Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. MyNeighborAlice (ALICE)

ALICE is a multiplayer builder game where anyone can buy and own virtual islands, collect and build exciting items, and meet new friends. Inspired by successful games such as Animal Crossing, the game combines the best of the two worlds – a fun narrative for regular players who want to enjoy the gameplay experience, as well as an ecosystem for players who want to collect and trade non-fungible tokens (NFTs).

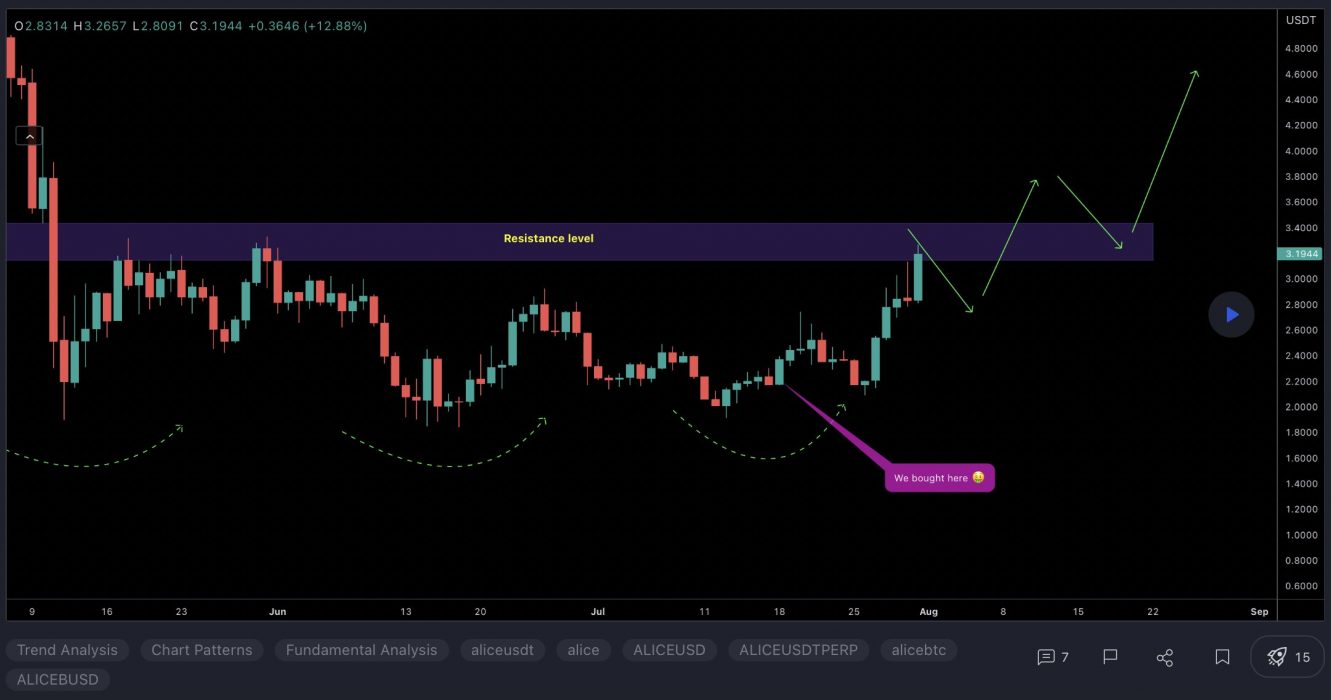

ALICE Price Analysis

At the time of writing, ALICE is ranked the 279th cryptocurrency globally and the current price is US$3.00. Let’s take a look at the chart below for price analysis:

ALICE dropped almost 80% from its Q2 highs. Since this drop, the price has consolidated in a tight range between approximately $3.40 and $2.38.

Support might have formed near $2.87. This area shows inefficient trading on the daily chart. It also overlaps June 15’s swing high and contains the 9 and 18 EMAs.

If this level breaks, the price might also find support at a small distance below, near $2.69. Here, the weekly chart shows that bulls rejected bears.

The 40 EMA is currently providing some resistance. Yet the price may be seeking the next resistance near $3.20. This level is near the top of the range, contains relative equal highs, and is just below the June monthly open.

A break through this level might reach the next resistance near $3.36. This level is just above relative equal highs and the June monthly open. It also shows inefficient trading on the weekly chart and overlaps with the June 2021 swing low’s wick.

If the rally continues, $3.70 could provide the next resistance. This level shows inefficient trading on the weekly and monthly charts. It also overlaps with June 2021’s weekly and monthly swing low candle body boundaries.

