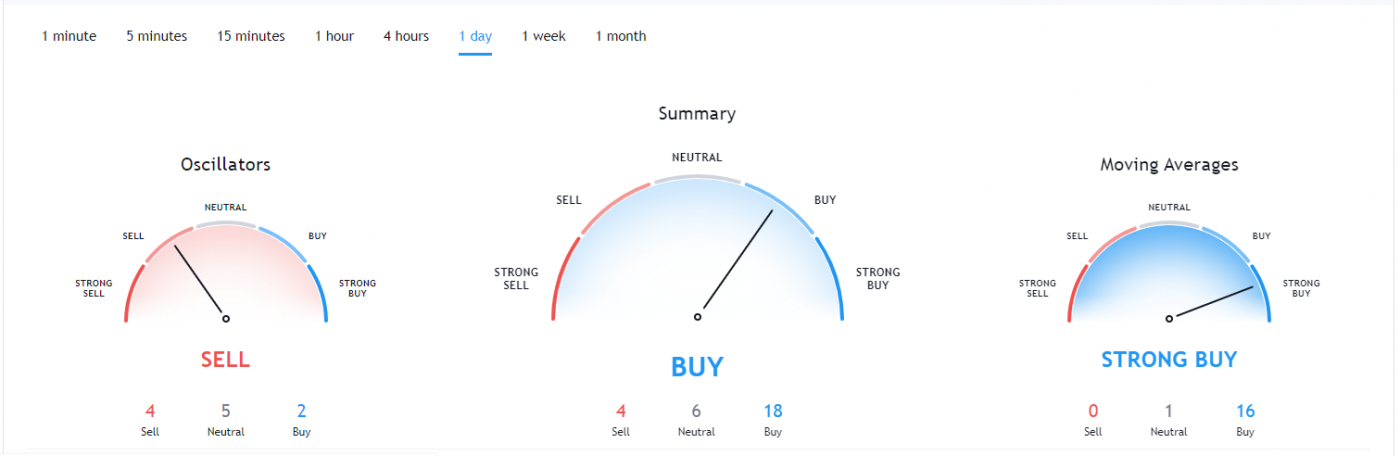

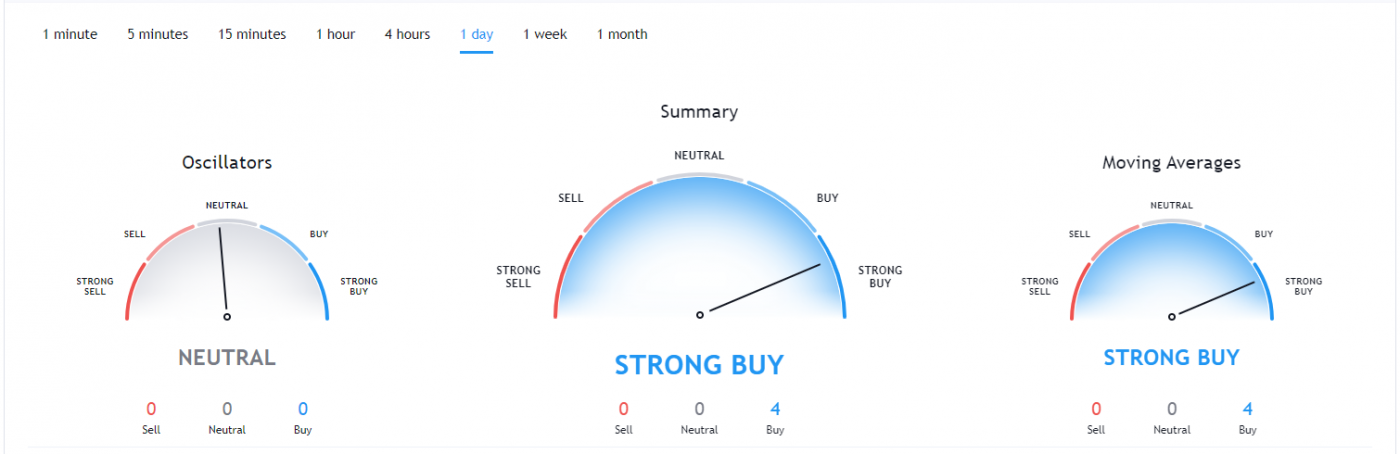

In recent weeks, some key Alts such as XRP, XLM, and Horizen have risen over 100% (CryptoTicker) and other key Alts such as Cardano, Zillaqa and Vechain all performing well with approximately 40% gains within a week’s time frame. Naturally, people are wondering is this the start of Alt season? And of course, analysts have been speculating with charts if it may happen, e.g. see article in BTCmanager.

If speculation is not enough to stir your curiosity then Verge may, “Verge XVG – Cryptocurrency is widely known as the “King Altcoin of 2017 Bullrun”, gave massive gains in that Altcoins season and, today XVG pumped +65% in a single day.” reported Crypto Trading News.

One of the products of Alt season, is many people did not sell as they expected the cryptos to keep going up and up, which did not occur as history tells. XRP is a classic example of this “bag holder” phenomena, in which people buy at the top due to FOMO (Fear of missing out) and then get stuck holding “bags of a crypto” for years until the price exceeds what they bought it for. So whilst Alt season is anticipated with the promise of big profits, there is also many risks that come with it.

Interestingly, the Daily Hodl reports on a poll of XRP bag holders and what their intended sell prices are:

“XRPs most ardent supporters, often referred to as the XRP army, are revealing when they plan to sell their holdings..” A poll was conducted on Twitter and investors have plans to sell at different points between $1 and $10, with a majority ie 63% saying they plan to sell above $10.

Click here for the latest trading news on crypto news.

Thought of the week: “Alt Season: what thoughts, feelings and perspectives are arising inside you relating to a possible upcoming Alt season , realistic and unrealistic?”