Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Litecoin (LTC)

Litecoin LTC is a cryptocurrency designed to provide fast, secure, and low-cost payments by leveraging the unique properties of blockchain technology. The cryptocurrency was created based on the Bitcoin protocol, but it differs in terms of the hashing algorithm used, hard cap, block transaction times, and a few other factors. Litecoin has a block time of just 2.5 minutes and extremely low transaction fees, making it suitable for micro-transactions and point-of-sale payments.

LTC Price Analysis

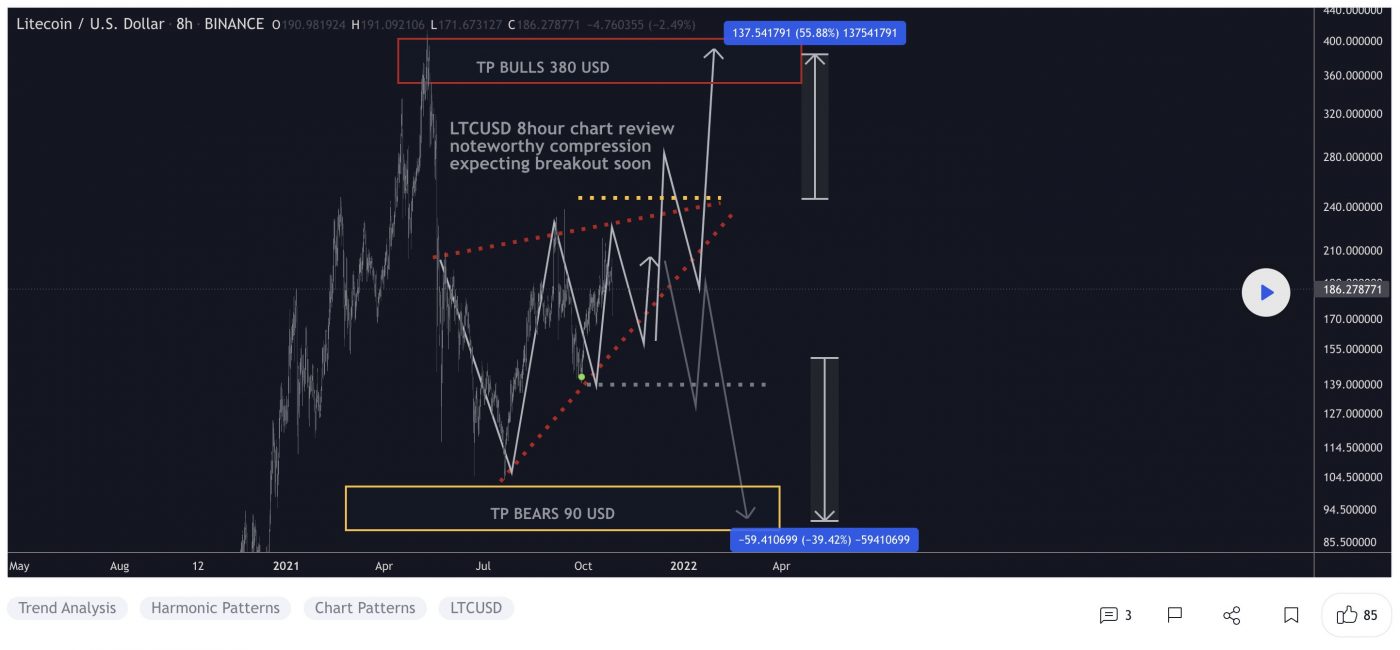

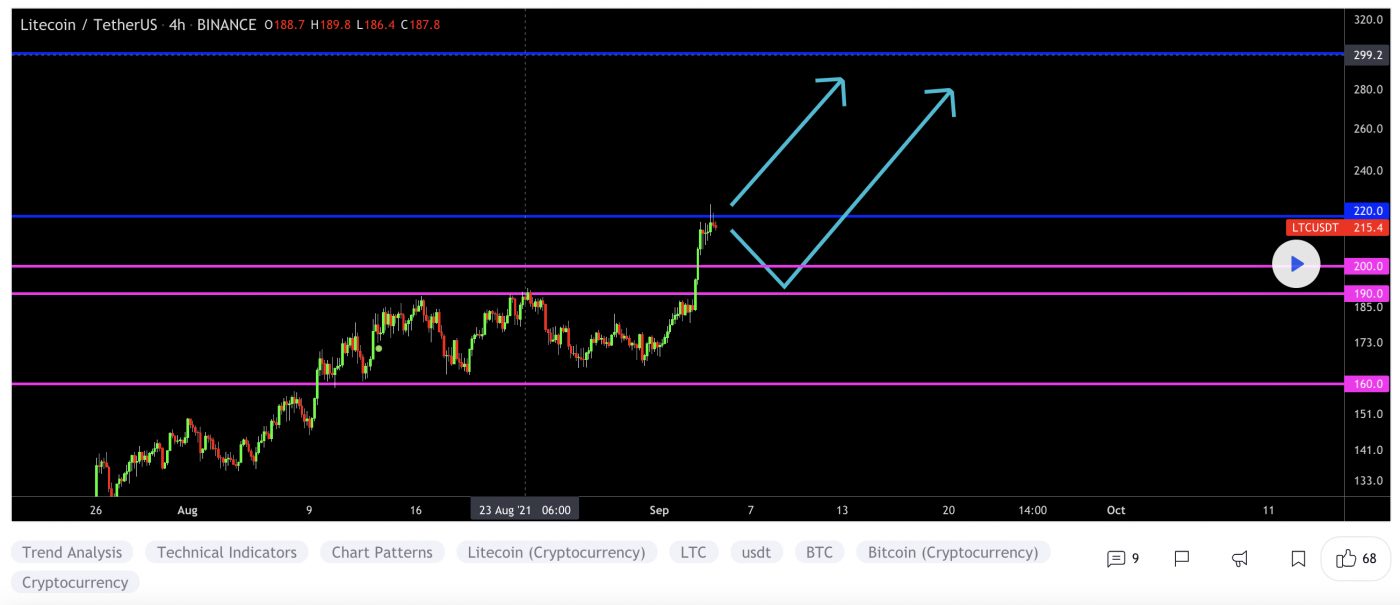

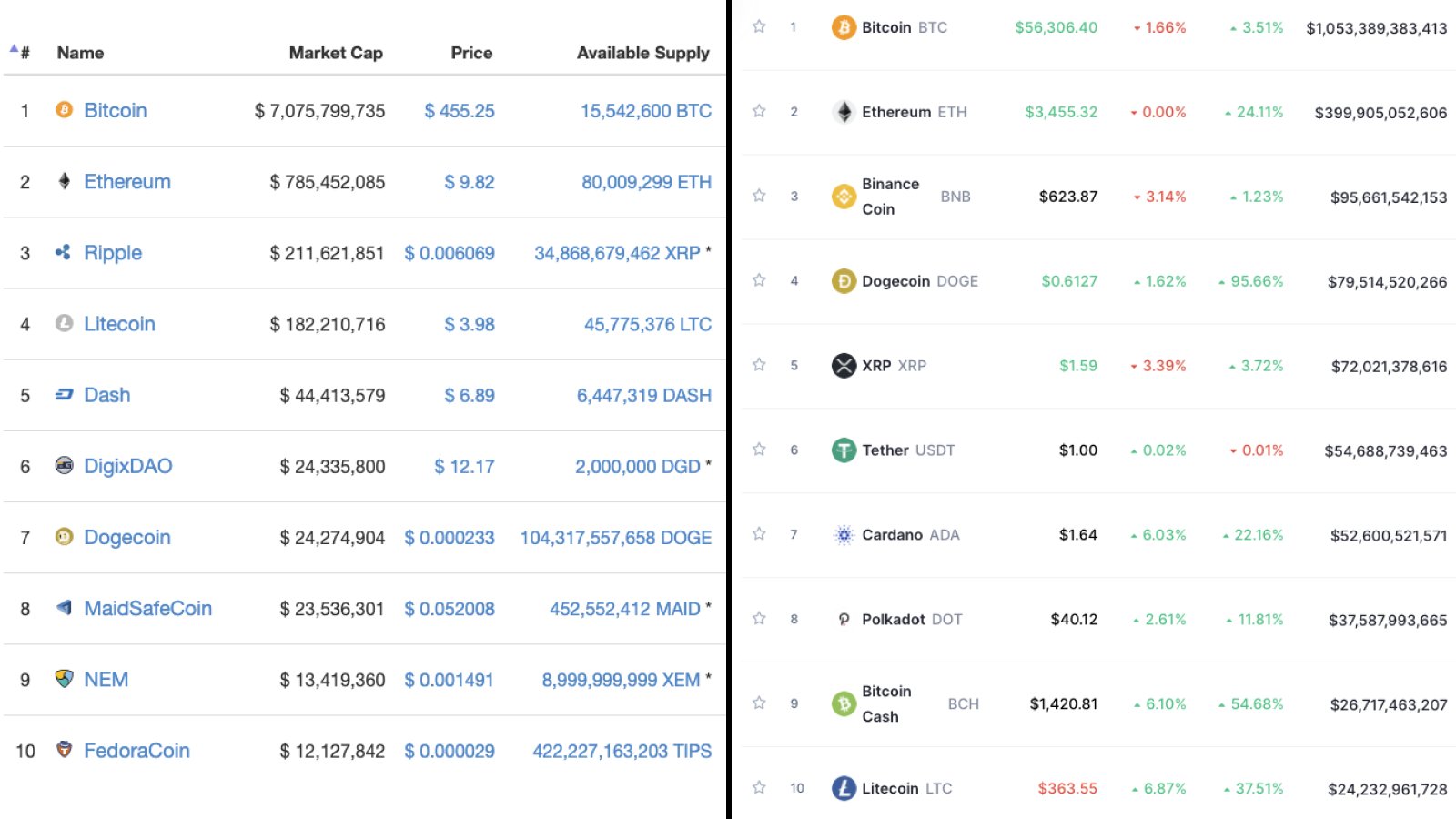

At the time of writing, LTC is ranked the 18th cryptocurrency globally and the current price is US$165.15. Let’s take a look at the chart below for price analysis:

After setting a low in late September, LTC kicked off a bullish trend that rallied nearly 85% by November to break the monthly highs.

The following 50% plummet found support near $150.36, sweeping under the 40 EMA into the 61.8% retracement level before bouncing to resistance beginning at $162.43.

