US inflation has hit a new 40-year high of 7.9 percent, driven by a surge in gas, food and housing costs, all of which are expected to increase further as geopolitical conflict intensifies in Ukraine.

From Bad to Worse

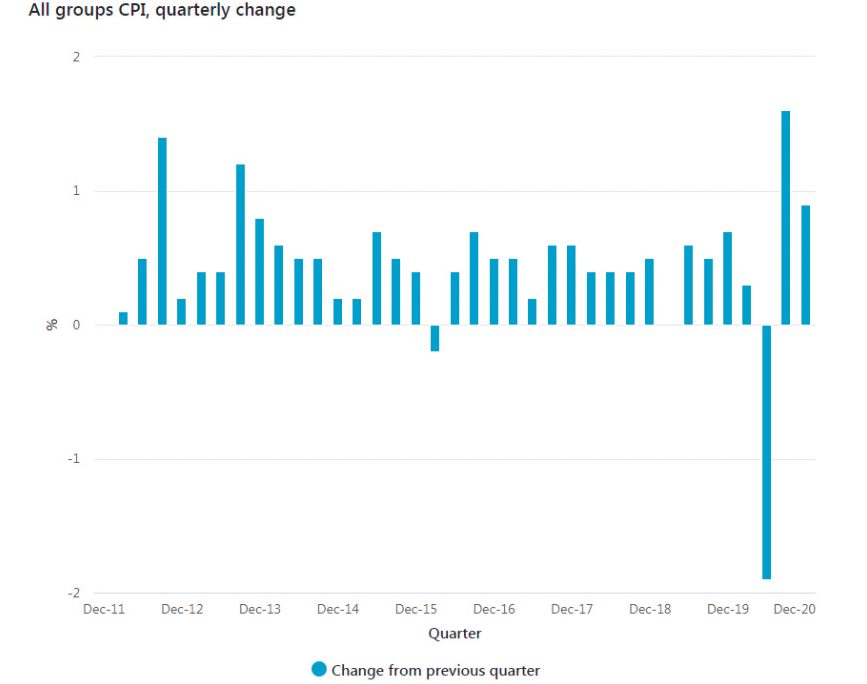

For the 12 months ending December 2021, US consumer price inflation (CPI) hit 7 percent, which at the time was the highest in four decades.

While Bitcoiners and other hard money advocates warned that more pain was potentially on the horizon, many mainstream commentators remained committed to the “inflation is transitory” narrative, citing Covid-related supply chain bottlenecks. They also referred to so-called “base effects”, a distortion in monthly inflation figures resulting from abnormally high or low levels of inflation in the year-ago month.

Turns out that inflation is stickier than anticipated, as the latest figures represent the highest CPI print since July 1981:

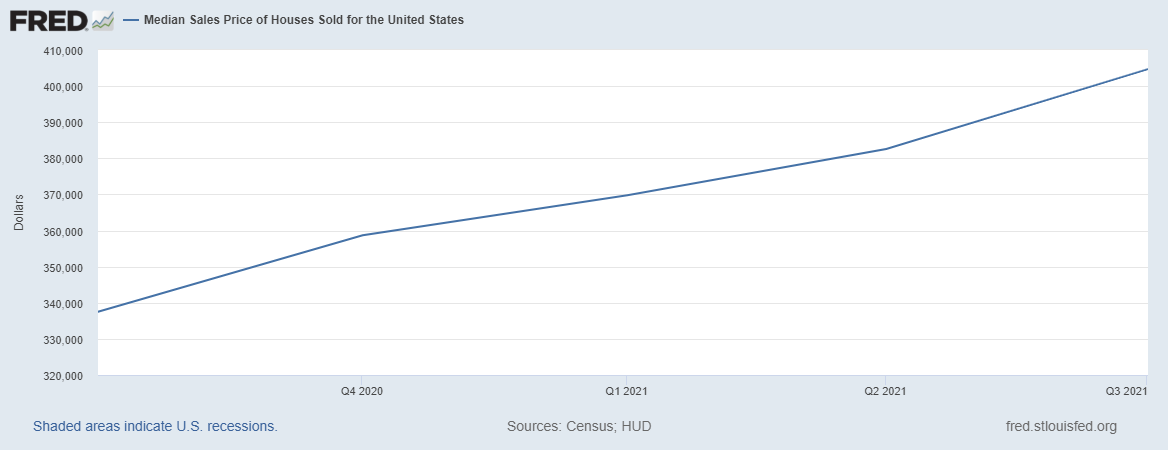

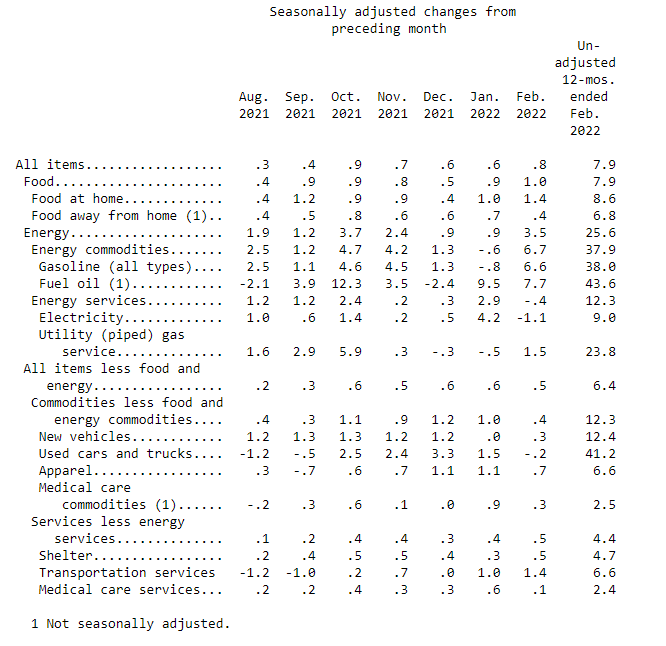

Costs are up across the board, but some segments are clearly increasing at a faster clip than others. Energy, fuel, transport and housing have experienced the most dramatic increases, as illustrated below:

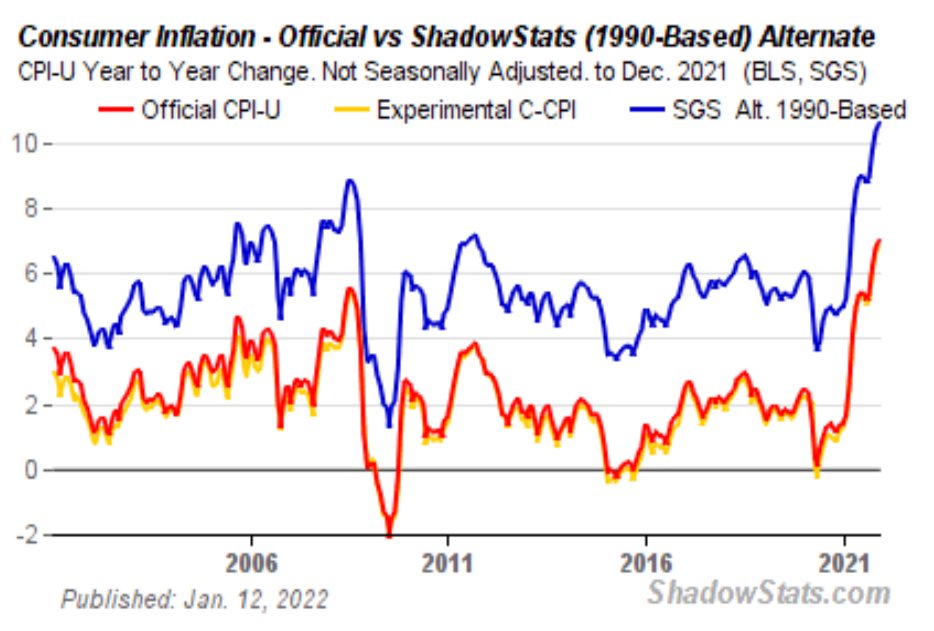

All of this assumes that you take the official CPI statistics at face value, which those in the Bitcoin world don’t:

