CumRocket is a new DeFi project that is aiming to disrupt the adult industry, by creating their own private subscription platform (similar to competitor OnlyFans) and NFT marketplace.

$CUMMIES – the project’s deflationary DeFi crypto token, reached its climax this week at $0.285 on the 5th of May, which is over a 1,000% increase for the week.

The $CUMMIES DeFi Token

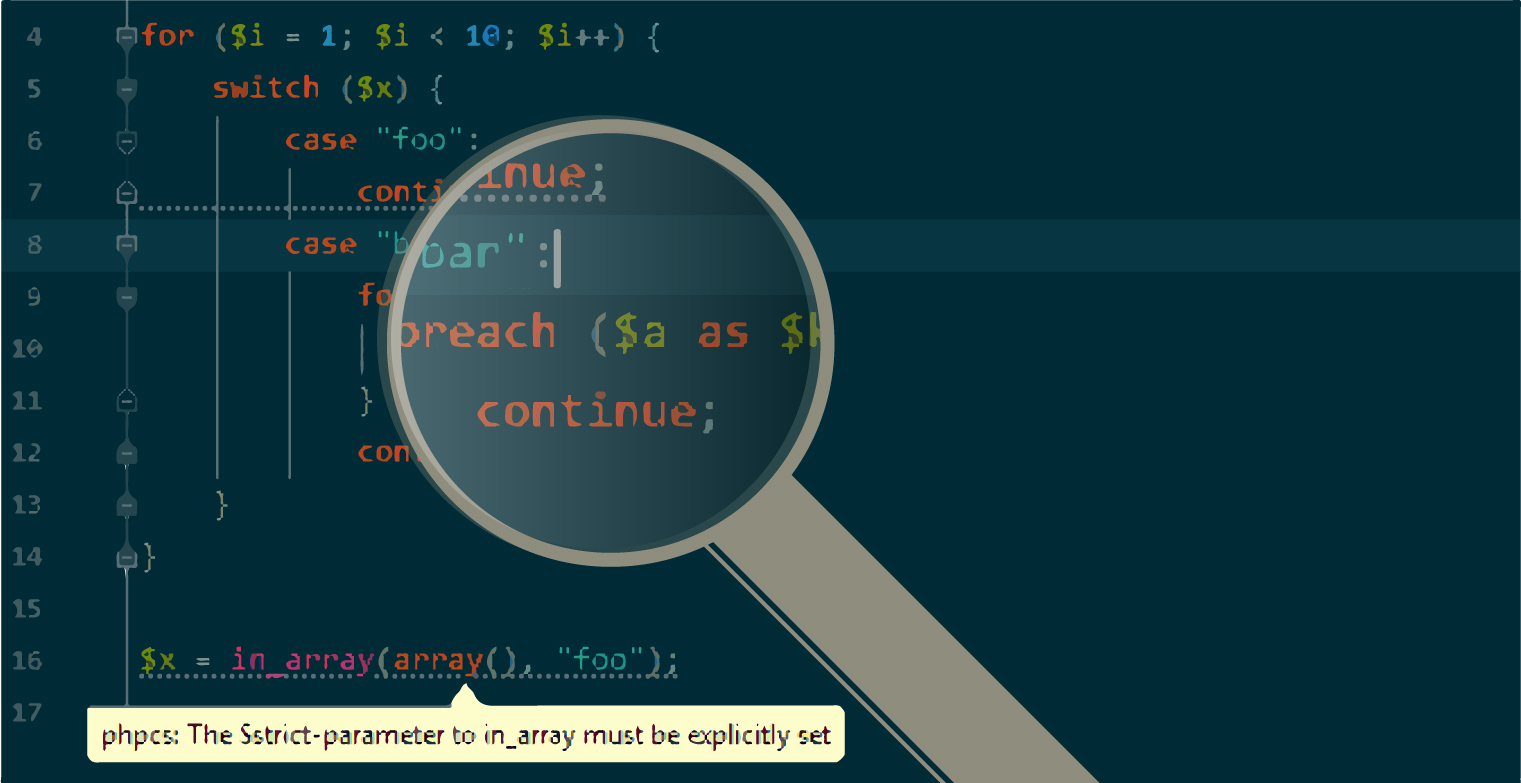

$CUMMIES is a “reflect” DeFi token on the Binance Smart Chain (BSC) powered by DEGENR – which means there is a fee applied to each transaction (in this case 5%), with half of the fee burned, and the other is redistributed to token holders.

Using $CUMMIES as the tipping currency on our NSFW platforms encourages more transactions.

cumrocketcrypto.com

According to CumRocket’s website, their service allows for a level of anonymity that “other popular platforms fail to provide”.

The token will be used for tipping, messaging, custom request and currency on their NSFW content platforms and their NFT marketplace.

In Q3 they will be launching a platform where adult creators can sell their private content for a monthly or yearly fee. And they also aim to have an exchange up and running in the near future. You can see their roadmap for more information.

Does The Project Have Legs?

The $CUMMIES token was launched via Dxsale by a public developer who is also an influencer in the TikTok space with over 24k followers.

The British software engineer Lydia, who announced its creation via TikTok on 4th April, saw less than three weeks later, CumRocket surge 634% in a single day, taking its market cap to over $140 million.

These increases might be due to novelty as well as the fact that it’s NSFW which usually turns an eye.

However, this brand new NSFW cryptocurrency, some might mistake for a meme-coin but the team explained in an live stream that they plan to disrupt the adult industry in a massive way.