This area could continue to provide resistance, possibly causing a retracement to the 9 EMA and 18 EMA near $175.12, where aggressive bulls might begin bidding. The level near $180.98, which has confluence with the 40 EMA, may see more interest from bulls loading up for an attempt on probable resistance beginning near $198.05.

However, if Bitcoin continues its sideways trend, much lower prices could be seen. The old support near $145.18 could provide at least a short-term bounce. If this level fails, the old highs near $138.44 might also give support and see the start of a new bullish cycle after retesting these support levels.

2. Oasis Network (ROSE)

The Oasis Network ROSE is the first privacy-enabled blockchain platform for open finance and a responsible data economy. Combined with its high throughput and secure architecture, the Oasis Network is able to power private, scalable DeFi, revolutionizing Open Finance and expanding it beyond traders and early adopters to a mass market. Its unique privacy features can not only redefine DeFi but also create a new type of digital asset called Tokenised Data that can enable users to take control of the data they generate and earn rewards for staking it with applications – creating the first-ever responsible data economy.

ROSE Price Analysis

At the time of writing, ROSE is ranked the 98th cryptocurrency globally and the current price is US$0.2549. Let’s take a look at the chart below for price analysis:

ROSE has dropped nearly 78% since late November and found a low in early December, with price action now trending upward through a higher-timeframe range.

The area beginning near $0.3046 has provided strong resistance and may do so again. However, relatively equal highs near $0.3512 offer a tempting target for bulls. A run of these highs may reach up into the daily gap near $0.3814.

Aggressive bulls might add to their positions near $0.2478. If the price breaks through this level, it may be reaching for the cluster of swing lows near $0.2254 and $0.2015. A more substantial move down may run stops below the relatively equal monthly lows, around $0.1866, into the daily gap at this level.

