Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

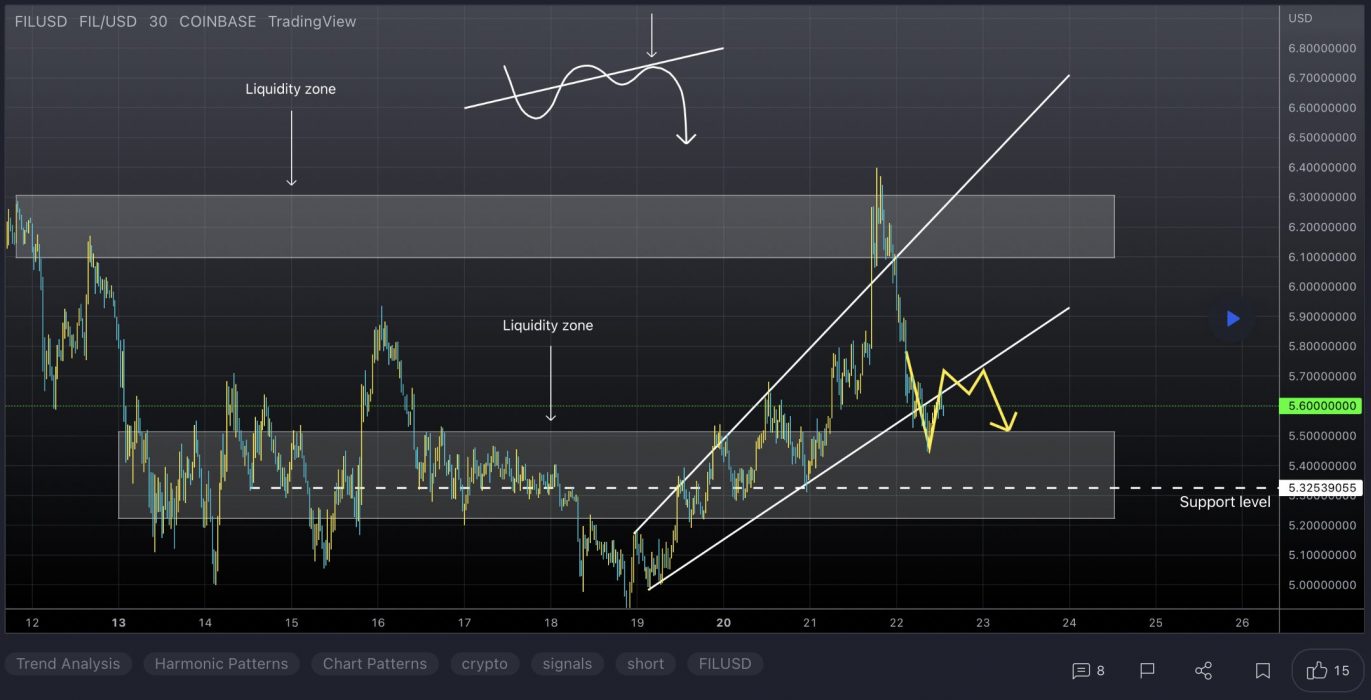

1. Filecoin (FIL)

Filecoin FIL is a decentralised storage system that aims to “store humanity’s most important information”. The project was first described back in 2014 as an incentive layer for the Interplanetary File System (IPFS), a peer-to-peer storage network. Filecoin is an open protocol backed by a blockchain that records commitments made by the network’s participants, with transactions using FIL, the blockchain’s native currency. The blockchain is based on both proof-of-replication and proof-of-space-time.

