Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Harmony (ONE)

Harmony ONE is a blockchain platform designed to facilitate the creation and use of decentralised applications (DApps). The network aims to innovate the way decentralised applications work by focusing on random state sharding, which allows creating blocks in seconds. Harmony was expected to introduce cross-shard contracts and a cross-chain infrastructure by the end of 2021.

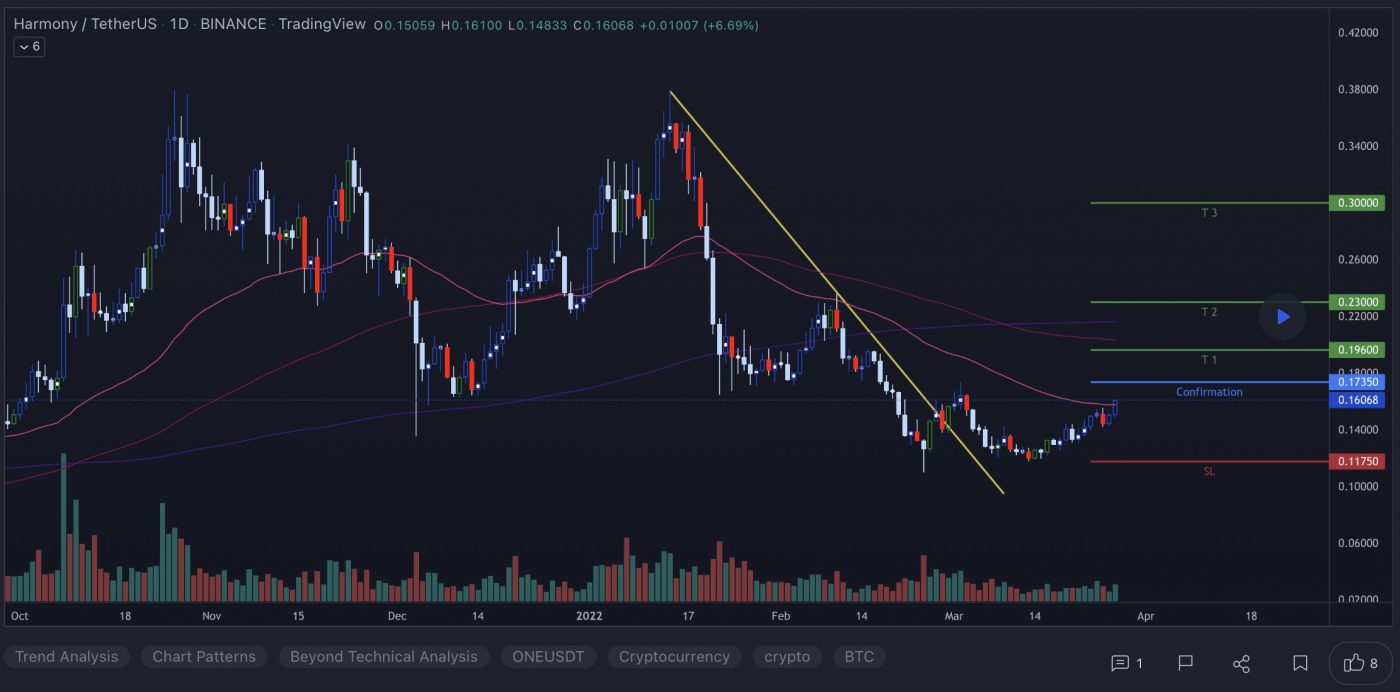

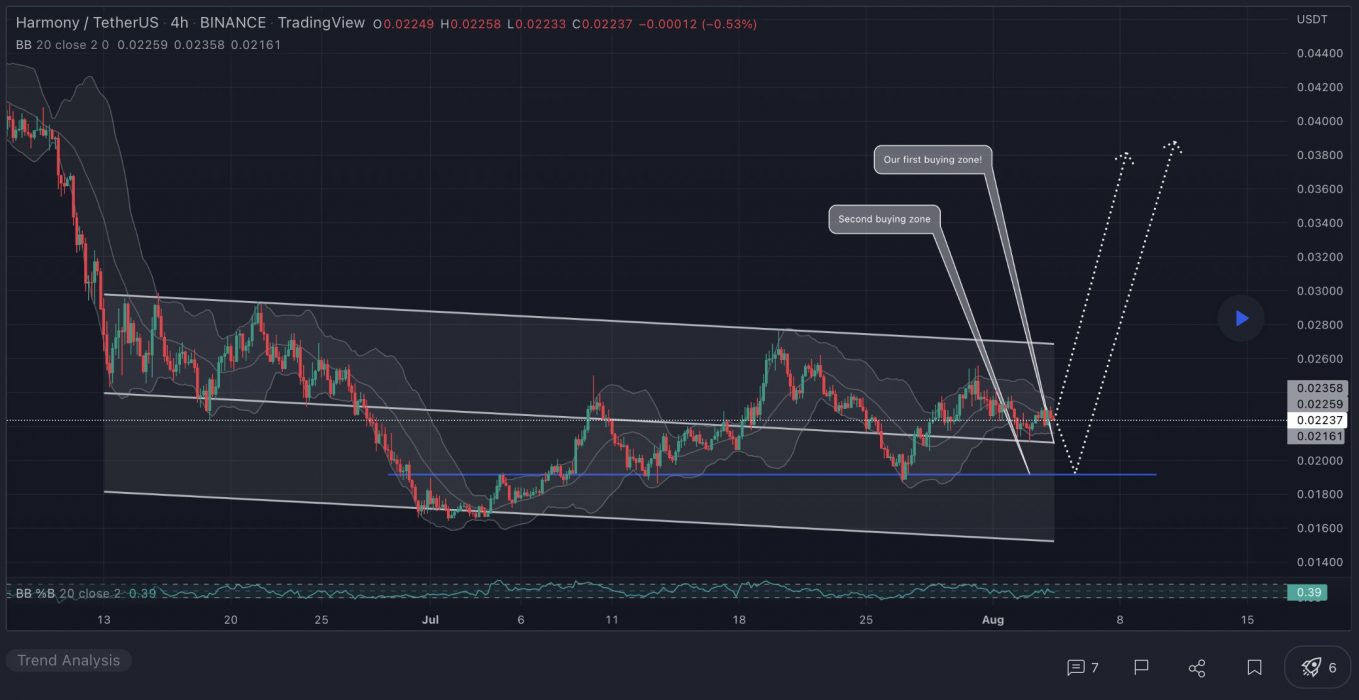

ONE Price Analysis

At the time of writing, ONE is ranked the 118th cryptocurrency globally and the current price is US$0.02215. Let’s take a look at the chart below for price analysis:

ONE bulls have had to endure a 80% drop since early Q2 until the price set a low and began a range in June.

Currently, the price is aggressively moving toward possible resistance, beginning near $0.02851. Stops above the swing high at $0.03215 might be the target before a downwards retracement. Multiple old lows mark this resistance, which is near the 77.6% retracement level of a recent significant bearish swing.

If the price continues through this high, it could be reaching for an inefficient area near $0.03542. Moving to this level would run bears’ stops above the swing high at the same level. A more substantial rally might reach an old swing high and inefficiently traded area between $0.03725 and $0.03938, which surrounds the yearly open.

If the price stays above the weekly low of $0.02035, this price could support a run above the $0.01965 swing high. Just below, at $0.01844, bulls might eye the consolidation high as more substantial support. This zone contains the 9 and 40 EMAs.

A deeper retracement might retest the accumulation area between $0.01735 and $0.01670. If this level breaks, bears may be targeting an inefficiently traded area on higher timeframes beginning near $0.01450. This area overlaps the 47% extension of a recent significant bearish swing.

2. Avalanche (AVAX)

Avalanche AVAX is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol. Avalanche is also low-cost, and green. Any smart contract-enabled application can outperform its competition on Avalanche. AVAX is the native token of Avalanche. It is a hard-capped, scarce asset that is used to pay for fees, secure the platform through staking, and provide a basic unit of account between the multiple subnets created on Avalanche.

