Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Litecoin (LTC)

Litecoin LTC is a cryptocurrency designed to provide fast, secure and low-cost payments by leveraging the unique properties of blockchain technology. The cryptocurrency was created based on the Bitcoin protocol, but it differs in terms of the hashing algorithm used, hard cap, block transaction times, and a few other factors. Litecoin has a block time of just 2.5 minutes and extremely low transaction fees, making it suitable for micro-transactions and point-of-sale payments.

LTC Price Analysis

At the time of writing, LTC is ranked the 20th cryptocurrency globally and the current price is US$103.65. Let’s take a look at the chart below for price analysis:

After setting a low last month, LTC kicked off a recovery trend that gained nearly 20% to break the weekly highs.

The following 65% plummet found support near $102.36, sweeping under the 40 EMA into the 61.8% retracement level before bouncing to resistance beginning at $120.53.

This area could continue to provide resistance, possibly causing a retracement to the 9 EMA and 18 EMA near $125.12, where aggressive bulls might begin bidding. The level near $134.98, which has confluence with the 40 EMA, may see more interest from bulls loading up for an attempt on probable resistance beginning near $147.13.

However, if Bitcoin continues its sideways trend, much lower prices could be seen. The old support near $100.18 could provide at least a short-term bounce. If this level fails, the old monthly lows near $91.23 might also give support and see the start of a new bullish cycle after retesting these support levels.

2. Stellar (XLM)

Stellar XLM is an open network that allows money to be moved and stored. When it was released, the goal was boosting financial inclusion by reaching the world’s unbanked – but soon after, its priorities shifted to helping financial firms connect with one another through blockchain technology. The network’s native token, lumens, serves as a bridge that makes it less expensive to trade assets across borders. All of this aims to challenge existing payment providers who often charge high fees for a similar service.

XLM Price Analysis

At the time of writing, XLM is ranked the 30th cryptocurrency globally and the current price is US$0.1902. Let’s take a look at the chart below for price analysis:

XLM set a high near $0.2557 in early April before retracing nearly 25% to find a low near $0.1780. The price consolidated around this level before the strong bullish impulse during the past several weeks.

Probable resistance near $0.2478 is slowing the bullish advance down. However, another leg might target the last swing high at $0.2822 and relatively equal highs at $0.3136. Resistance near $0.3359 could cap the move before the second swing high. Beyond these levels, little stands in the bulls’ way before reaching the swing high near $0.3856.

A retracement before a move higher might find support in the daily gap near $0.1743, just above the monthly open. Relatively equal lows near $0.1675 could also provide support. Run-on stops at $0.1605 and $0.1583 might find support in the gap beginning near $0.1520.

3. Kava.io (KAVA)

KAVA is a cross-chain DeFi lending platform that allows users to borrow USDX stablecoins and deposit a variety of cryptocurrencies to begin earning a yield. The Kava DeFi hub operates as a decentralised bank for digital assets, allowing users to access a range of decentralised financial services, including its native USD-pegged stablecoin, USDX, as well as synthetics and derivatives. Through Kava, users are able to borrow USDX tokens by depositing collateral, effectively leveraging their exposure to crypto-assets.

