The Australian government has announced that it will extend record-breaking stimulus support payments into 2021, detailing several multi-billion dollar efforts to protect Australian jobs from the COVIC-19 pandemic.

While the fiscal efforts of the Australian government are designed to assist Australian families, employees, and employers through the pandemic-induced financial crisis, Australian consumers have other ideas on how stimulus capital should be spent.

Aussies Spend Super Funds on Furniture, Gambling, Cryptocurrency

Data published by Accenture’s illion and AlphaBeta platform indicates that retail spending in Australia has skyrocketed 17 percent above normal levels, with over 2.8 million Australians seeking early release of superannuation funds as part of the Australian Government’s COVID response.

Consumer spending across Victoria, which has recently returned to stage 3 lockdown in several regions including Melbourne, has decreased due to lower retail activity — but that hasn’t stopped Australians in other states from spending 54 percent more than normal at department stores, 51 percent more on online gambling, and 114 percent more than normal on furniture.

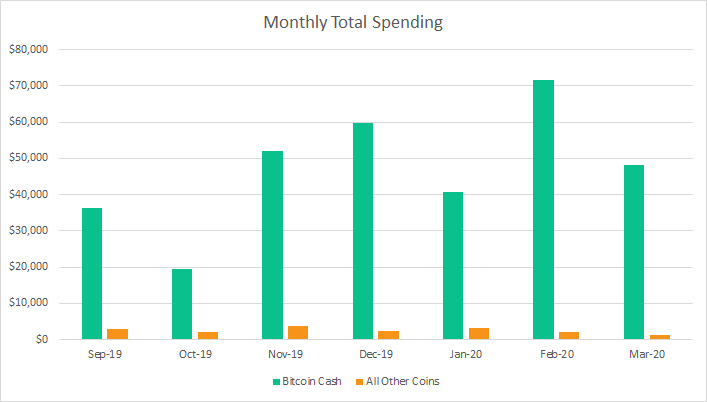

The retail sector isn’t the only market benefiting from COVID stimulus — Australian cryptocurrency purchasing and investment patterns match those published by popular cryptocurrency exchange Coinbase earlier this year, with Australians investing a portion of the $2.8 billion paid out thus far under the early superannuation release scheme directly into crypto markets.

Cocaine Use at 20-Year High

While the retail and cryptocurrency markets are experiencing an inflow of new capital, so too is the Australian illicit drug trade. Australians in lockdown, according to academic data, are more likely to spend money on illicit drugs such as cocaine, resulting in a large spike in cocaine use across the country.

Data published by the Australian Institute for Health and Welfare reveals that cocaine use is at a 20-year high — academic studies into the impact of the COVID-19 lockdown on Australians indicate that lockdown periods are likely to increase illicit drug use in Australia despite supply chain interruptions.