Blockchain security firm CertiK has identified Arbix Finance as a rug pull, warning users who have engaged with the protocol to stay way from it and its ARBX token.

Another Rug in the DeFi Space; This Time Users Are Warned

Arbix Finance is a Binance Smart Chain-based protocol that describes itself as a yield-farming aggregator. So far, it has amassed over US$10 million in deposits by users.

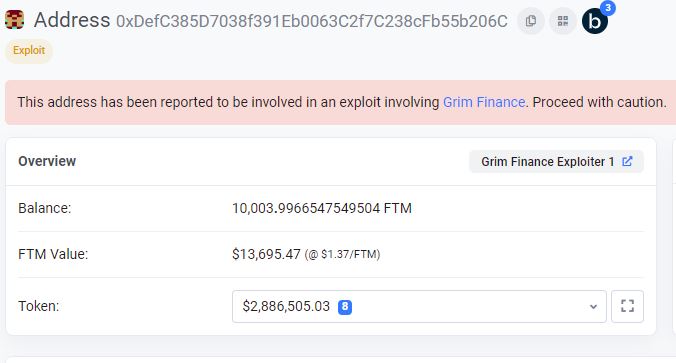

CertiK found several red flags in Arbix thanks to its Skytrace tool, which it uses to analyse the risk of fraud. Some of the firm’s initial findings were that investors’ funds had been allocated in unverified pools through the depositor contract, which were later drained by the Arbix team.

The protocol’s underlying code was purposefully made to allow developers to mint millions of ARBX tokens, with roughly 4.5 million tokens minted to only one wallet.

The exploited contract was not in the audit scope that was done for Arbix. The project inserted eight ‘mint()’ functions to a newly deployed ARBX ERC20 contract, which allowed the owner to mint any amount of ARBX tokens to any address.

CertiK statement

Arbix Disappears Amid Accusations

It appears that Arbix Finance quietly disappeared shortly after the accusations were made – the project’s website and Twitter account are gone, and the ARBX token dropped to $0.

Discerning between a legit DeFi project with goals and a scam is difficult for newcomers in the space. While CertiK managed to warn users before more damage was done, some warnings come too late. In November last year, Crypto News Australia reported how the creators of DeFi token launch Monkey Jizz rugged investors out of US$300,000 worth of BNB.