We are officially off to the races again as ETH leads the charge in a strong bullish ascent back up towards previous all-time highs after a month of sideways action. In the past week alone, ETH is up over 20 percent, reaching A$5,120 at the time of publication.

Ethereum has now beaten bitcoin’s price action for three months straight. The King of Crypto has struggled to break through the key psychological resistance level of US$50,000, while Ethereum is picking up the pace, rising by 50 percent in the last month.

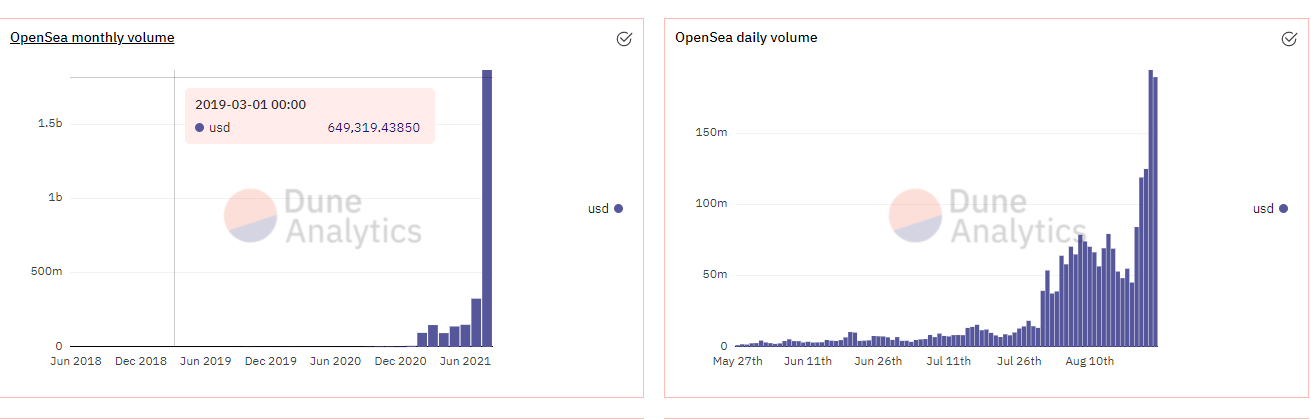

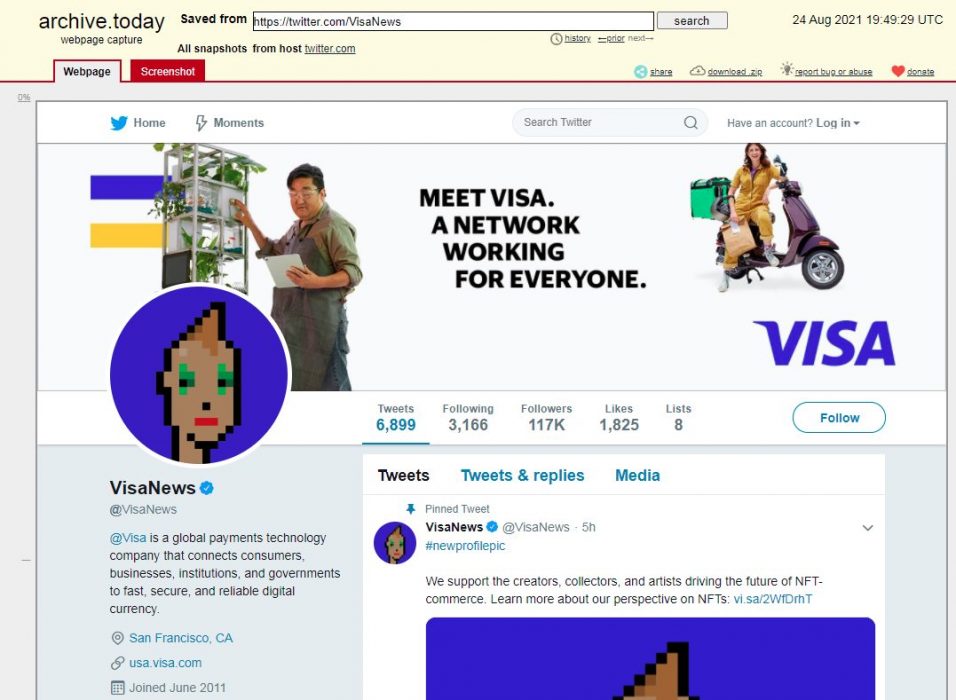

ETH has climbed over 380 percent so far in 2021, with gains largely attributed to the booming DeFi and NFT sectors. Bitcoin, however, has only managed to gain 62 percent so far this year against the USD.