The overall market is still bearish, so bulls should be cautious. There is no historical price action to suggest support below the current price. The local range’s 50% extension suggests that $2.25 to $2.00 could be the next longer-term downside target.

2. Oasis Network (ROSE)

The Oasis Network ROSE is the first privacy-enabled blockchain platform for open finance and a responsible data economy. Combined with its high throughput and secure architecture, the Oasis Network is able to power private, scalable DeFi, revolutionising Open Finance and expanding it beyond traders and early adopters to a mass market. Its unique privacy features can not only redefine DeFi but also create a new type of digital asset called Tokenised Data that can enable users to take control of the data they generate and earn rewards for staking it with applications – creating the first-ever responsible data economy.

ROSE Price Analysis

At the time of writing, ROSE is ranked the 89th cryptocurrency globally and the current price is US$0.08846. Let’s take a look at the chart below for price analysis:

ROSE climbed 42% from its Q1 low, then dropped nearly 73% into support last month.

The price is currently testing this resistance, near $0.09230. It may also provide support again and has confluence with the 61.8% and 78.6% retracements.

Resistance begins just above, at $0.09837. This inefficiently traded area, which reaches slightly beyond $0.1146, contains the previous monthly highs, a bearish market structure break on the daily chart, and the 9, 18 and 40 EMAs.

These confluences often provide strong resistance. Since this resistance is close to the $0.1230 support, the price may enter consolidation before breaking out to the next move.

If the price breaks this resistance, bulls could eye an area of old rejection, near $0.1310, as their next target. Continuation through this level may target another area of bearish rejection on the weekly chart, near the 27% extension from $0.1329 to $0.1357.

A more significant bearish turn in the market may reach for bulls’ stops under the Q2 lows, down to an area of old support in an inefficiently traded area between $0.08341 and $0.07217.

3. Gala (GALA)

GALA aims to take the gaming industry in a different direction by giving players back control over their games. Gala Games’ mission is to make “blockchain games you’ll actually want to play”. The project wants to change how players can spend hundreds of dollars on in-game assets and countless hours playing the game, all of which could be taken away from them with the click of a button. It plans to reintroduce creative thinking by giving players control of their games and in-game assets with the help of blockchain technology.