AVAX Price Analysis

At the time of writing, AVAX is ranked the 14th cryptocurrency globally and the current price is US$23.18. Let’s take a look at the chart below for price analysis:

AVAX‘s gains in Q2 ended with an almost 78% retracement as the rest of the altcoin market dropped after May. Bulls stepped in near the 62.8% retracement of Q2’s move, creating a consolidation that ended with the bullish impulse to resistance near $26.30.

With the 9, 18 and 40 EMAs stacked bullish and a bullish higher-timeframe trend, it’s reasonable to anticipate retracement to possible support before further bullish expansion.

Near the 40 EMA, a broad zone from $20.35 to $19.00 could see interest from bulls before further expansion. Bears might capitalise on any sharp moves down in Bitcoin, aiming for possible support near the 75% retracement, at $18.10, and potentially lower to a higher-timeframe support zone between $16.60 and $15.32.

If the higher-timeframe recovery trend resumes and the current resistance near $30.64 breaks, the wicks near $34.14 and the new monthly highs may see profit-taking.

3. VeChain (VET)

VeChain VET is a blockchain-powered supply chain platform. VeChain aims to use distributed governance and Internet of Things (IoT) technology to create an ecosystem that solves some of the major problems with supply chain management. The platform uses two in-house tokens, VET and VTHO, to manage and create value based on its VeChainThor public blockchain. The idea is to boost the efficiency, traceability, and transparency of supply chains while reducing costs and placing more control in the hands of individual users.

