Members of the Harmony (ONE) community have reacted angrily to a proposal from the Harmony team to reimburse victims of last month’s Horizon bridge hack in which almost US$100 million of users’ assets were stolen:

The proposed plan would see victims recompensed not from treasury funds but through the minting of billions of new ONE tokens, requiring a hard fork of the blockchain and potentially resulting in further devaluing of the token and more losses for holders.

Harmony Team Offers Two Reimbursement Options

The reimbursement proposal from the Harmony team gives community members two options, the primary difference between them being how many new tokens will need to be minted. ONE holders will have the opportunity to vote on the option they prefer, which will then be implemented by the Harmony team.

The Harmony team claims that issuing new tokens is the best way to compensate victims, explaining that paying compensation directly from the project’s treasury could endanger its very survival:

We decided against using the foundation treasury in the interest of the longevity and wellbeing of the project, as reimbursing from the treasury would greatly hinder the foundation’s ability to support the growth of Harmony and its ecosystem.

Harmony team

Under the first option, victims of the hack will be compensated for 100 percent of their losses, requiring the minting of 4.97 billion new ONE tokens. The second option is reimbursement of only 50 percent of victims’ losses, requiring the minting of 2.48 billion new tokens.

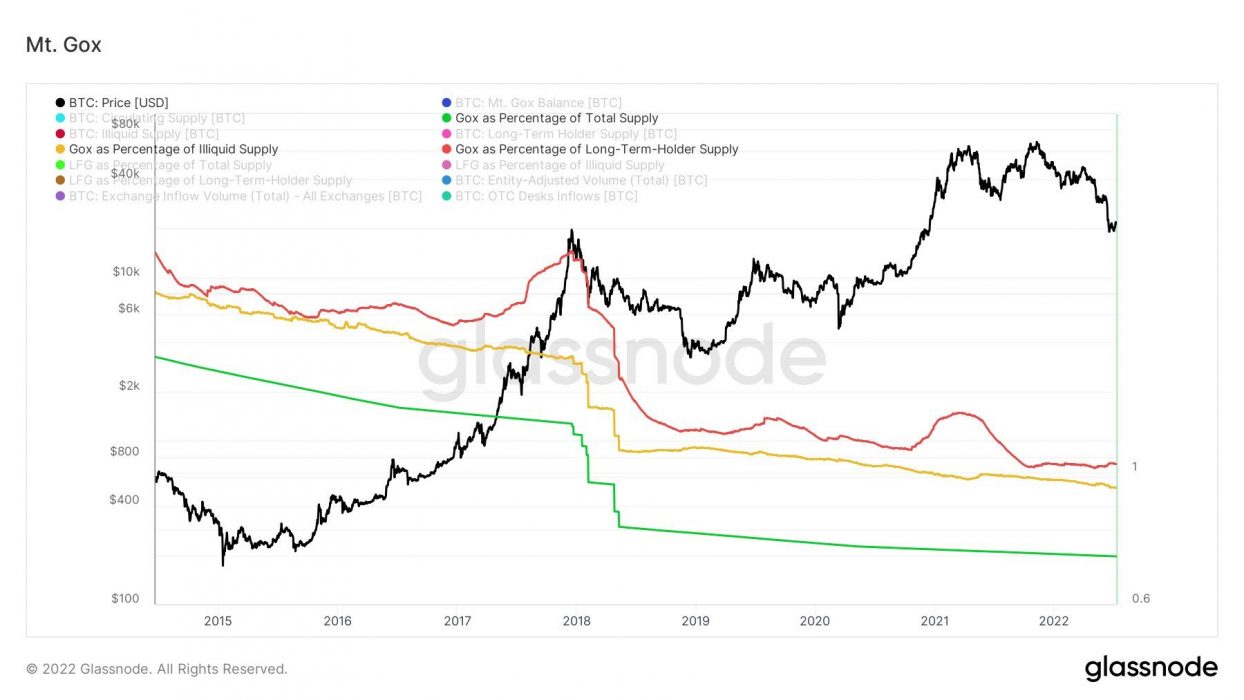

Both options would take three years to complete, with victims required to claim 1/36th of their share of tokens each month over that period. The Harmony team says a slow drip feed of tokens to victims would “prevent market disruptions from a sudden increase in supply of ONE tokens”.

Harmony’s current total token supply is 13.1 billion, meaning that by the end of the reimbursement scheme its supply will have inflated by between 19 and 38 percent.

Community Not Impressed

Unsurprisingly, the Harmony community is generally unimpressed with this proposal. Most holders are concerned about the massive inflation of supply and the effect this will have on the value of their investment:

By minting more tokens to payback those effected by the hack your going to drive the price down for others in the community.

— DOGE_Pilot Matt (@DogecoinPilot) July 27, 2022

More supply usually means lower prices.

Ser @stse @lijiang2087 @harmonyprotocol $ONE, kindly listen to the OGs community. We’re here asking to be heard. We helped you through the bad times and celebrated along the way on good times. Please provide us another solution rather than this “printer goes brrrr” offer. Thanks. pic.twitter.com/KUHFfKo6L1

— USS Harmony Validator 💙🇸🇦 (@ussharmony) July 27, 2022

Holders’ concerns are likely justified – for the price of ONE to grow during the three years of the proposed reimbursement scheme, it would have to overcome the injection of an additional 69 million or 138 million tokens (depending on the option) each and every month.