Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Filecoin (FIL)

Filecoin FIL is a decentralised storage system that aims to “store humanity’s most important information”. The project was first described back in 2014 as an incentive layer for the Interplanetary File System (IPFS), a peer-to-peer storage network. Filecoin is an open protocol backed by a blockchain that records commitments made by the network’s participants, with transactions using FIL, the blockchain’s native currency. The blockchain is based on both proof-of-replication and proof-of-spacetime.

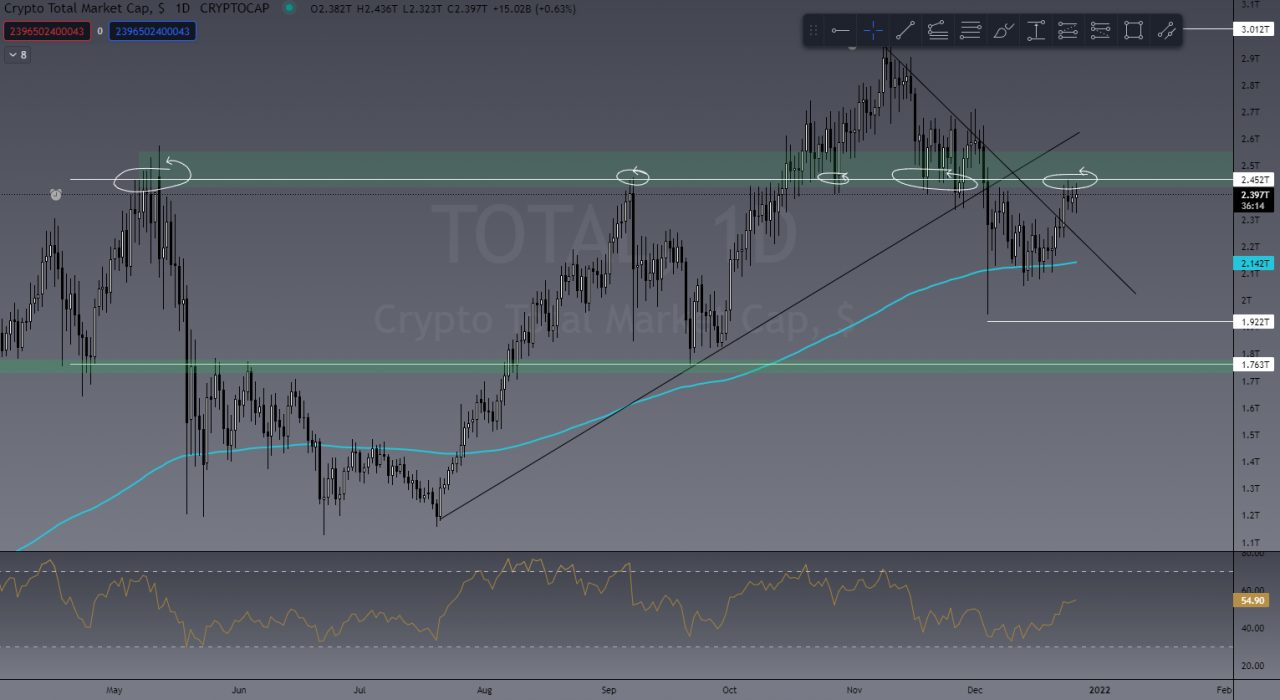

FIL Price Analysis

At the time of writing, FIL is ranked the 36th cryptocurrency globally and the current price is US$36.96. Let’s take a look at the chart below for price analysis:

After retracing nearly 75% from its October high, FIL set a low near $33.57 as it formed its current range.

Last week, the price swept highs near $40.34. Relatively equal daily highs near $45.23 provide a reasonable target, although resistance beginning near $47.68 could cap the move. A break of this resistance is likely to target the swing high near $50.12 into higher-timeframe resistance beginning near $58.07.

The current area near $33.40 could provide support, although bulls may be more likely to buy near the price fractal near $30.15 if a retracement reaches this level. A break of this area could continue down to sweep the monthly low near $28.93 into possible support beginning near $25.36.