3. Elrond (EGLD)

Elrond EGLD is a blockchain protocol that seeks to offer extremely fast transaction speeds by using sharding. The project describes itself as a technology ecosystem for the new internet, which includes fintech, decentralised finance, and the Internet of Things. Its smart contracts execution platform is reportedly capable of 15,000 transactions per second, six-second latency, and a $0.001 transaction cost. The blockchain has a native token known as eGold, or EGLD, that is used for paying network fees, staking, and rewarding validators.

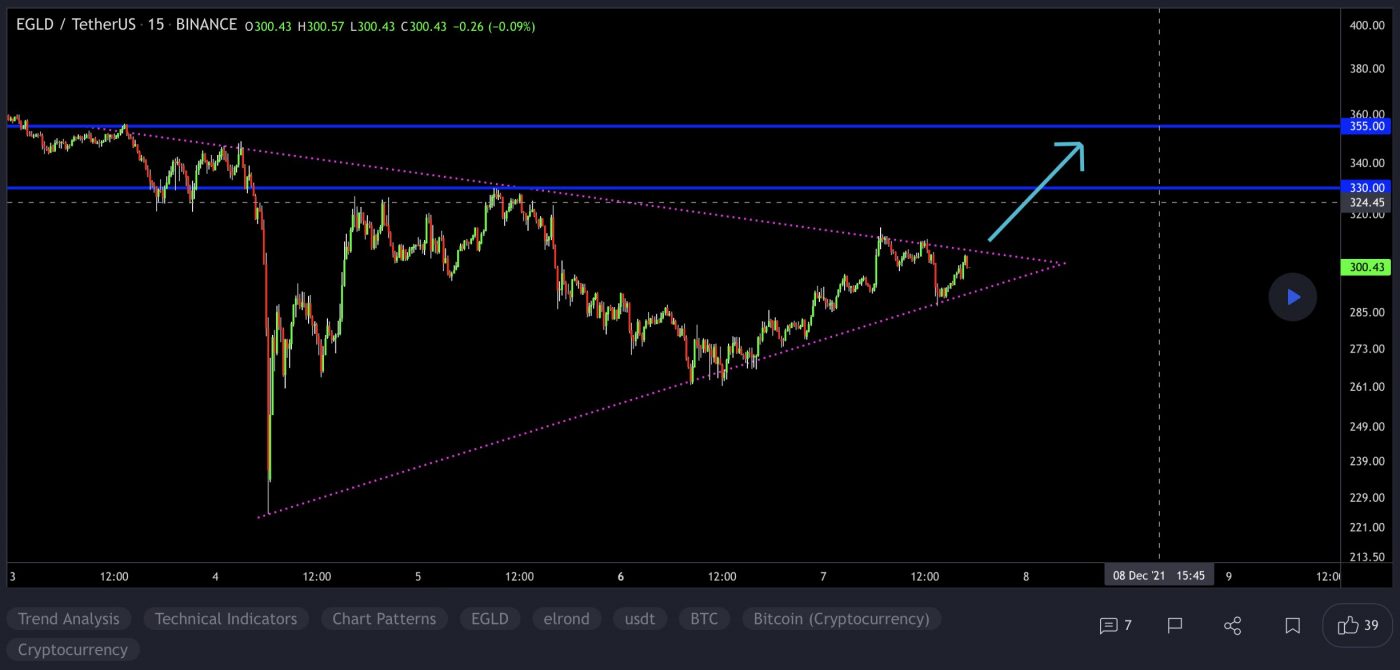

EGLD Price Analysis

At the time of writing, EGLD is ranked the 30th cryptocurrency globally and the current price is US$294.41. Let’s take a look at the chart below for price analysis:

EGLD‘s 65% retracement from its Novembers highs set a low near $285.23 during its consolidation that began in early December.

Relatively equal highs near $312.44 could be the current target if the price breaks through resistance beginning near $322.50. Bullish continuation might reach through the next significant swing high near $330.71 into the daily gap near $335.16,

If bullish strength continues, the zones just below the monthly open near $344.69 and $359.87 could halt any retracement.

A bearish shift in the market might seek the relatively equal lows near $278.19 into possible support near $370.43 If this down move occurs, the swing low near $361.22 and possible support near $349.70 may be the primary objective.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Duration: 6-week course

From: November 15 to December 22

Date/Time: Twice a week, Mon and Wed at 7pm AEST

Location: Zoom webinar

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.