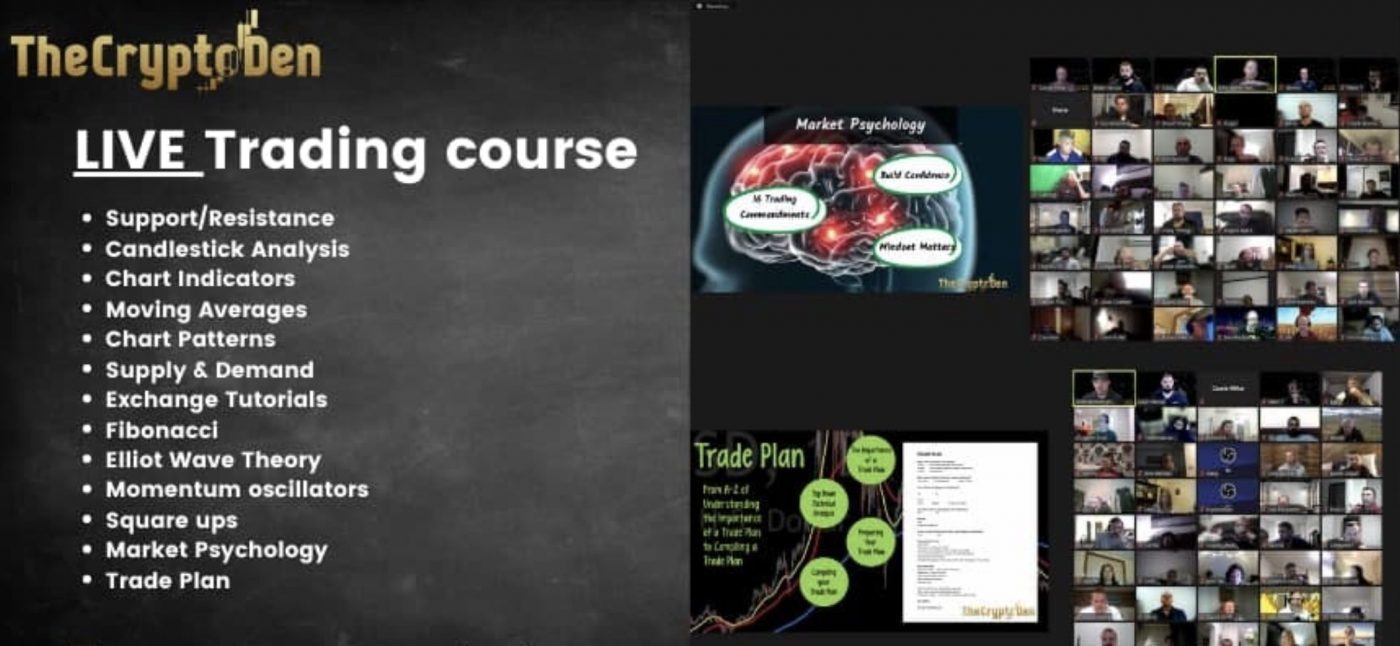

FIL Price Analysis

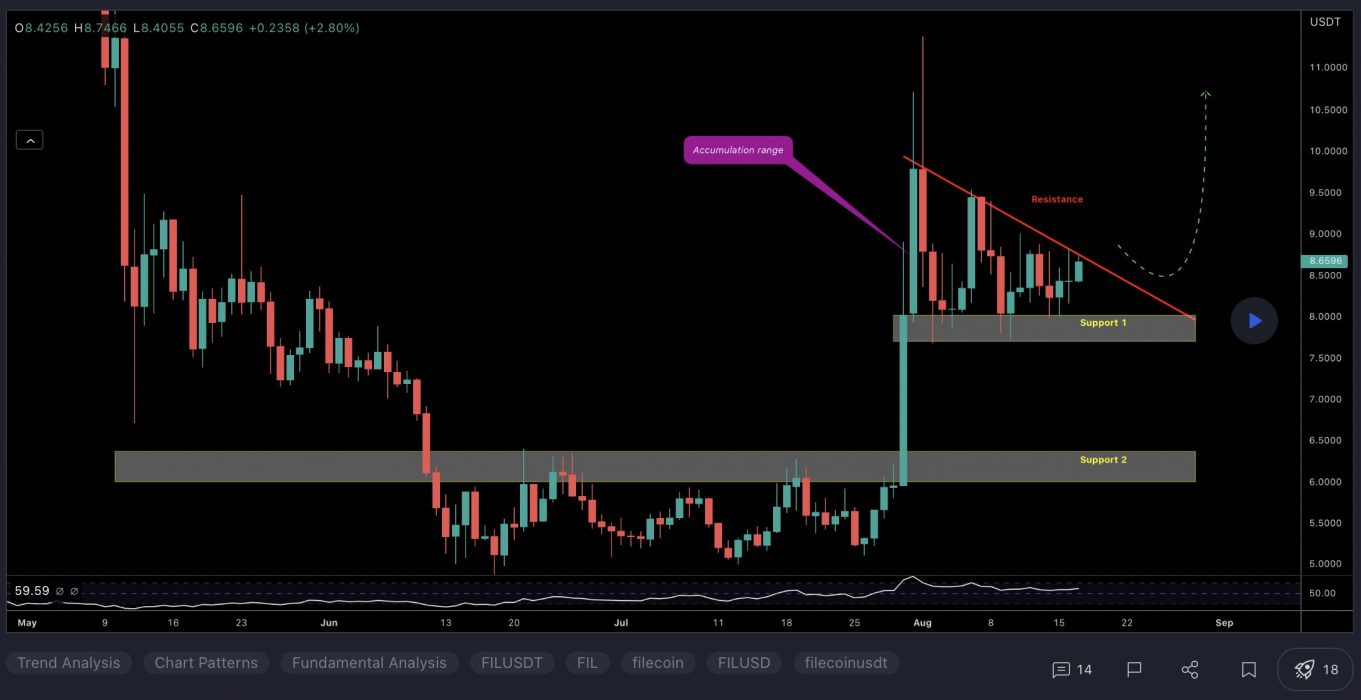

At the time of writing, FIL is ranked the 33rd cryptocurrency globally and the current price is US$8.22. Let’s take a look at the chart below for price analysis:

FIL has dropped 85% from its Q2 highs, finding support near $5.16 before starting a consolidation range. This level, near the lows, could continue to provide support. A year-long consolidation from 2019 to 2020 pivoted around this level many times. It’s also near the middle of the last down candle before 2020’s massive rally. A retest of this level would run bulls’ stops under swing lows formed in late June and early July.

The price is testing a closer area of possible support near $7.83. Bulls rejected bears many times in early July at this level. It’s also in the upper part of July’s swing low candle. The closest resistance is likely near $8.65. This area, up to $9.40, shows inefficient trading on the daily chart. It also contains the 9 and 18 EMAs.

If the price breaks through this level, it may aim for bears’ stops above $9.72. Even if it doesn’t reach these stops, the area between $9.96 and $10.18 could provide a bearish setup. Here, bears rejected bulls near the bottom of an area of inefficient trading on the weekly chart.

If the market turns more bullish, a rally beginning in this range may be aiming for the new monthly highs, near $10.40. This level is near the bottom of an area of inefficient trading on the daily chart.

2. Chiliz (CHZ)

Chiliz CHZ is the leading digital currency for sports and entertainment, powering the world’s first blockchain-based fan engagement and rewards platform, Socios.com. Here, fans can purchase and trade branded fan tokens as well as having the ability to participate, influence, and vote in club-focused surveys and polls. Founded in Malta in 2018, the company states its vision is to bridge the gap between active and passive fans, providing millions of sports fanatics with a fan token that acts as a tokenised share of influence.

CHZ Price Analysis

At the time of writing, CHZ is ranked the 46th cryptocurrency globally and the current price is US$0.2196. Let’s take a look at the chart below for price analysis:

