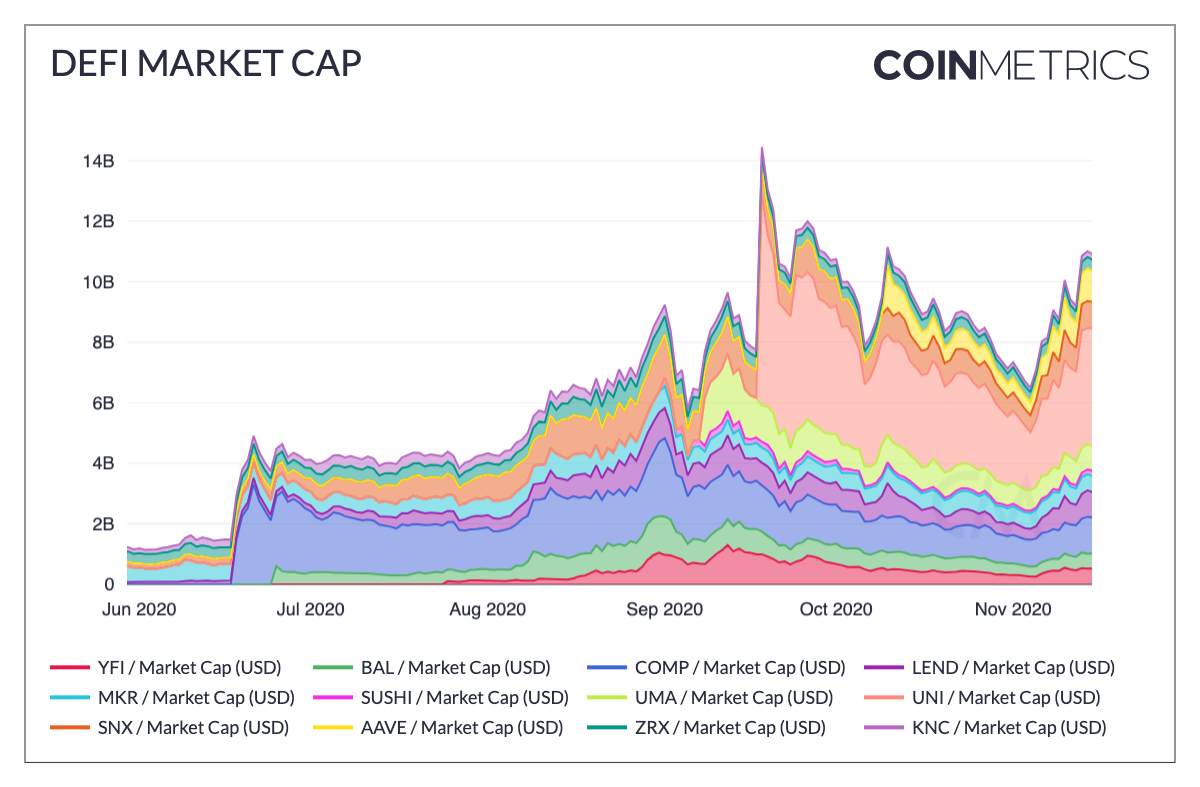

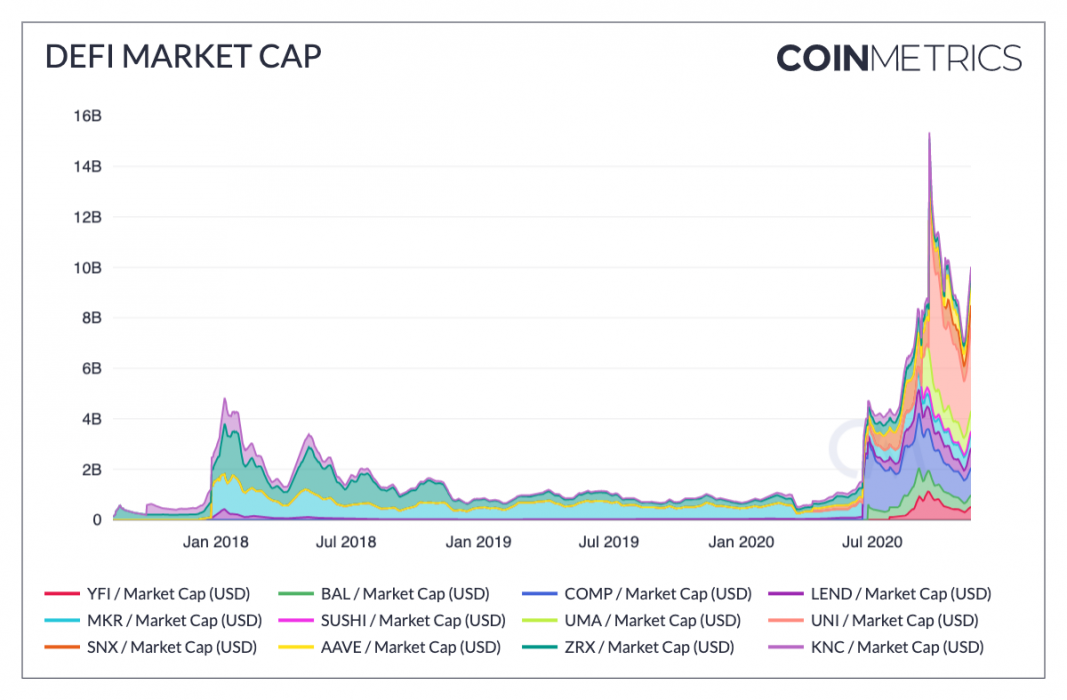

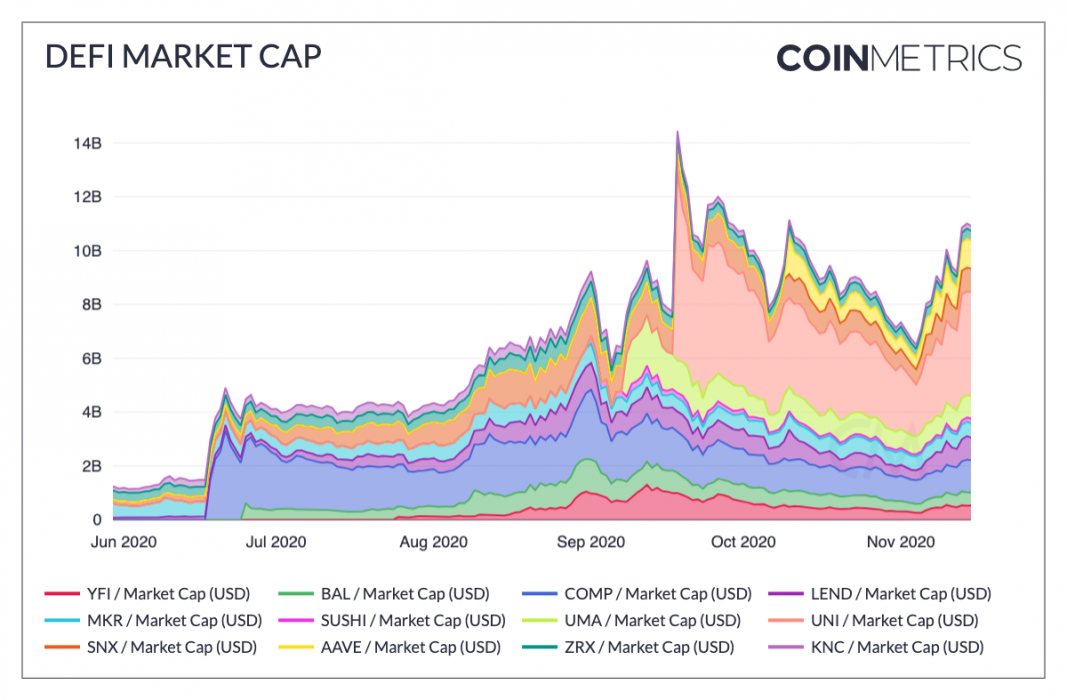

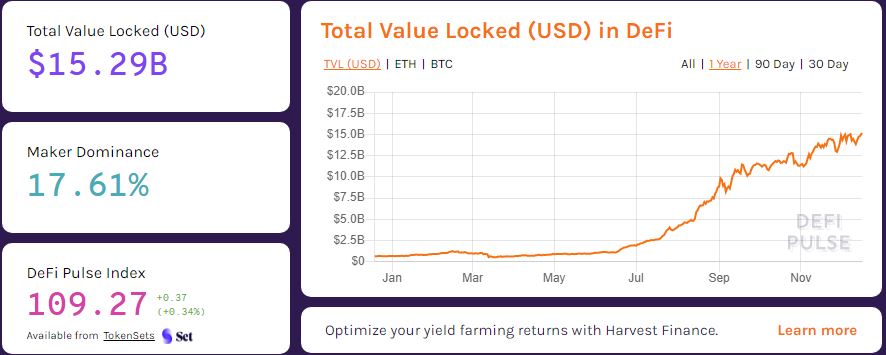

Interest in the decentralized finance (DeFi) market is still growing gradually, although the industry hypes seem to have calmed down lately. According to the information on DeFi Pulse today, the market valuation of assets locked in DeFi protocols has surpassed another milestone record of US$15 billion.

