Protecting your digital currency is arguably one of the most important aspects of investing in the cryptocurrency market. While cryptocurrencies may offer a wide range of advantages over traditional fiat currencies (such as the Australian Dollar), they are far more susceptible to hacking attacks and require a careful approach to storage.

If you’re already investing in Bitcoin or another cryptocurrency, then it’s likely that you already own at least one crypto wallet, which is where you store Bitcoin and cryptocurrency. Wallets basically consist of two elements — a private key and a public address. Your public address is used to receive cryptocurrency, while your private key is used to access your wallet and send cryptos.

It’s essential to keep your private key highly secure, as it provides access to all of the cryptocurrency in your wallet. Should your private key fall into the wrong hands it’s likely that your wallet will be emptied with no chance of recovering the lost funds.

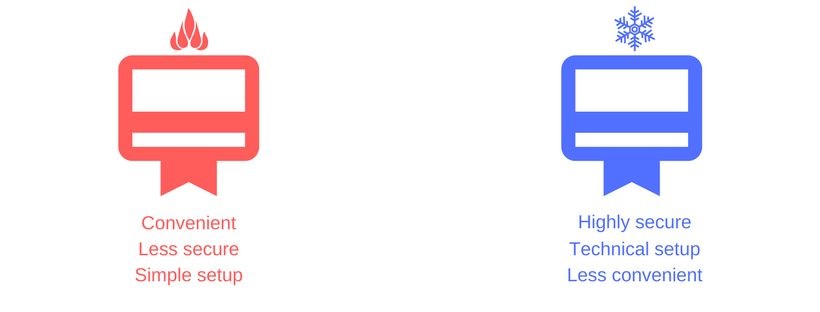

There are many different types of crypto wallets used today. The most commonly used type of crypto and Bitcoin wallet is a hosted, or “hot ” wallet. These solutions are typically provided by exchange platforms or cryptocurrency brokers and are far less secure than “ cold ” wallets — their offline counterparts.

The biggest security issue presented by hosted wallets is the potential of a hacking attack against the platform that provides it. The Mt. Gox hack, which occurred over several years, resulted in the loss of more than $460 million worth of bitcoin. Another popular exchange, still active also experienced a Bitfinex hack in 2016 that resulted in the loss of $75 million worth of Bitcoin — although users were eventually compensated.

The most secure method of storing your cryptocurrency is with a cold wallet, which is not connected to the internet. Hardware wallets are dedicated devices that contain a cold wallet and add a variety of strong security measures. There are, however, a number of hosted “hot” wallet solutions that offer greater security than the average exchange wallet (explained below in the Hot Wallets section).

In this article, we’ll take a look at the most secure wallet solutions available and break down their key features to help you determine the safest way to store cryptocurrency.

Check out our Top 10 Crypto Hardware Wallets.

Cold Wallets

A cold storage wallet is a highly secure offline wallet that keeps your cryptocurrency holdings disconnected from the internet. There are physical wallets typically found in the form of “hardware wallets”, which are purpose-built devices similar in size to a USB drive.

It’s important to note that you should only ever purchase a hardware wallet form the manufacturer to eliminate the threat of tampering. Never purchase a hardware wallet secondhand or from Ebay. See news article: Man’s Life Savings Stolen from eBay Reseller Hardware Wallet.