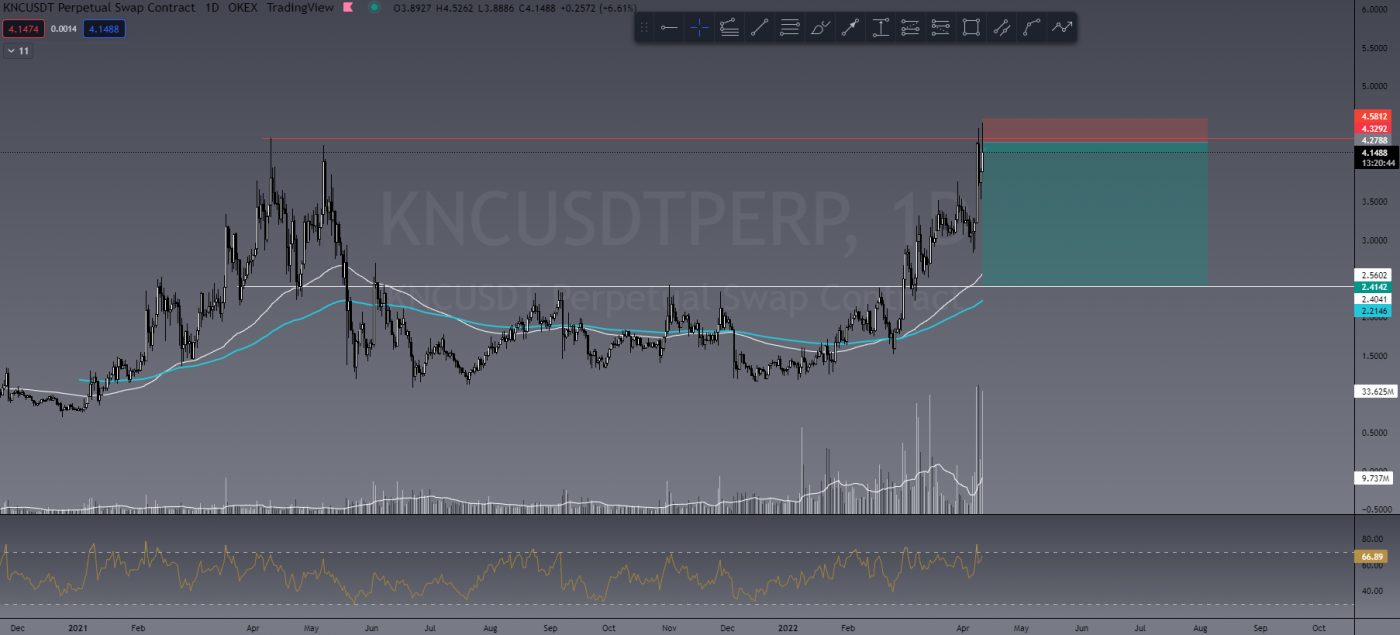

KAVA Price Analysis

At the time of writing, KAVA is ranked the 96th cryptocurrency globally and the current price is US$4.07. Let’s take a look at the chart below for price analysis:

The last year saw KAVA travel through a massive range from approximately $8.00 to $3.66. Currently, it is trending downward into the range lows.

Resistance might be found just above the current price, beginning near $4.75. This area has confluence with the 9 and 18 EMAs.

A stronger retracement against the bearish trend could reach the 40 EMA and the March monthly open, near $3.70.

Although unlikely in the current bearish market conditions, a more significant rally might reach over the 2022 yearly open to test an inefficiently traded area from $4.19 to $4.48.

During Q1, the price bounced from the support between $3.15 to $3.00 while wicking just under a narrow support zone at $2.89. These two levels could provide support again.

However, the price has been consolidating on higher timeframes since late January. Given the current bearish market conditions, it seems likely that a retest of these two support levels may fail.

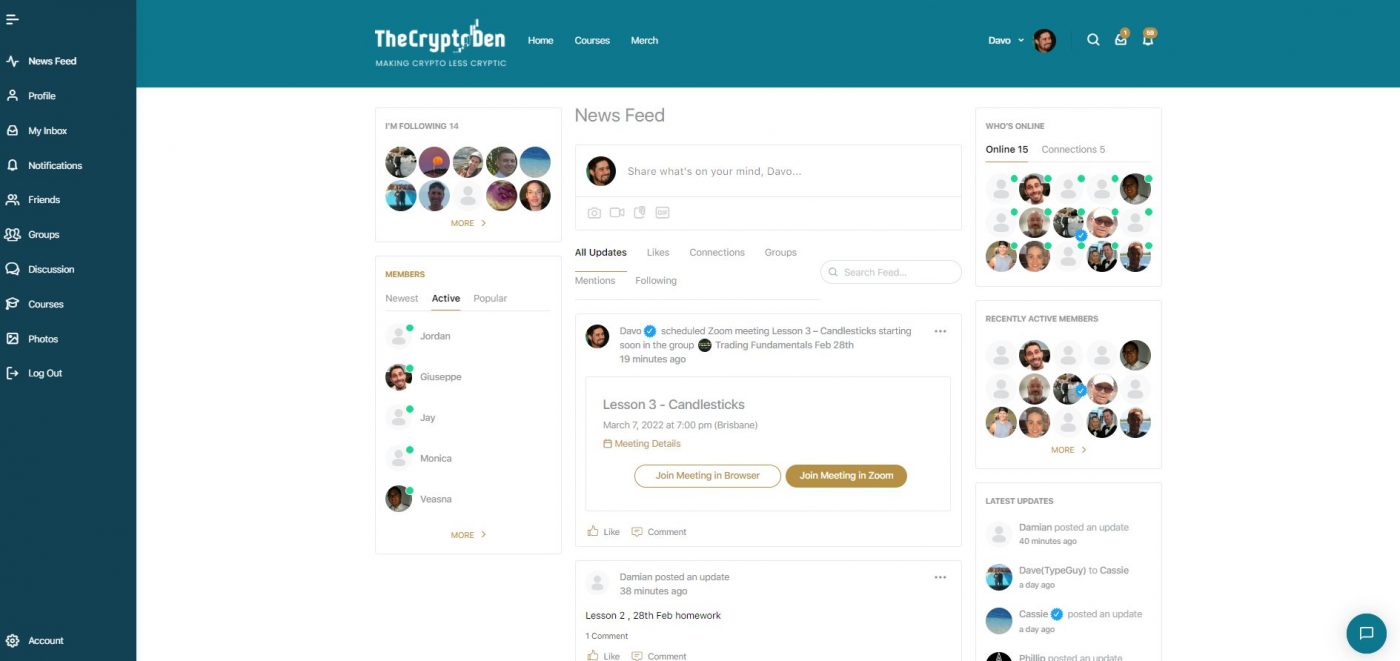

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.