Here Comes DeFi Summer 2.0

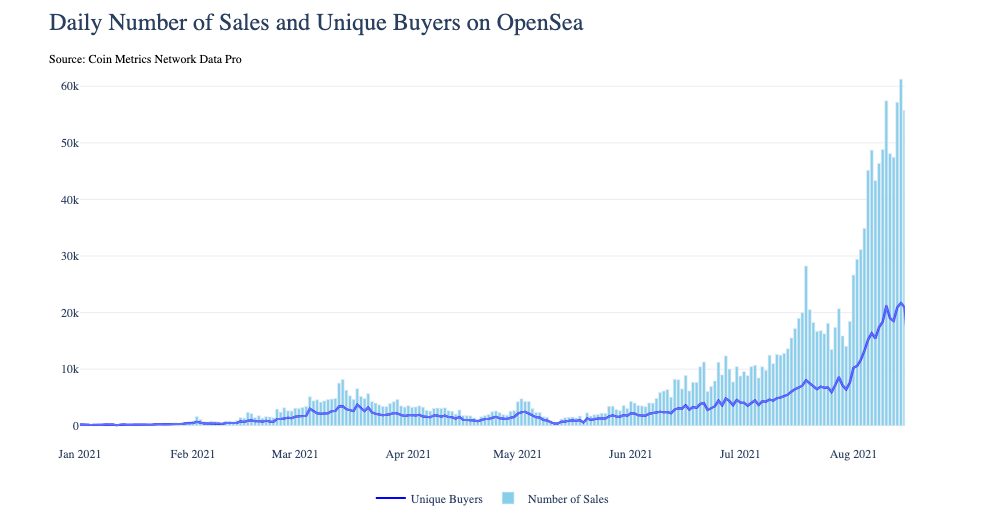

Market activity and token prices are surging as altcoins, especially in DeFi, look to the upside and we welcome the announcement of DeFi Summer 2.0.

There used to be just bitcoin and altcoins. Now you’ve got bitcoin, altcoins, DeFi, NFTs, all these different things, and then within those you’ve got subcategories of gaming NFTs, JPG NFTs, collections of NFTs and real world NFTs. There are so many different things within crypto…and basically all the money does between all these different things is shift.

@ThatMartiniGuy, YouTube

Calling ‘Alt Season’