2. Gala (GALA)

GALA aims to take the gaming industry in a different direction by giving players back control over their games. Gala Games’ mission is to make “blockchain games you’ll actually want to play”. The project wants to change the fact that players can spend hundreds of dollars on in-game assets, and countless hours playing the game, all of which could be taken away from them with the click of a button. It plans to reintroduce creative thinking into games by giving players control of the games and in-game assets with the help of blockchain technology.

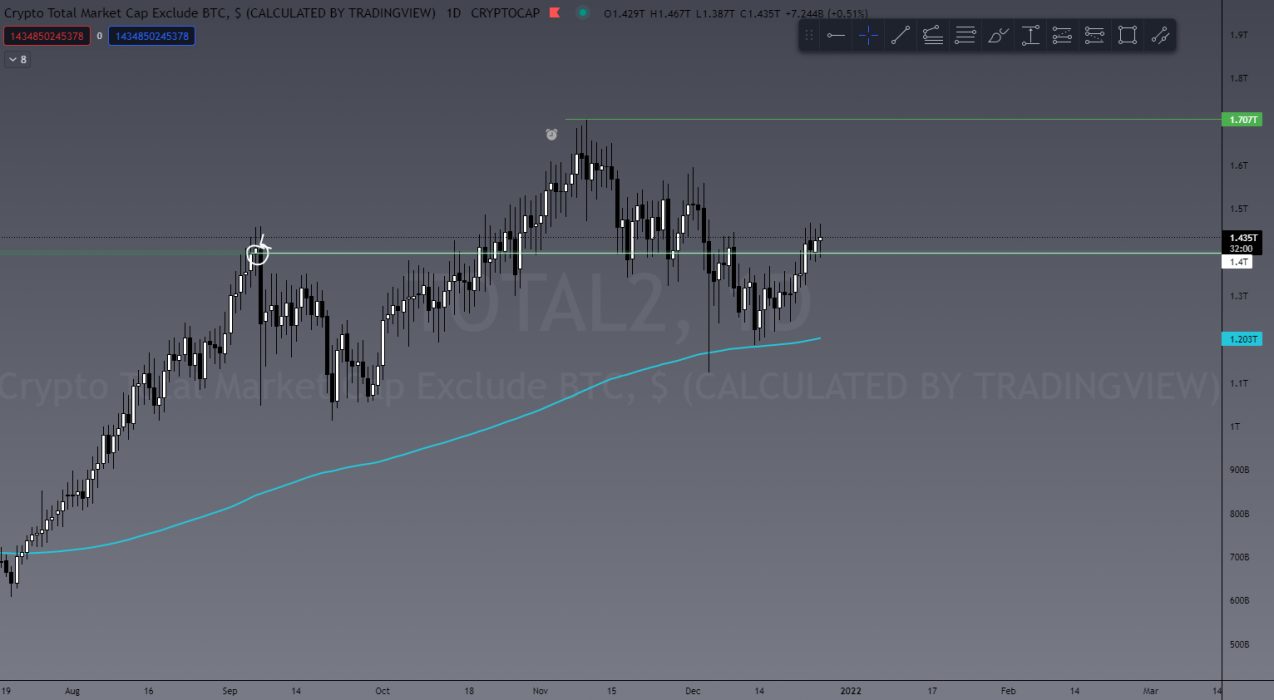

GALA Price Analysis

At the time of writing, GALA is ranked the 55th cryptocurrency globally and the current price is US$0.4285. Let’s take a look at the chart below for price analysis:

After setting a low in late October, GALA kicked off a bullish trend that rallied nearly 500% by November to break the new all-time highs.

The following 60% plummet found support near $0.4066, sweeping under the 40 EMA into the 61.8% retracement level before bouncing to resistance beginning at $0.4630.

This area could continue to provide resistance, possibly causing a retracement to the 9 EMA and 18 EMA near $0.5212, where aggressive bulls might begin bidding. The level near $0.5540, which has confluence with the 40 EMA, may see more interest from bulls loading up for an attempt on probable resistance beginning near $0.6180.

However, if Bitcoin continues its sideways trend, much lower prices could be seen. The old support near $0.3931 could provide at least a short-term bounce. If this level fails, the old highs near $0.3550 might also give support and see the start of a new bullish cycle after retesting these support levels.