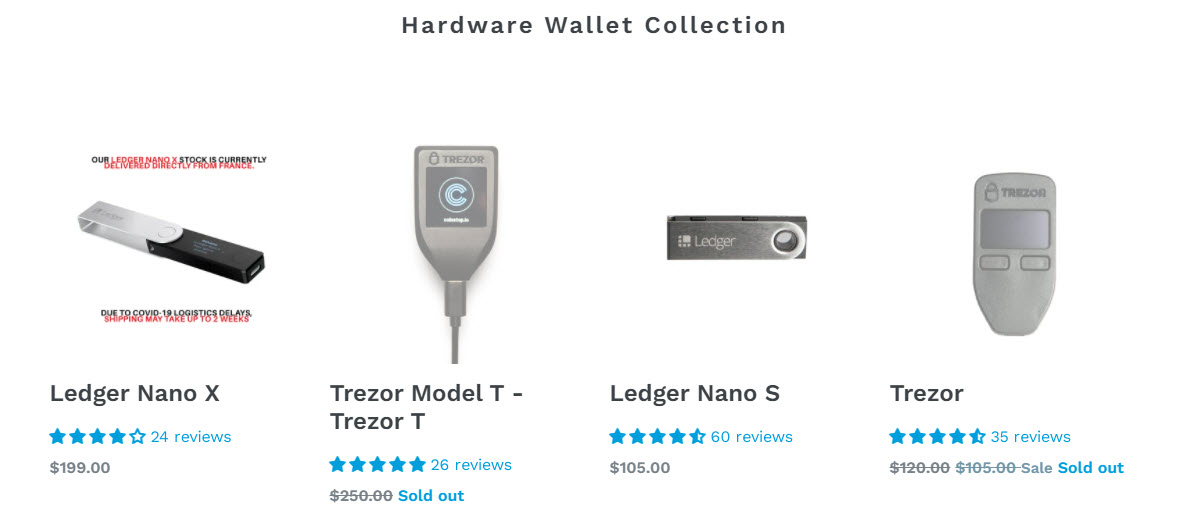

Trezor

Price: ~89€ ($136 AUD)

> Click here to visit the Official Trezor website.

The Trezor was the first Bitcoin hardware wallet to hit the market and is largely considered to be the “gold standard” of cryptocurrency cold storage security. The Trezor connects to any computer via a USB cable and offers users multiple layers of security that virtually eliminate the threat of a third party gaining access to your private keys.

Each Trezor is protected by a PIN code and adds another layer of security by requiring users to press a physical button on the device itself to confirm transactions. If a device is lost or misplaced, Trezor provides users with a randomly-generated 24-word “recovery seed” that can be used to recover the wallet it contains and the funds therein.

The Trezor can also be secured with two-factor authentication and supports Bitcoin, Dash, Litecoin, and all ERC20 tokens. The device also boasts a convenient OLED screen that can be used to confirm transaction amounts.

Importantly, the Trezor offers extremely high privacy levels. None of the Trezor hardware wallets possesses serial numbers, which means Satoshi Labs — the creator of the Trezor — has no way of tracking your actions. The Trezor can be used with a variety of software wallets, including Electrum, MyCelium, and MultiBit HD.

Ledger Nano X

Price: ~79€ ($120 AUD)

> Click here to visit the Official Ledger Nano S website.

The Ledger Nano S is the cheapest hardware wallet with a screen on the market and is the most popular option. Offering a simple and easy setup with any computer, the Nano S comes with a range of security features that are similar to those offered by the Trezor.

Like the Trezor, the Ledger Nano S offers physical buttons, which add an extra security layer, and the option of two-factor authentication. The Nano S also requires PIN code confirmation for any transaction — after three incorrect attempts, the device wipes itself.

This complete device wipe doesn’t result in the complete loss of your wallet, fortunately — the Ledger Nano S offers the same 24-word recovery phrase feature as the Trezor. Although these two devices seem virtually identical, the difference can be found in the architecture of the devices themselves.

The Trezor can be considered to be a “mini computer”, while the Ledger Nano S consists of two secure chips. It’s also possible to set up a Ledger Nano S without a computer, which makes it a better option for highly security-minded individuals.

Paper Wallet

Price: Free (just the cost of paper to print it out)

The idea of a paper wallet may sound strange, but with this technique, it’s entirely possible to store billions of dollars in cryptocurrency on a single piece of paper. A cryptocurrency wallet, as mentioned previously, consists of a private key and a public key. A paper wallet is simply these two keys printed out on a piece of paper.

Paper wallets typically include QR codes in order to streamline the process of either receiving crypto or adding keys into a software wallet to make transactions. The obvious advantage of a paper wallet is that it is completely immune to hacking, hardware failures, or any other digital attack vector.

While paper wallets are essentially unhackable, they are subject to the same risks as any other high-value paper document. Paper degrades, can be destroyed, or can be misplaced. If you’re considering creating a paper wallet, it’s essential to treat it with the same level of security as you would any other high-value asset. If you lose a paper wallet, you’ll never be able to access the cryptocurrency it holds ever again.

If you’re interested in creating your own Bitcoin paper wallet, BitcoinPaperWallet.com makes the process relatively easy.

USB Sticks

Do not use regular USB sticks to store your Cryptocurrency. The regular USB sticks offer no security, they usually have a short lifespan and are prone to the occasional corrupt drive syndrome.

Hot Wallets

While it’s best to keep the majority of your cryptocurrency holdings secured on a hardware wallet or another cold wallet solution, there are a number of hot wallet solutions that provide greater security than others.

When assessing a hot wallet solution it’s important to assess the way in which the platform handles user funds, the authentication and security options available to users, and the security track record of the platform.

There is some contention in the cryptocurrency community as to whether software wallets — which are downloaded and installed on a computer — are defined as hot crypto wallets. While software wallets can be disconnected from the internet, they can still be attacked if a hacker gains access to your machine.

Software wallets are far more secure than hosted wallets but are still technically “hot” wallets.

