The government of the United Kingdom (UK) is launching a taskforce to explore the concept of central bank digital currency (CBDC). Following a report on Monday, the UK now adds to the list of major countries studying a potential digital currency.

We’re launching a new taskforce between the Treasury and the Bank of England to coordinate exploratory work on a potential central bank digital currency (CBDC).

Rishi Sunak, British Finance Minister

UK Becomes Another Country Researching CBDC

The Bank of England (BoE) and the country’s Treasury will spearhead the new initiative, according to Sunak. They will drive the taskforce towards researching the benefits of launching a national digital currency. However, the UK has no immediate need to launch a digital currency, which the finance minister touted as “Britcoin”.

The Government and the Bank of England have not yet made a decision on whether to introduce a CBDC in the UK and will engage widely with stakeholders on the benefits, risks and practicalities of doing so.

Bank of England

The CBDC Taskforce also said consumers and businesses in the UK would use the digital currency alongside physical cash. This means the digital currency won’t replace the Pound Sterling and bank deposits outright.

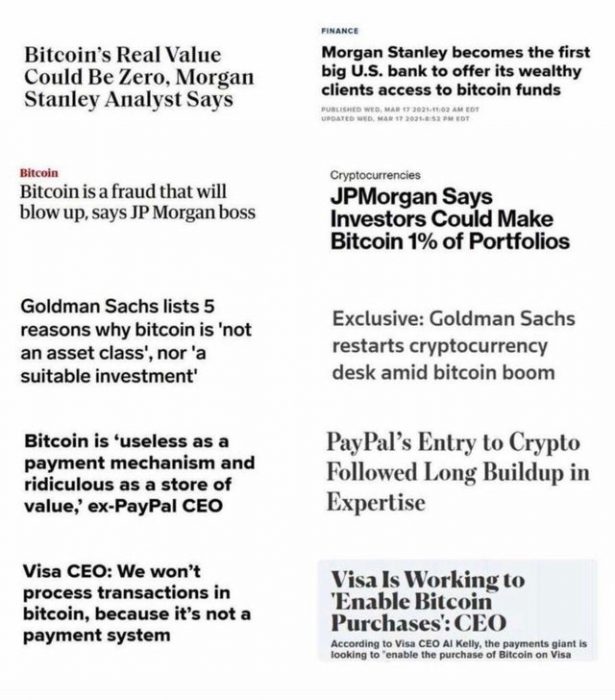

Interest in CBDC is Rising Globally

Many central banks in the world are beginning to research the possibility of launching the digital version of their national currency in the form of CBDC. This follows the growing interest in digital currencies for payment, seemingly propelled by the outbreak of the coronavirus pandemic.

Crypto News Australia recently reported that the Reserve Bank of Australia (RBA) intended to launch a wholesale CBDC. The RBA said it didn’t see any strong case for issuing a retail CBDC.