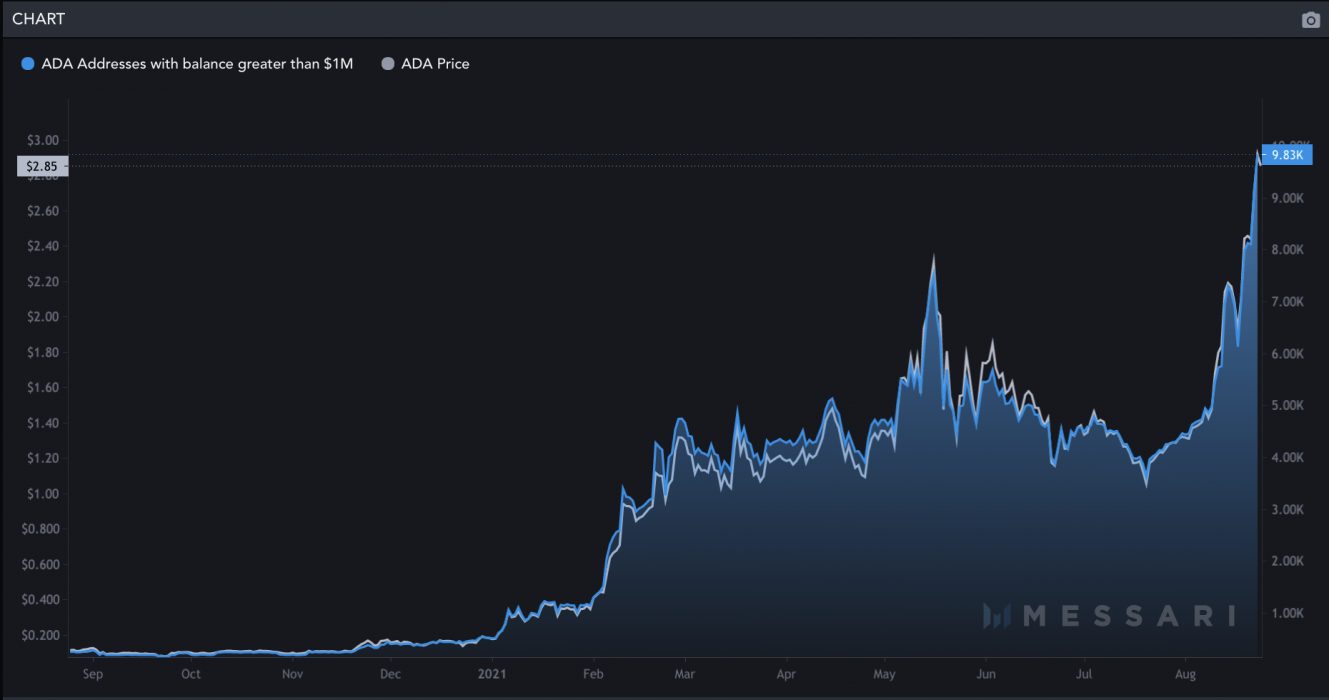

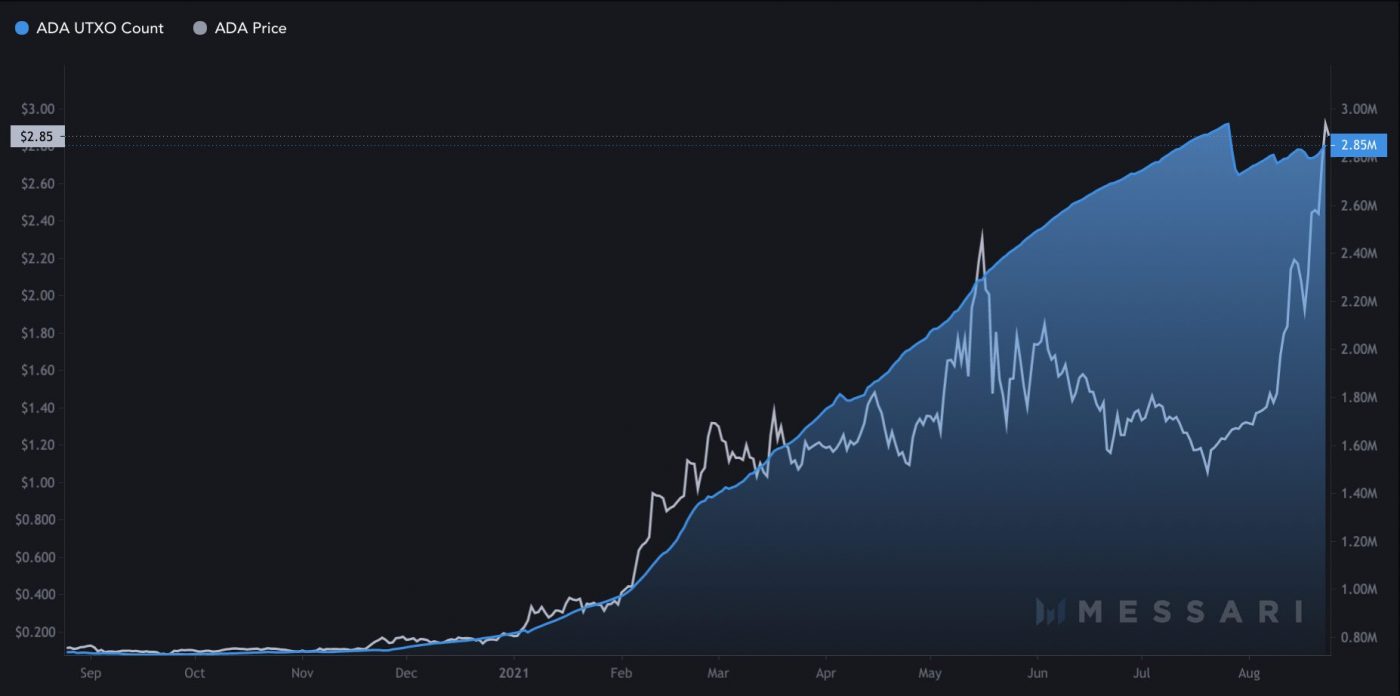

Traditionally when Ethereum breaks and Bitcoin dominance drops, money in the market flows into other cryptocurrencies. That is exactly what is starting happen as mid-caps begin to surge. The likes of Cardano, Solana, Polkadot and Kusama have all been performing exceedingly well as the sea begins to rise once again.