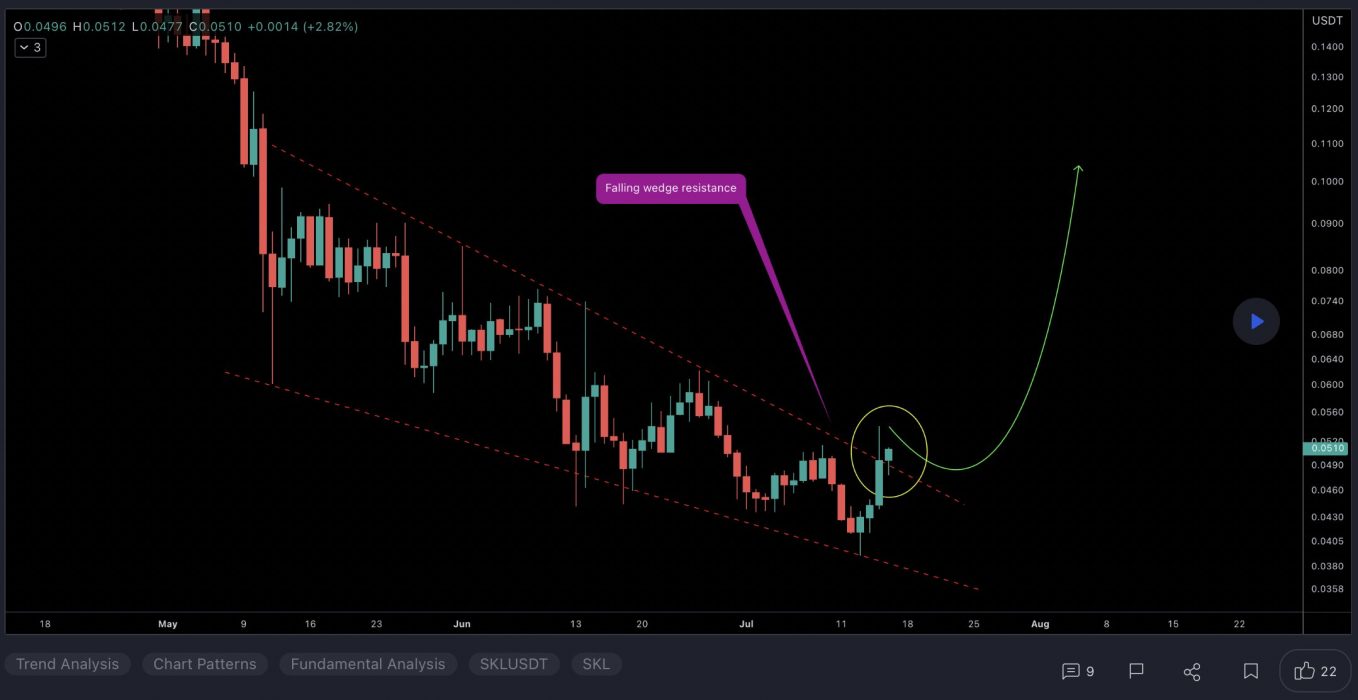

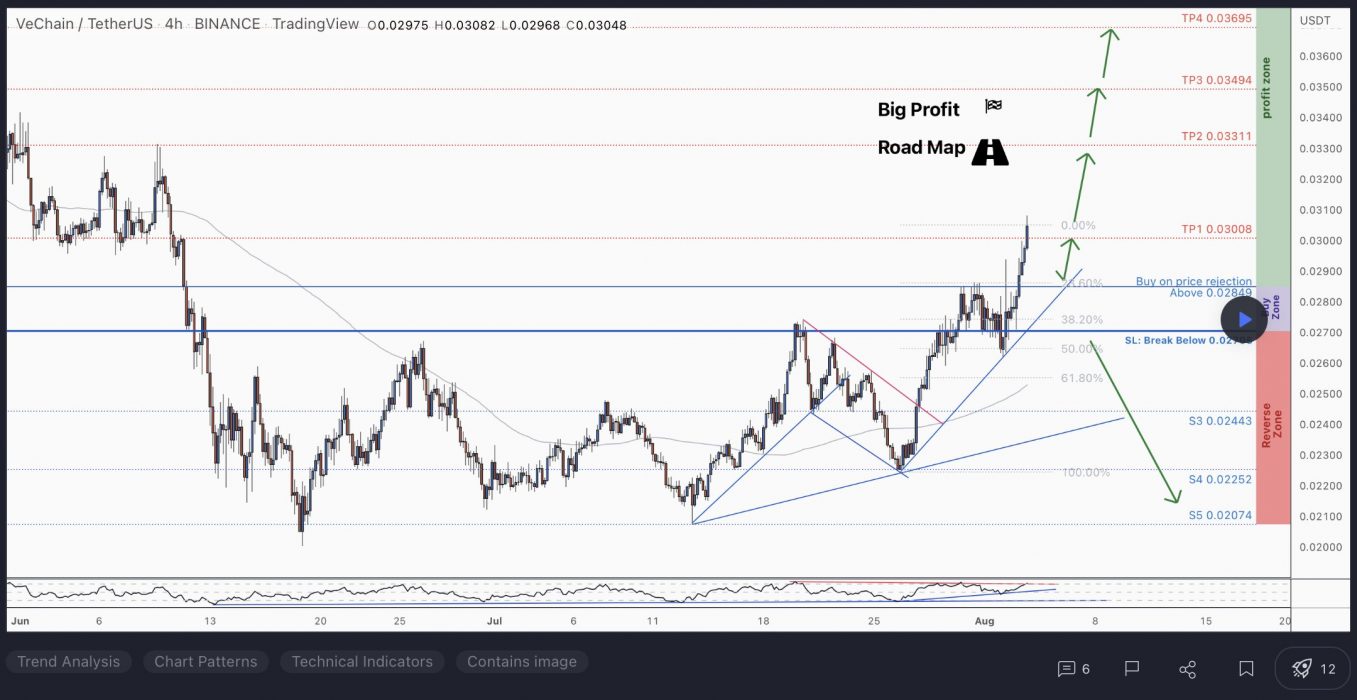

VET Price Analysis

At the time of writing, VET is ranked the 34th cryptocurrency globally and the current price is US$0.02903. Let’s take a look at the chart below for price analysis:

VET‘s 50% move during late March ran into resistance near $0.08450, at the 35% extension of the Q1 swing.

An old high and the 18 EMA have provided support near $0.02383 and may give support again on a retest. This area also has confluence with the 55% and 68.9% retracements of November’s swing.

Just below, near $0.02143, the 50.8% retracement of the current Q1 swing might also mark an area of support.

If the market turns bearish, $0.02032 is unlikely to be revisited but could see interest from bulls during any deeper retracement.

An area near $0.03348, at the 50% extension of the last week swing, could see some profit-taking if bulls break the current resistance near $0.03728. Above, old consolidations near $0.04025 and $0.04472 may also provide some resistance before another round of price discovery.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.