When ConstitutionDAO was outbid in its effort to buy a rare, first-edition copy of the United States Constitution earlier this week, the community announced it would give donors a choice – either accept refunds, or remain in the DAO and receive a new “We The People” (WTP) governance token.

Refund Option Largely Ignored

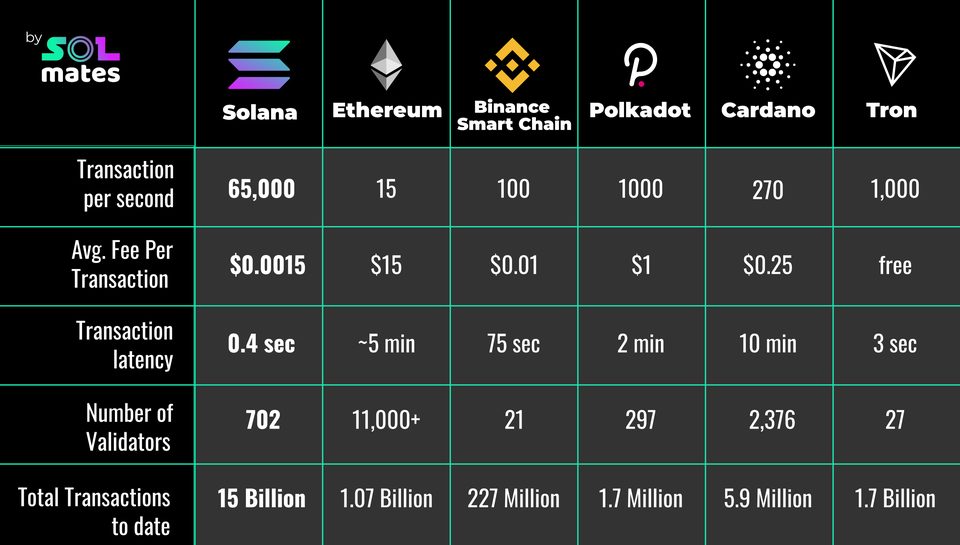

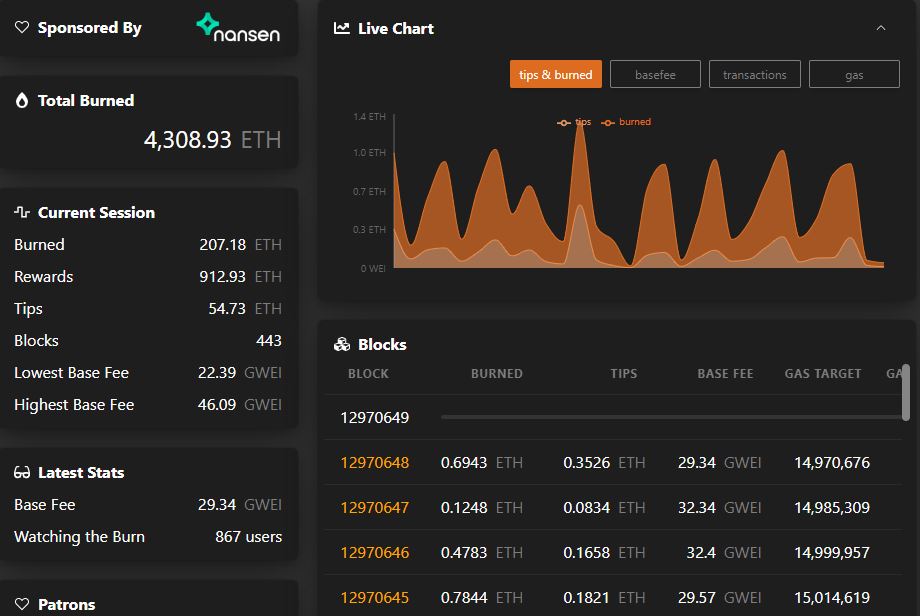

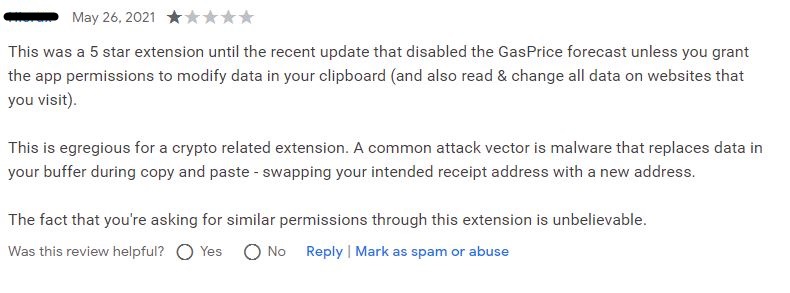

Left with US$47 million worth of crowdfunded ETH reserves in its multi-signature wallets, ConstitutionDAO was probably unsurprised when many among its Discord community opted against refunds because of the associated high gas fees.

Most instead chose to receive WTP tokens without having to pay a gas fee at the rate of 1 PEOPLE per WTP, pumping the former token’s price by 200 percent. Meanwhile, ConstitutionDAO got to retain the capital in ETH. Win-win, with the bonus that the future price of WTP would rise in tandem with Ether.

DAOs Prove the Sky Is the Limit

DAOs are proving what a community can do when it chooses to achieve a collective goal. The day after ConstitutionDAO’s failed bid for the US Constitution, Krause House – an internet group named after late Chicago Bulls manager Jerry Krause – announced its intention to buy an NBA franchise, funded by the sale of NFTs. The group hit its goal of 200 ETH in the first 15 minutes of launching the sale via Mirror.

And earlier this year, Australian DeFi trading platform Tracer DAO managed to raise US$4.5 million in a strategic round of funding backed by various crypto companies.