DeFi market is considered as the next big thing in the cryptocurrency ecosystem, as it provides high-interest earning opportunities for participating investors.

DeFi TVL Reaches New ATH at US$15B

This year holds the largest and most profitable record for the decentralized finance market, although there were also losses from hack. There are currently US$15.291 billion assets locked in DeFi, making another all-time high in the TVL. More than US$1.8 billion worth of assets were added since the past month.

Also, the market is up by more than 2000 percent on the year-to-date (YTD) chart, as there was only US$691 million in assets locked around January this year.

The decentralized lending protocol, Maker, is ranked as the largest in terms of total assets locked. DeFi Pulse showed that US$2.69 billion in assets had been locked in Maker protocol, giving it a market dominance of 17.6 percent. The Bitcoin tokenization protocol, Wrapped Bitcoin (WBTC) holds the second-largest asset valuation at US$2.33 billion. WBTC is followed by Compound, Aave, Uniswap, etc., all of which has an asset valuation of around $1.7 billion.

CeFi vs DeFi

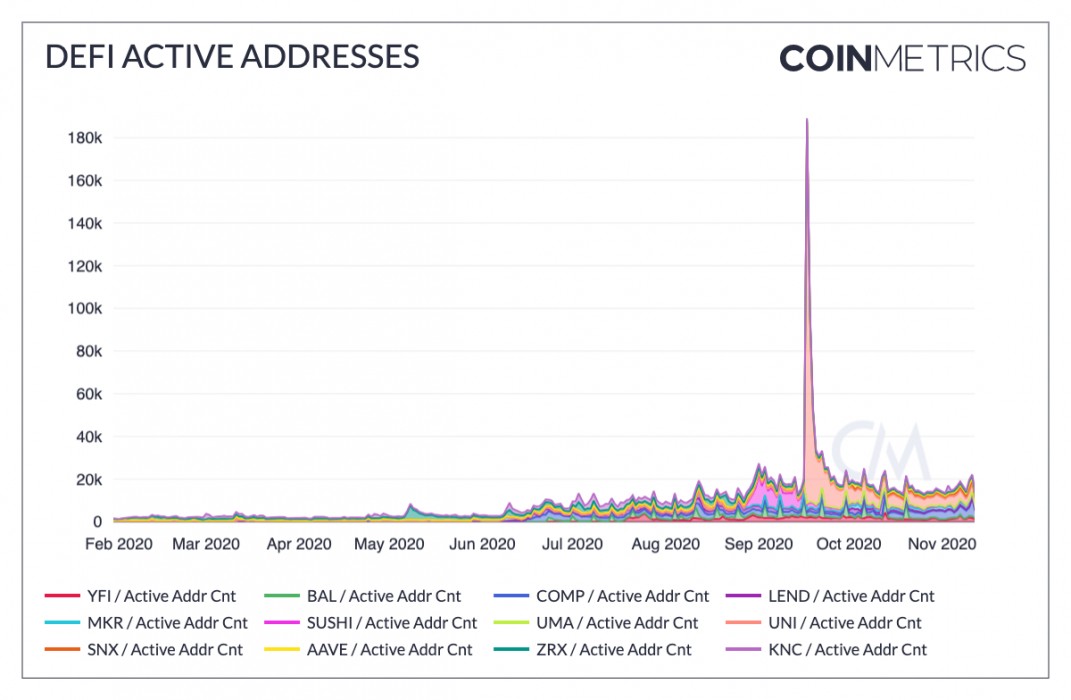

The growth of the decentralized market was once a concern for many centralized players in the crypto industry, especially exchanges. The recent yield farming craze in DeFi had caused a massive outflow of coins like Ether (ETH) from crypto exchanges to DeFi protocols. Evidently, decentralized exchange Uniswap posted more trading volume than most popular CeFi trading platforms during these times.

However, CeFi exchanges are beginning to show support for DeFi by offering trading support for the native tokens from protocols and other related services.