3. Smooth Love Potion (SLP)

Smooth Love Potion SLP tokens are earned by playing the Axie Infinity game. This digital asset serves as a replacement for experience points. SLP are ERC-20 tokens, and they can be used to breed new digital pets known as Axies. The cost of breeding begins at 100 SLP but increases gradually, rising to 200 SLP for the second breed, 300 for the third, 500 for the fourth, 800 for the fifth, and 1,300 for the sixth. Axies can be bred a maximum of seven times, and the seventh breed costs 2,100 SLP. This limit exists in order to prevent hyperinflation in the marketplace.

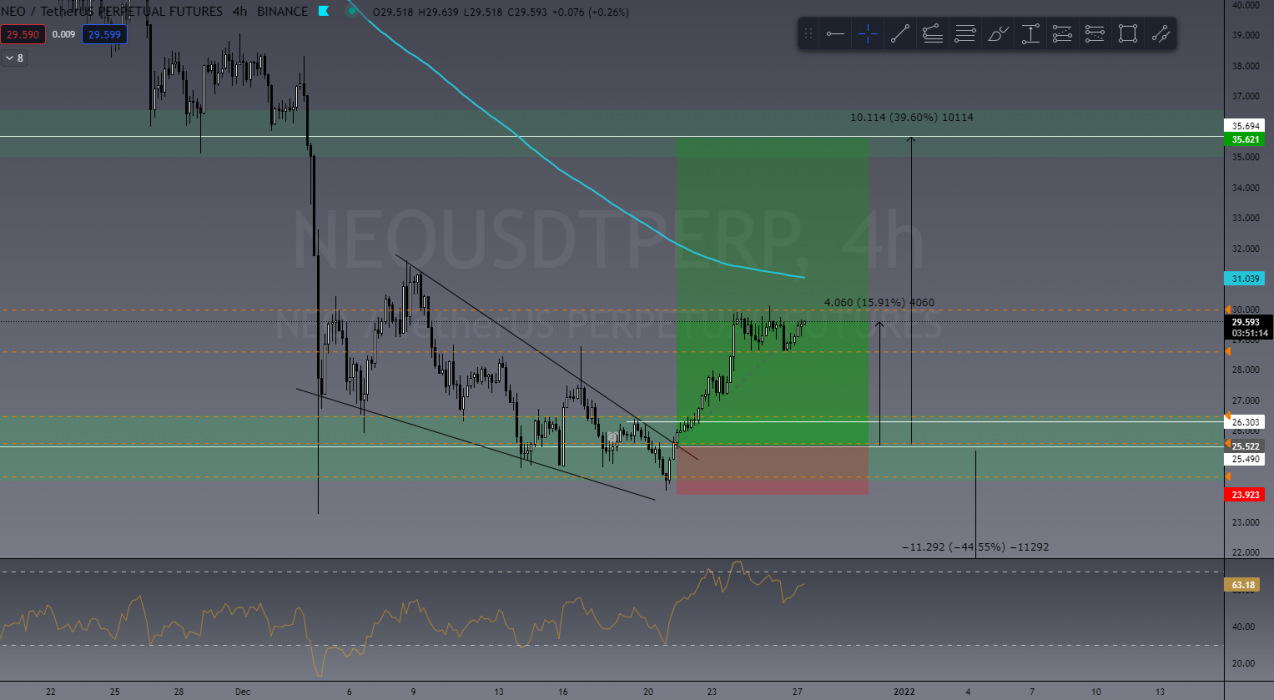

SLP Price Analysis

At the time of writing, SLP is ranked the 504th cryptocurrency globally and the current price is US$0.02532. Let’s take a look at the chart below for price analysis:

SLP‘s 83% rally during Q4 ran into 45% retracement near $0.02515. Since then, the price has been consolidating in a 120% range between $0.02324 and $0.02945.

Just below the late-December low, $0.02397 is the first level likely to provide substantial support. If the price breaks down through this level, overlapping levels near $0.02278 might cap a run on the lows near $0.02104 and $0.02035.

The higher-timeframe analysis points to the area near $0.02851 as the next substantial resistance. Significant selling has been occurring here on the daily chart. If this level breaks, the swing highs near $0.03247 and $0.03740 may be the next targets.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.