CHZ‘s stunning rally to $0.2550 plummeted over 13% to sweep consolidation lows at $0.1925. This could set the stage for a new bullish cycle to begin.

The price is currently balancing around the monthly open. A quick stop run into support beginning near $0.1820 could set the stage for a move into the daily gap beginning near $0.1735, potentially reaching resistance near $0.2437.

A sweep of the highs near $0.2558, followed by a sharp sell-off, hints that bulls are preparing to run the swing high near $0.2647. This run could find the next resistance around $0.2846 in the candle wick that created the monthly high. If the market remains bullish, the price will likely reach into possible resistance near $0.3028.

3. Horizen (ZEN)

Horizen ZEN is an interoperable blockchain system supported by a decentralised node infrastructure. Its sidechain platform focuses on scalable data privacy, and as such enables businesses as well as developers to build private or public blockchains using the unique sidechain technology known as Zendoo. Horizen claims to be completely decentralised, fully customisable with privacy features, and supports low costs associated with building blockchains with configurable revenue models and an unlimited number of tokens and digital assets.

ZEN Price Analysis

At the time of writing, ZEN is ranked the 126th cryptocurrency globally and the current price is US$20.98. Let’s take a look at the chart below for price analysis:

ZEN saw an energetic run during Q1, climbing approximately 70% before cooling off into resistance beginning near $32.85 that pinned down last month’s attempt to rally, which is likely to retest possible support near $15.64.

A deeper marketwide retracement could take out the relatively equal lows below the weekly open and support near $18.23. This move may offer entries near probable support between $17.47 and $16.78.

However, more bullish market conditions may prompt a rally to the relatively equal highs near $24.67 into resistance beginning at $26.46. If the price reaches this level, the last high at $29.58 gives the next likely target before price discovery begins.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.