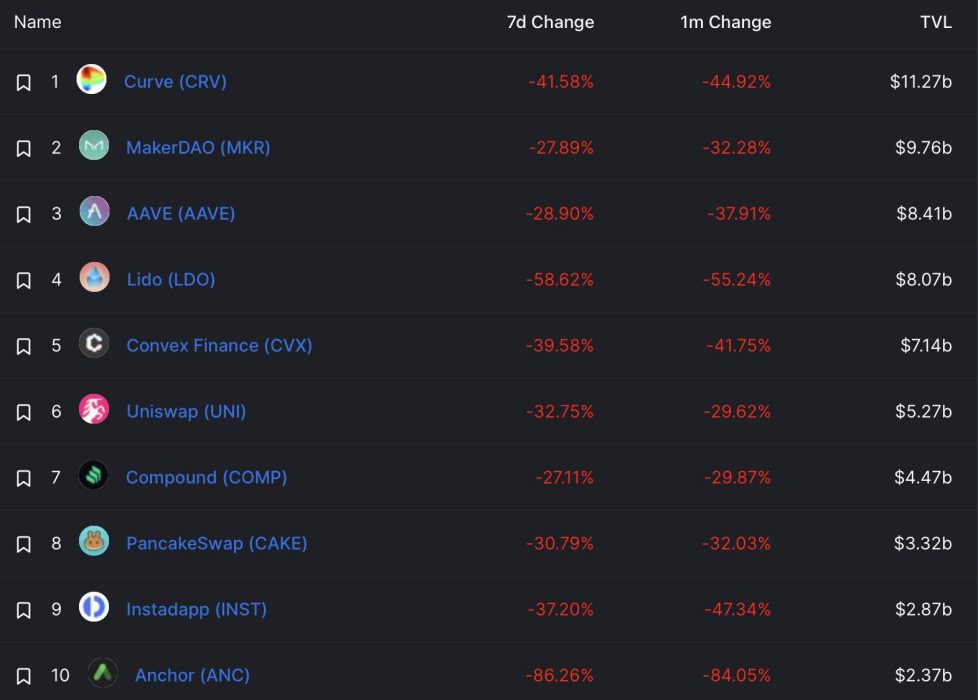

Following on from the collapse of TerraUSD (UST), the Fantom-based algorithmic stablecoin DEI has also lost its dollar peg, plummeting 35 percent in value to reach an all-time low of US$0.54 on May 16.

Like many algorithmic stablecoins, DEI became unstable after DeFi market confidence was rocked by the UST debacle, dropping to US$0.97 on May 15 before suddenly falling dramatically the next day. At the time of writing, DEI was trading at US$0.62:

If we take a look at the chart, it clearly shows the peg sinking into the red:

What is DEI?

DEI is an algorithmic stablecoin on the Fantom blockchain created by DeFi project DEUS Finance. It’s the unit of account for all projects built on DEUS infrastructure.

In many ways DEI is similar to UST, the primary difference between them being that DEI is collateralised – meaning that users can mint 1 DEI by depositing US$1 of collateral in the form of either USD Coin (USDC), Fantom (FTM), Dai (DAI), wrapped Bitcoin (WBTC) or DEUS (the DEUS Finance governance token).

DEI attempts to maintain its peg much like UST by using an algorithm that incentivises arbitrage trading to maintain a stable value.

What Triggered the Crash?

The proximate cause of DEI’s decline was the loss of confidence in algorithmic stablecoins caused by the sudden collapse of LUNA and UST, though there were other factors that made DEI especially vulnerable.

The DEUS Finance ecosystem had suffered two flash loan attacks in the past two months, losing over US$30 million. In addition, the DEUS governance token has plummeted in value over the past six weeks, falling from its all-time high of US$1062.41 on April 2 to just US$218.80 at the time of writing.

These issues have caused the collateral ratio of DEI to drop to only 43 percent, according to DEUS Finance, which means there isn’t enough capital backing the coin for users to make redemptions against their DEI, further undermining confidence.

DEUS Finance Doesn’t Want to See DEI Die

To try to avoid complete collapse, DEUS Finance has suspended redemptions of DEI in an attempt to stabilise its price. It has also announced a treasury bond program to attempt to raise funds to increase DEI’s collateral ratio and restore confidence:

Despite these efforts, some community members took to Twitter to voice their concerns that DEI may go the way of UST:

really hope you guys will not end like terra/luna, already lost too much on there

— alsd 💜 (@ALSD4tweet) May 16, 2022

How do I short this?

— OxRugged (@OxRugged) May 16, 2022