Exodus

Price: Free (they make a small fee when you trade coins using the software)

> Click here to visit the Official Exodus website.

Exodus is a software wallet solution that offers a robust, sleek design and a large feature set that has made it one of the most popular hot wallets available. Functioning as a desktop software wallet, Exodus supports a broad spectrum of cryptocurrencies and, importantly, integrates with the ShapeShift.io instant cryptocurrency exchange platform.

Exodus is a “lite wallet”, which means it’s far more agile than software solutions that require users to download the entire blockchain onto their computer or mobile device. The Exodus solution leaves private keys in the hands of users but is only as secure as the computer it is installed on.

The Exodus wallet also offers users a range of different analysis tools that can be used to organize assets, as well as track asset value in real-time with live market updates. As a bonus feature, Exodus also makes it possible to customize the look and feel of the wallet with a variety of different themes.

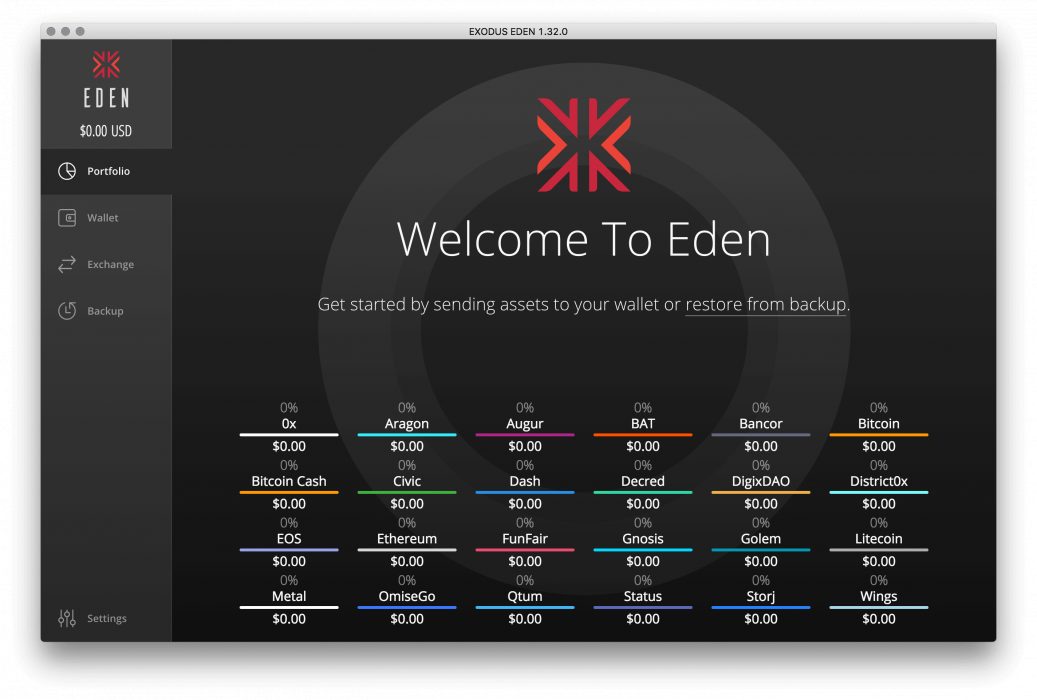

Eden

Price: Free (they make a small fee when you trade coins using the software)

> Click here to visit the Official Eden website.

Eden is the highly advanced evil twin of Exodus which delivers a powerful set of tools designed specifically for professional cryptocurrency investors and traders. It is important to note that while Exodus is stable and has really good support, Eden is delivered as unsupported & experimental. Exodus makes it clear that the Eden solution is not for beginners, even going so far as to recommend that users don’t recommend it to their “noob friends” as they will likely “get stuck doing tech-support for them”.

At this point in time, the Eden solution is experimental and thus may cause issues with wallet balances, so it’s probably best to avoid using it to manage large sums of cryptocurrency. If you’re looking for a digital wallet solution that delivers all of the functionality of Exodus along with support for Bitcoin Cash, Factom, Ethereum Classic, Ripple, and more, however, Eden is worth trying out.

Although Eden has more than 20+ coins available, if you can’t find what you’re looking for then we recommend using an Exchange such as Swyftx where you can buy and trade hundreds of coins.

Final Thoughts

Most professional cryptocurrency traders and investors lock away the greater part of their cryptocurrency capital in a hardware wallet solution, transferring it to a hosted wallet or exchange when trading. Regardless of the amount of capital you’ve invested in the cryptocurrency market, it’s essential to ensure your crypto holdings are secure with a dedicated cold wallet.