Swiss crypto tracking and tax assistance platform Accointing has released a new Trading Tax Optimiser (TTO) tool to help traders stay on top of the taxes they are liable pay for their trades.

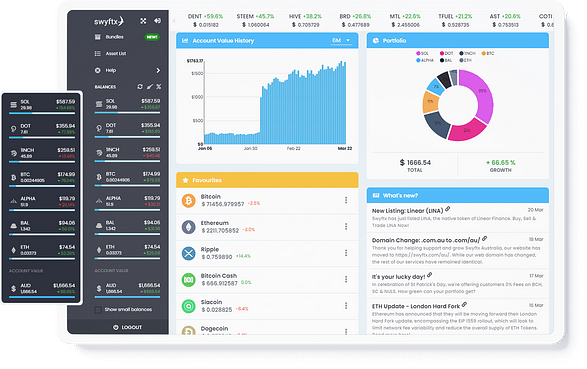

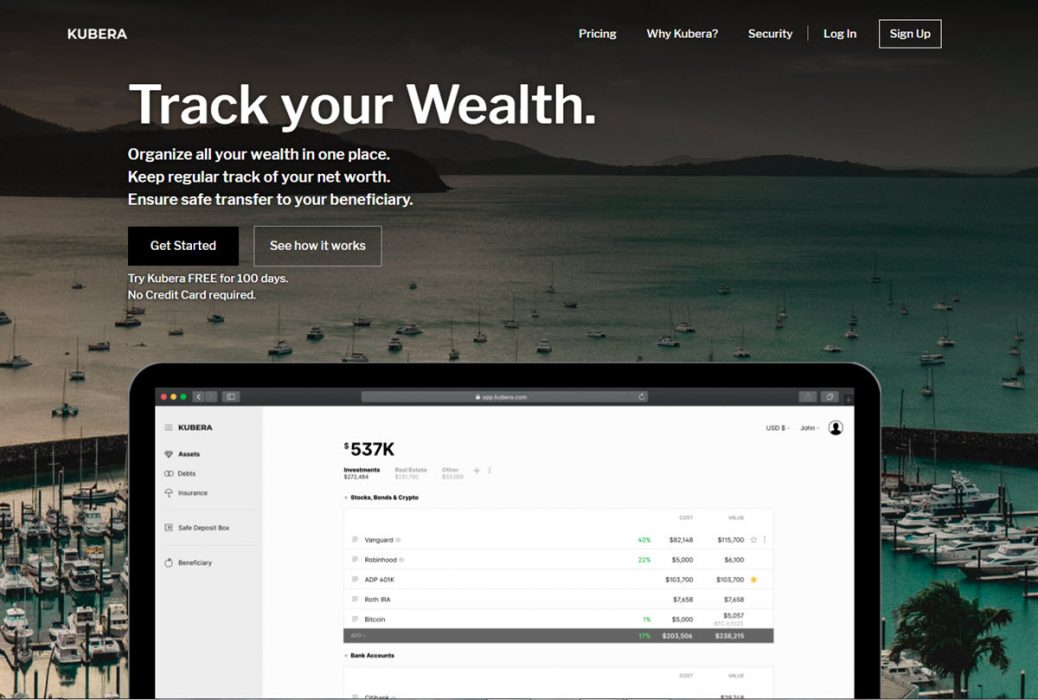

For any sort of trader, it’s important to keep track of trades in order to file for taxes. Traders who don’t make proper preparation can be confronted by huge tax bills that can potentially eat away at profits. Accointing can assist users with organising and keeping track of their crypto data:

How the TTO Tool Works

Some crypto traders don’t really pay attention to the potential tax consequences of their trades until it’s too late. It can easily be the case that if a trader had sold a different coin from a different wallet using the same strategy, they could have reduced their tax bill substantially.

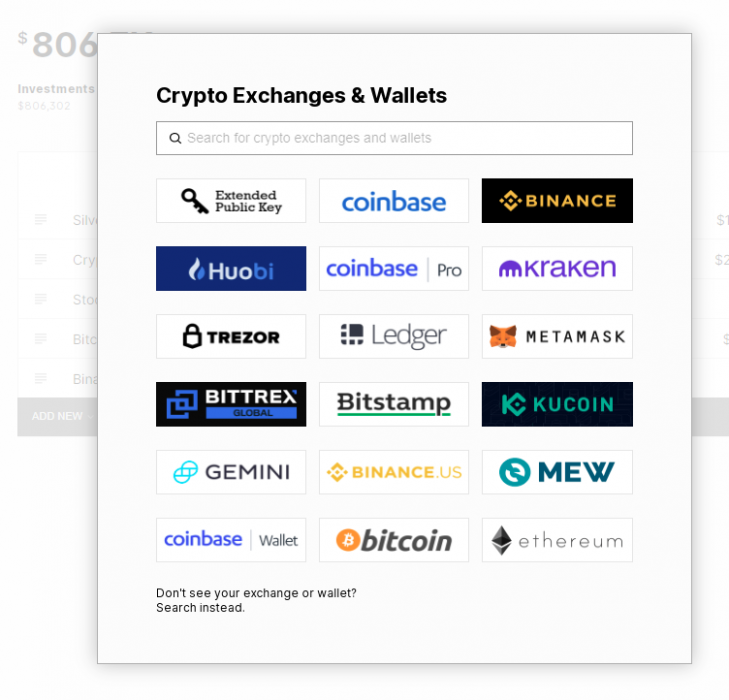

To fill this gap, Accointing’s TTO tool can help determine tax consequences before making a trade to help reduce tax deductibles. Before a trade is made, users can take a look at their dashboard to see the tax implications of the particular coin they want to sell.

The difference in tax rates for selling the same coin held in different wallets can be significant. By displaying the tax implications of selling different coins in a portfolio and which coins attract the lowest taxes, users can manage their deductibles and potentially save thousands of dollars.

Getting Ready for Tax Time

According to Accointing’s business developer, in the US the highest marginal tax rate at the federal level is 37 per cent if you sell one coin, but selling the same coin from a different wallet for the same price can result in a tax rate as low as 15 per cent. The platform allows users to see these implications before making a trade, which could cost them more at tax time. Accointing also has a solution for Australian users to help them at tax time.

By planning ahead, the tool can show users how their tax situation will develop by tracking positions across all wallets. And since all the data is stored on the platform, when it comes around to tax filing time users can simply print their tax report.

In October last year, Melbourne’s RMIT University urged the Australian government to reform crypto capital gains tax. Here are some additional tax tips for Australian traders published by the Australian Tax Office (ATO).