Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Stellar (XLM)

Stellar XLM is an open network that allows money to be moved and stored. When it was released, the goal was boosting financial inclusion by reaching the world’s unbanked – but soon after, its priorities shifted to helping financial firms connect with one another via blockchain technology. The network’s native token, lumens, serves as a bridge that makes it less expensive to trade assets across borders. All of this aims to challenge existing payment providers who often charge high fees for a similar service.

XLM Price Analysis

At the time of writing, XLM is ranked the 27th cryptocurrency globally and the current price is US$0.1225. Let’s take a look at the chart below for price analysis:

XLM set a high near $0.2457 in Q2 before retracing nearly 80% to find a low near $0.1038. The price consolidated around this level before the strong bullish impulse over the past several days.

Probable resistance near $0.1320 is slowing the bullish advance down. However, another leg may target the last swing high at $0.1426 and relatively equal highs at $0.1530. Resistance near $0.1659 could cap the move before the second swing high. Beyond these levels, little stands in the bulls’ way before reaching the swing high near $0.1846.

A retracement before a move higher might find support in the daily gap near $0.1204, just above the weekly open. Relatively equal lows near $0.1135 could also provide support. Run-on stops at $0.1064 and $0.09574 may find support in the gap beginning near $0.08912.

2. Basic Attention Token (BAT)

Basic Attention Token BAT is the token that powers a new blockchain-based digital advertising platform designed to fairly reward users for their attention while providing advertisers with a better return on their ad spend. The Basic Attention Token itself is the unit of reward in this advertising ecosystem and is exchanged between advertisers, publishers and users. Advertisers pay for their advertising campaigns in BAT tokens. Out of this budget, a small portion is distributed to advertisers, while 70% is distributed to users – whereas the intermediaries that typically drive up advertising costs are cut out of the equation to improve cost-efficiency.

BAT Price Analysis

At the time of writing, BAT is ranked the 67th cryptocurrency globally and the current price is US$0.4518. Let’s take a look at the chart below for price analysis:

BAT has dropped nearly 75% from its Q2 2022 high and 89% from its November 2021 all-time high.

Support might have formed last week from $0.3734 to $0.4065 and should hold if bulls are ready for a bounce. This zone overlaps with an inefficiently traded area on the weekly chart from $0.3653 to $0.3394.

If this level breaks, bears may target an inefficiently traded area on the monthly chart from $0.3147 to $0.3032. Below this level, $0.2845 to $0.2780 could provide support after a run on bulls’ stops under the Q4 2020 lows into an area of significant accumulation.

The closest resistance begins near $0.4983. This level has confluence with the 9 EMA and a brief consolidation before May 11’s spike downward.

A more significant rally might find resistance near $0.5540. This level is inefficiently traded and has confluence with the lows of last summer’s accumulation and the 18 EMA.

If the market becomes more bullish, $0.6245 may provide the next resistance. This level is slightly above the May monthly open, overlaps with multiple old lows, and aligns with the 40 EMA.

3. Internet Computer (ICP)

The Internet Computer ICP is the world’s first blockchain that runs at web speed with unbounded capacity. It also represents the third major blockchain innovation, alongside Bitcoin and Ethereum. The Internet Computer scales smart contract computation and data, runs them at web speed, processes and stores data efficiently, and provides powerful software frameworks to developers. By making this possible, it enables the complete re-imagination of software, providing a revolutionary new way to build tokenised internet services, pan-industry platforms, decentralised financial systems, and even traditional enterprise systems and websites.

ICP Price Analysis

At the time of writing, ICP is ranked the 35th cryptocurrency globally and the current price is US$7.83. Let’s take a look at the chart below for price analysis:

ICP has dropped 60% from its most recent Q2 high as it continues its nine-month downtrend. The edge of the recent swing’s lower candle bodies could provide the closest support, near $6.42. This level overlaps with the 100% extension of June’s opening rally.

Currently, the price is testing possible resistance near $8.20. This level has confluence with the 9 EMA. It is unclear if it will hold as resistance, but it’s reasonable to anticipate a run above bears’ stops at $8.75.

If the price breaks through this resistance, it may find its next resistance near $8.97. This level is near the midpoint of May 12’s swing low and the midpoint of an inefficiently traded area on the weekly chart.

A rally this high may reach slightly higher, near $9.15. This area formed the base of the June opening rally, shows inefficient trading on the daily chart, and is at the low end of May’s accumulation range.

Below, there is no historical price action to suggest possible support. The next downside targets may be near $6.70 and $5.92. These approximate levels are near the 150% and 200% extensions of June’s opening rally.

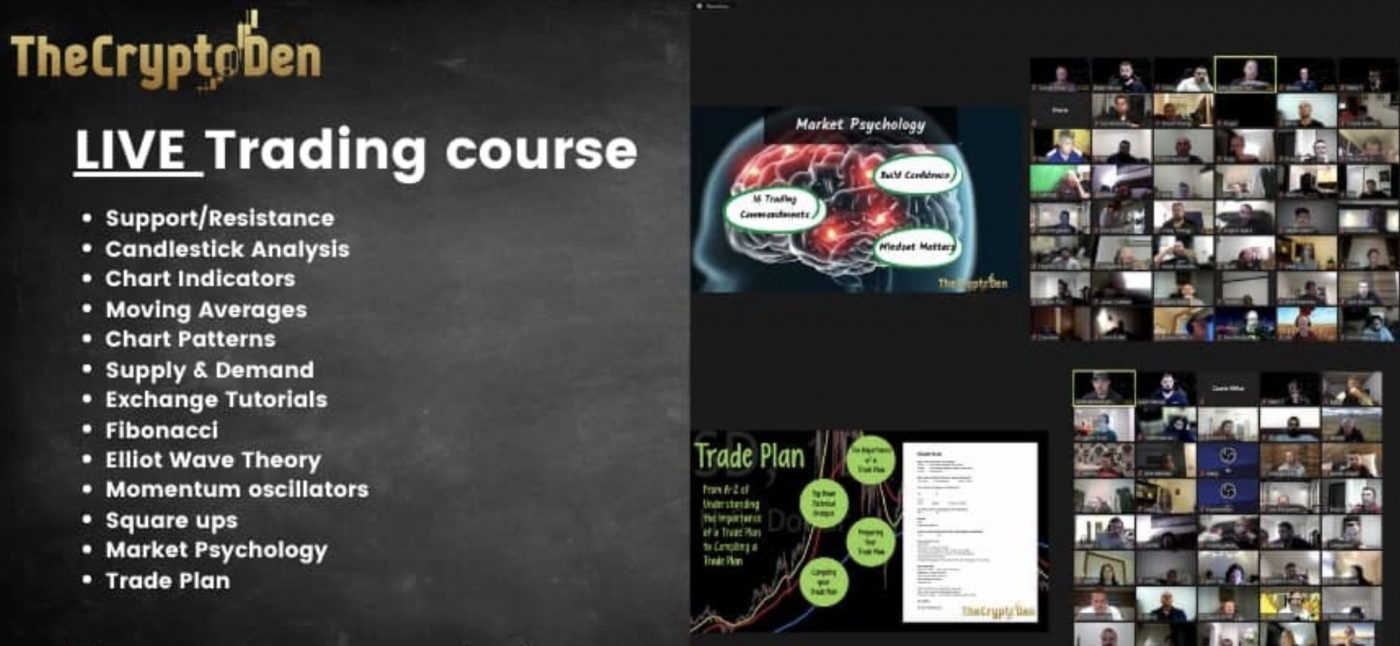

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.