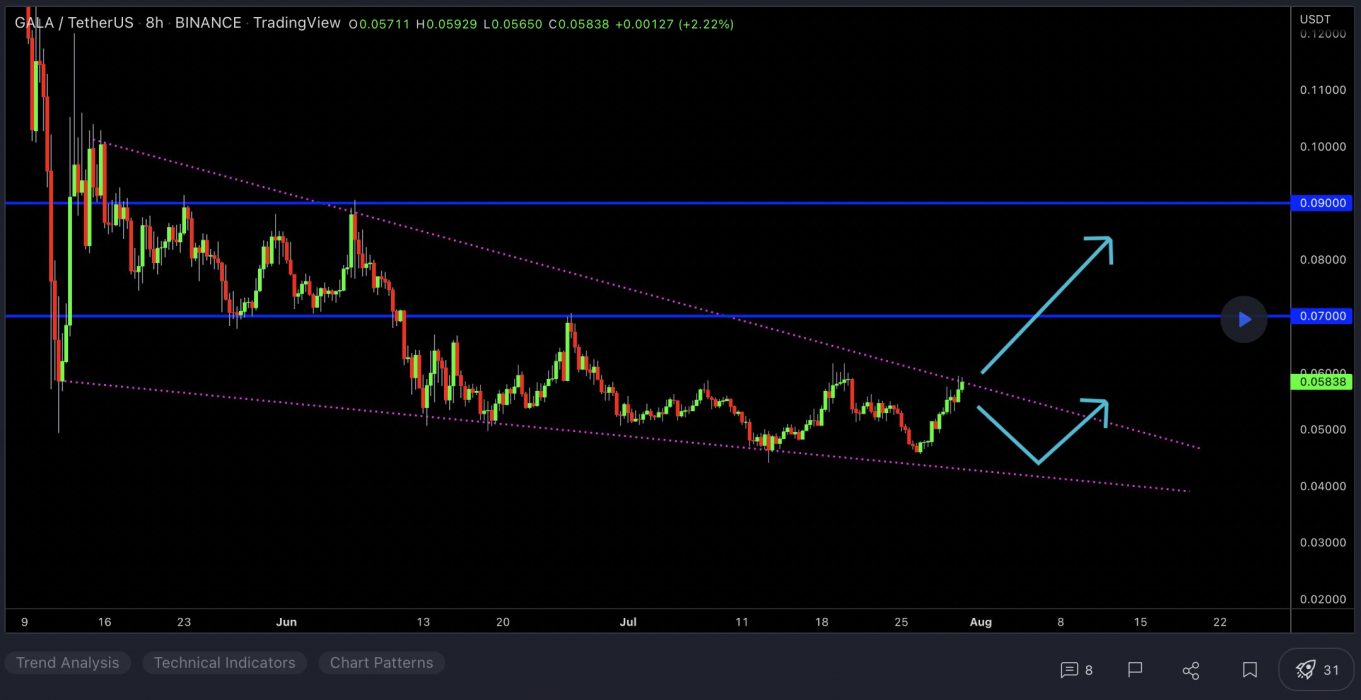

GALA Price Analysis

At the time of writing, GALA is ranked the 94th cryptocurrency globally and the current price is US$0.05995. Let’s take a look at the chart below for price analysis:

After setting a low last week, GALA turned into a recovery trend to make the new monthly highs.

The following 75% plummet found support near $0.05029, sweeping under the 40 EMA into the 60.8% retracement level before bouncing to resistance beginning at $0.06420.

This area could continue to provide resistance, possibly causing a retracement to the 9 EMA and 18 EMA near $0.06812, where aggressive bulls might begin bidding. The level near $0.07325, which has confluence with the 40 EMA, may see more interest from bulls loading up for an attempt on probable resistance beginning near $0.08475.

However, if Bitcoin continues its sideways trend, much lower prices could be seen. The old support near $0.04720 could provide at least a short-term bounce. If this level fails, the old highs near $0.03835 might also give support and see the start of a new bullish cycle after retesting these support levels.

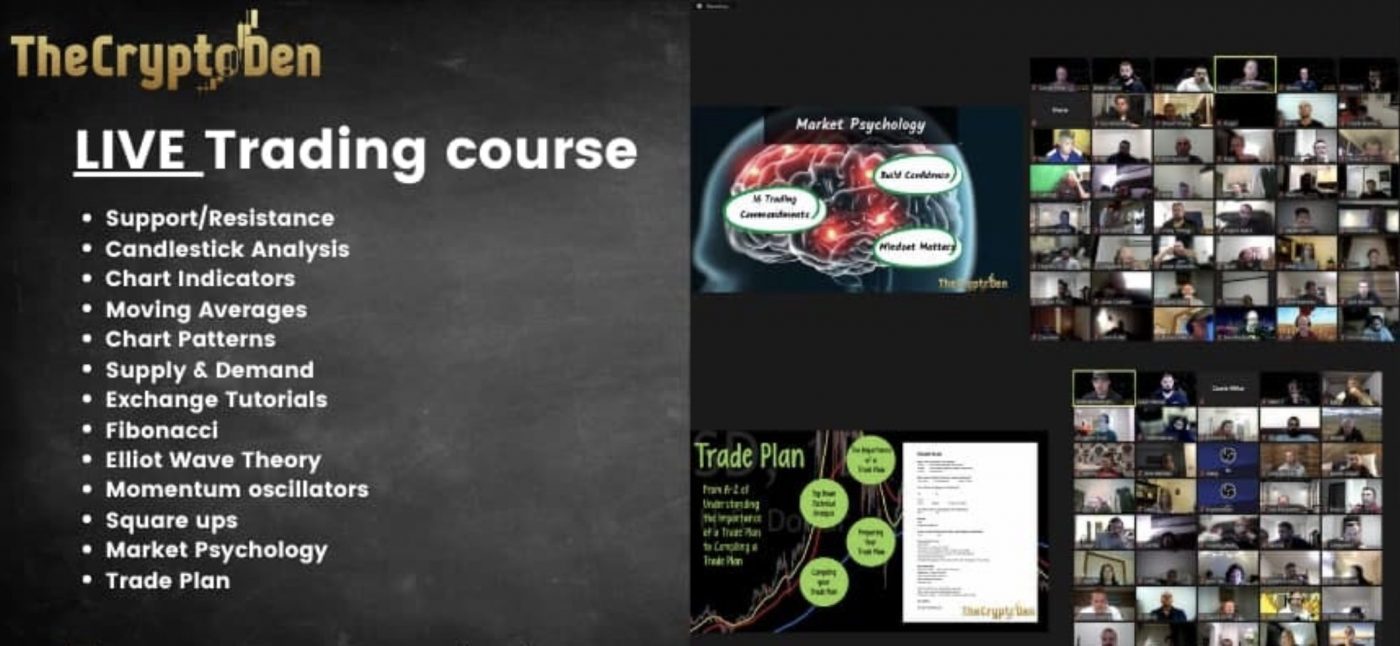

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.