Decentralised Finance (DeFi) is a blockchain-based form of finance that does not rely on central financial intermediaries (such as brokerages, exchanges, or banks) to offer traditional financial instruments: instead, DeFi utilises smart contracts on blockchains, Ethereum being the most commonly used.

Recently, new chains have emerged to offer users an alternative to Ethereum, which has become notoriously expensive to use, especially in times when the network becomes heavily congested, resulting in gas wars and extraordinarily high transaction fees.

These new decentralised applications (known as ” DApps”) run on a distributed computing system. DApps have been popularised by distributed ledger technologies to allow easy transfer and swapping of crypto assets.

Here is a list of the Top 10 DeFi Swap Token Apps:

UniSwap

Pink unicorn-branded UniSwap is perhaps the most popular DeFi protocol used to exchange cryptocurrencies. The protocol facilitates automated transactions between ERC-20 tokens on the Ethereum blockchain through the use of smart contracts. Uniswap empowers developers, liquidity providers and traders to participate in a financial marketplace that is open and accessible to all. UniSwap V3 was released in May and boasts the most flexible and efficient automated market maker (AMM) ever designed. $UNI is the native token of the Uniswap protocol. Holders of UNI are entitled to governance rights and voting privileges on changes to the protocol, while liquidity providers can receive UNI tokens for their contributions. With its user-friendly interface, UniSwap makes it easy to swap DeFi tokens.

SushiSwap

SushiSwap (SUSHI) is a fork of UniSwap. Unlike Uniswap, which follows Automated Market Makers (AMM), SushiSwap is a user-oriented platform where users provide liquidity in lieu of rewards. It is an audited Decentralised Exchange (DEX) and DeFi protocol described as “Uniswap meets Yield Farming” with SUSHI tokenomics. The protocol’s native token SUSHI is used to govern the platform. SUSHI holders also receive a portion of SushiSwap’s trading fees. SushiSwap is funded by an anonymous group that goes by the name Chef Nomi.

QuickSwap

QuickSwap is a fork of Uniswap that runs on the Polygon network (formerly Matic Network), a Layer-2 scaling solution for Ethereum. Polygon has lower transaction fees compared to the Ethereum mainnet, enabling QuickSwap to facilitate token swaps at a lower cost relative to exchanges like Uniswap.

1inch Network

1inch is an Aggregation Protocol Network that unites decentralised protocols whose synergy enables the fastest, most lucrative and protected operations in the DeFi space. The platform has 540K+ users and a total volume of $70 billion+. It facilitates cost-efficient and secure atomic transactions by utilising a wide range of protocols and performing argument validation and execution verification. The governance and utility token for the platform is self-titled 1INCH. The 1inch Liquidity Protocol is a next-generation automated market maker that protects users from front-running attacks and offers capital efficiency to liquidity providers. The 1inch Limit Order Protocol is perhaps the best feature of this DApp, allowing users to enjoy the most innovative and flexible limit order functionality in DeFi. Its implementation of the Chi gastoken makes transactions on 1inch up to 42% cheaper than swapping tokens on Ethereum. Chi tokenised gas that is pegged to the Ethereum network’s gas price, but the difference is that Chi is used on 1inch and Curve while GasToken is used across the entire Ethereum network.

AirSwap

AirSwap is a peer-to-peer network. A simple combination of web protocols and smart contracts powers its RFQ (request-for-quote) style protocol. There are two kinds of liquidity providers on AirSwap: those running their own HTTP servers to provide liquidity, and those managing on-chain delegates that swap on their behalf. Each swap is between two parties, a signer and a sender. The signer is the party that creates and cryptographically signs an order, and the sender is the party that sends the order to the Ethereum blockchain for settlement.

HoneySwap

HoneySwap is a permissionless decentralised exchange (DEX) based on Ethereum, built on xDai Layer 2 scalability infrastructure. The xDai Chain enables users to experience fast and secure transactions with incredibly low fees. By utilising xDai chain for transactions, Honeyswap allows users to trade any ERC20 token and experience fast and secure transactions with incredibly low fees.

BakerySwap

BakerySwap is an automated market maker and non-fungible token (NFT) marketplace that runs on the Binance Smart Chain. It is powered by BakeryToken (BAKE). BakerySwap is the all-in-one DeFi platform that provides both AMM and NFT Marketplace solutions in one place. Users can exchange tokens, provide liquidity, participate in liquidity farming, and also mint NFTs and trade them.

Balancer

Balancer is an automated portfolio manager and trading platform offering investors portfolios that generate yield and rebalance automatically. Balancer turns the concept of an index fund on its head: instead of paying fees to portfolio managers to rebalance your portfolio, you collect fees from traders who rebalance your portfolio by following arbitrage opportunities.

Aave

Aave is an open-source, non-custodial decentralised lending protocol that allows users to earn interest on deposits and borrow digital assets. Users can participate as depositors or borrowers. Depositors provide liquidity to the market to earn a passive income, while borrowers are able to borrow in an over collateralised (perpetually) or under collateralised (one-block liquidity) fashion. Aave offers simplified and decentralised access to a wide range of digital assets and interoperability with multiple DeFi platforms. The protocol features Flash Loans to users enabling them to borrow instantly and easily, no collateral needed, provided that the liquidity is returned to the pool within one transaction block. Stakeholders can actively contribute as part of the community to the Aave Protocol and its governance.

ShibaSwap

ShibaSwap was recently launched by the Shiba Inu team – SHIB, LEASH, and BONE – to create a decentralised cryptocurrency exchange platform, the next evolution in DeFi platforms. ShibaSwap gives users the ability to DIG (provide liquidity), BURY (stake), and SWAP tokens to gain WOOF Returns through a sophisticated and innovative passive income reward system. The ShibaSwap platform allows the ShibArmy to access upcoming NFTs and additional tools, such as portfolio trackers, to make navigating the crypto world simple and intuitive.

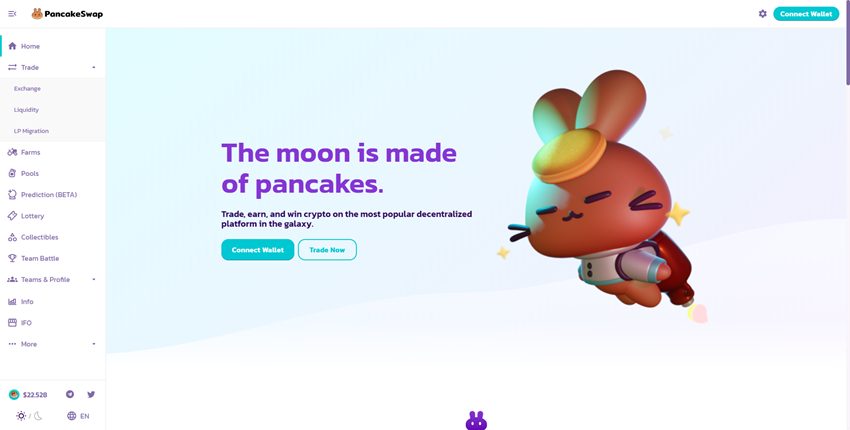

Pancake Swap

PancakeSwap is one of the leading decentralized exchanges on Binance Smart Chain, with some of the highest trading volumes in the market. Unlike centralized exchanges like Binance or Coinbase, PancakeSwap doesn’t hold your funds when you trade. The pancake DAPP can run on mobile applications with integrations crypto wallets such as Trust Wallet allowing you to swap your tokens seamlessly.