Well-known US e-commerce platform Bolt has bought the crypto payment service Wyre in a billion-dollar deal, with the Aussie start-up’s founder joining the Young Rich List as the Silicon Valley deal earns him more than A$260 million.

On May 5, Bolt announced that it had acquired Wyre for an estimated US$1.5 billion, netting the latter company’s Australian founder, Michael Dunworth, an estimated A$267 million for handing over his 12.5 per cent holding in the company.

Secure, Regulated Crypto-to-Fiat Payments

Wyre uses blockchain-based technology to offer merchants fast cross-border payments. The start-up also vends a crypto-based payments application programming interface (API) that allows businesses to plug directly into secure, regulated crypto-to-fiat payment infrastructure.

Founded in 2013, Wyre has spent the intervening years attaining its money-transmitter licences, now valid in 27 US states and also legally operable in China and Brazil.

This acquisition will pave the way for seamless, secure crypto transactions, and NFT enablement for our retailers.

Maju Kuruvilla, CEO, Bolt

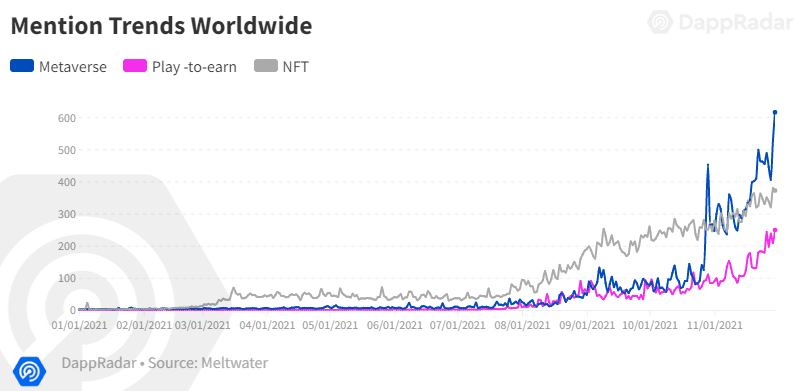

Growing Demand to Pay with Crypto

According to the press release from Bolt, the acquisition was made because of the “growing demand for purchasing goods and services with cryptocurrency and the opportunity of Web3”. Wyre’s API will help reduce the barriers to entry to utilise cryptocurrencies for payments from Bolt’s massive list of retailers.

Bolt CEO Maju Kuruvilla also stated in an interview that he hopes the integration will increase crypto adoption as it allows new functionality for “every crypto asset, every chain, to every merchant, irrespective of any shopping platform”.

Bolt is an incumbent in the payments space, and they can see crypto is where the market is heading […] They are like Peter Parker, and we’re the spider that’s going to bite them, turning them into Spider-Man.

Michael Dunworth, founder and CEO, Wyre

The newly added crypto functionality is planned to be fully integrated before the end of the year. Once complete, the acquisition will bring the power of Bolt’s CheckoutOS – its one-click checkout service that helps with authentication, payments, and fraud protection – to the cryptocurrency ecosystem.

This acquisition is the fulfilment of a longtime ambition. When I wrote the draft business plan for Bolt, I had always imagined cryptocurrency at its centre.

Ryan Breslow, founder and executive chairman, Bolt

Another Australian blockchain start-up, Lygon, recently secured more than A$12 million in funding for the joint venture of the ‘Big Four’ Australian banks and IBM to create the first digital bank guarantee.