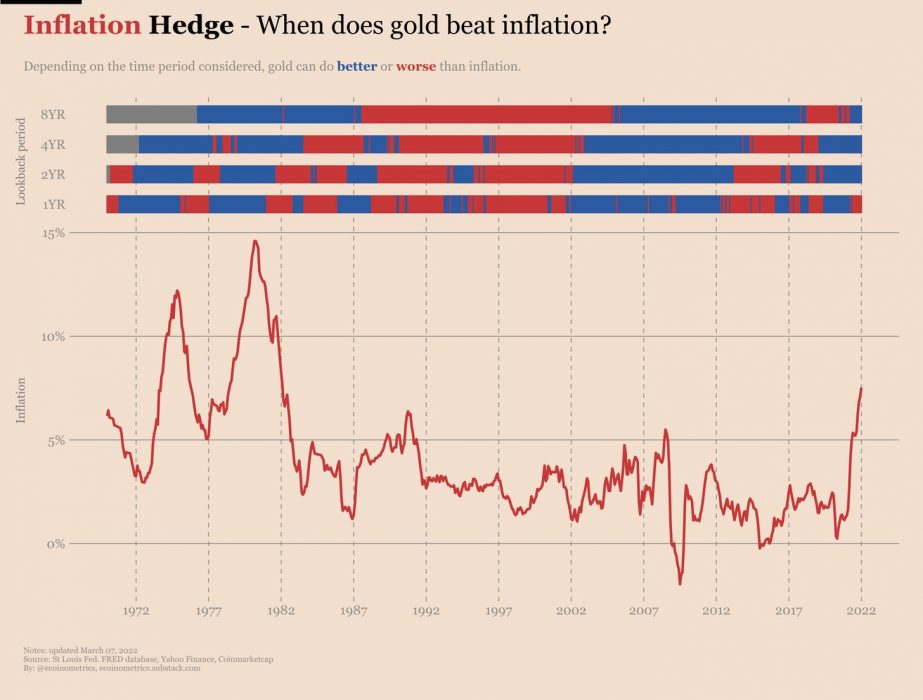

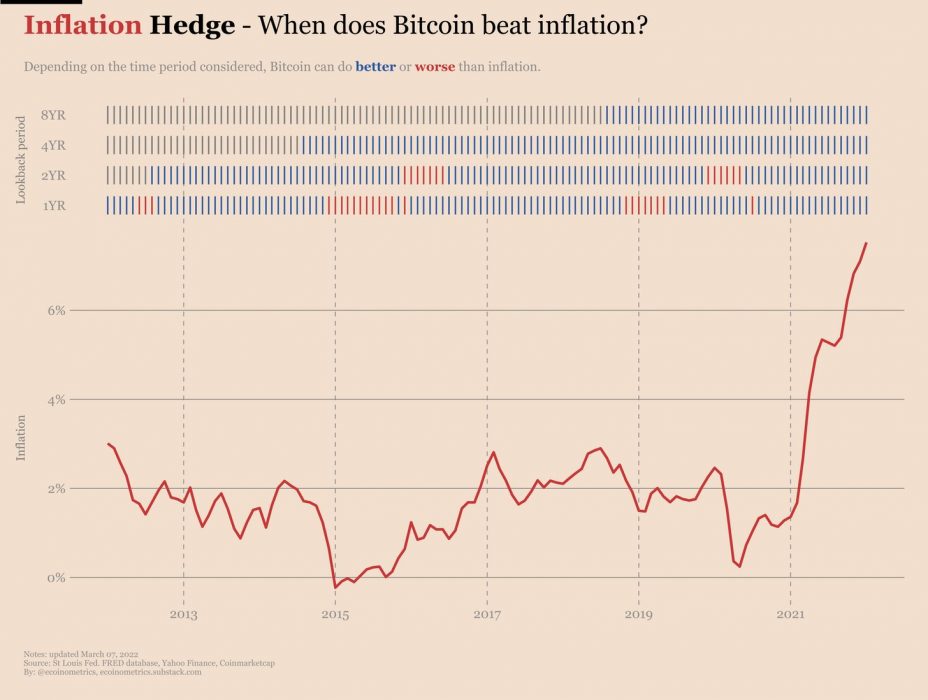

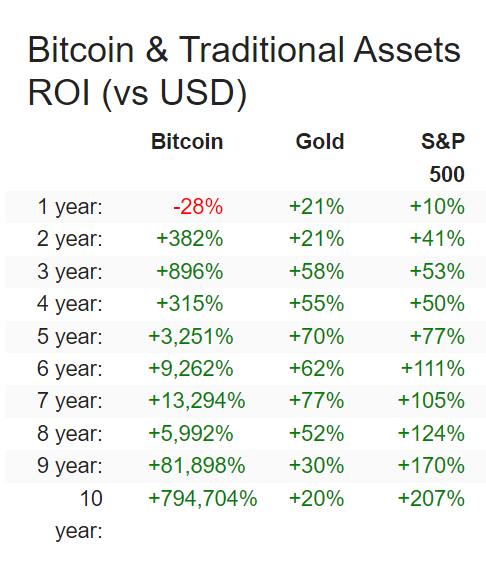

Bitcoin Offers No Short-Term Relief, More Pain on the Horizon?

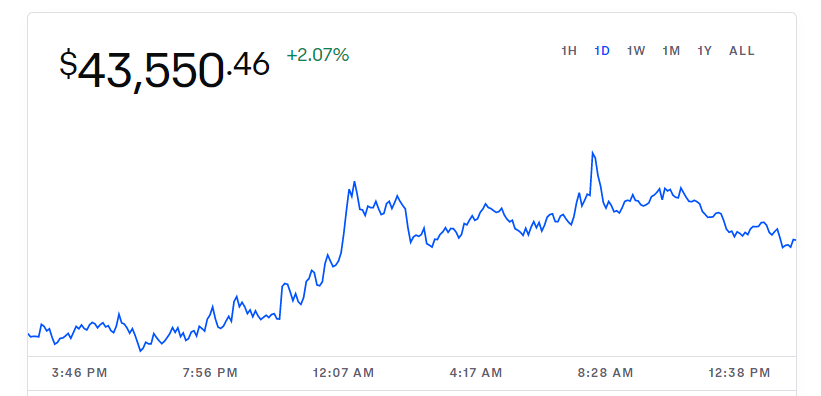

Bitcoin held steady on the news at US$39,300, confirming what most market participants believe – namely that in the short-run, it remains a risk-on asset. Interestingly, this trend was recently reversed amid the Russian invasion of Ukraine, but the point remains.

All of this is happening at a time when commentators are signalling that the US stock market is due for a serious correction:

The US markets have been in a bull market since 2010 and some have been screaming for a market correction for months, if not years. It’s entirely inevitable that the party will end. The timing, of course, remains unknown.

In the interim, ordinary consumers will continue to feel the pain as inflation, regarded by some as “tax without legislation”, continues to far outpace domestic wage increases.