Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Binance Coin (BNB)

Binance BNB is the biggest cryptocurrency exchange globally, based on daily trading volume. Binance aims to bring cryptocurrency exchanges to the forefront of world financial activity. Aside from being the largest cryptocurrency exchange, Binance has launched a whole ecosystem of functionalities for its users. The Binance network includes the Binance Chain, Binance Smart Chain, Binance Academy, Trust Wallet, and Research projects, which all employ the powers of blockchain technology to bring new-age finance to the world. Binance Coin is an integral part of the successful functioning of many of the Binance sub-projects.

BNB Price Analysis

At the time of writing, BNB is ranked the 3rd cryptocurrency globally and the current price is US$548.67. Let’s take a look at the chart below for price analysis:

After a 60% decline from August to September, BNB has ranged between $650.23 and $516.55.

The recent rally was approaching probable resistance near $610.33 but could be aiming for stops above the relatively equal highs near $560.21. Continuation of the bullish move could target the daily gap near $578.12.

Aggressive bulls might add to positions near $557.67 and $550.32. Price action near $528.66 may be more likely to provide support – if it gets there – during any retracements.

Relatively equal lows clustered around $487.47 seem likely to be swept if the bearish trend resumes. If this move occurs, the price might find support at the significant higher-timeframe level near $445.90.

2. Solana (SOL)

Solana SOL is a highly functional open-source project that banks on blockchain technology’s permissionless nature to provide decentralised finance (DeFi) solutions. The Solana protocol is designed to facilitate decentralised app (DApp) creation. It aims to improve scalability by introducing a proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of the blockchain.

SOL Price Analysis

At the time of writing, SOL is ranked the 5th cryptocurrency globally and the current price is US$186.04. Let’s take a look at the chart below for price analysis:

SOL retraced nearly 65% from its high before finding a low during last week. Since then, the price has been sweeping stops on both sides of its local range as the current consolidation sets up the next move.

Aggressive bulls might bid near $172.34, although a sweep of the stops near $165.61 could reach below the next swing low into possible support near $150.12. A continued downtrend might run into the weekly gap near $144.26.

Some bears might add more shorts near $195.87, although a push to $210.66 is reasonable. A daily candle close over the swing high near $230.04 could suggest that a longer-term trend reversal is in play, with bulls possibly entering on a retracement near $245.32 for monthly high prices.

3. Polygon (MATIC)

Polygon MATIC is the first well-structured, easy-to-use platform for Ethereum scaling and infrastructure development. Its core component is Polygon SDK, a modular, flexible framework that supports building multiple types of applications. The MATIC token will continue to exist and will play an increasingly important role, securing the system and enabling governance.

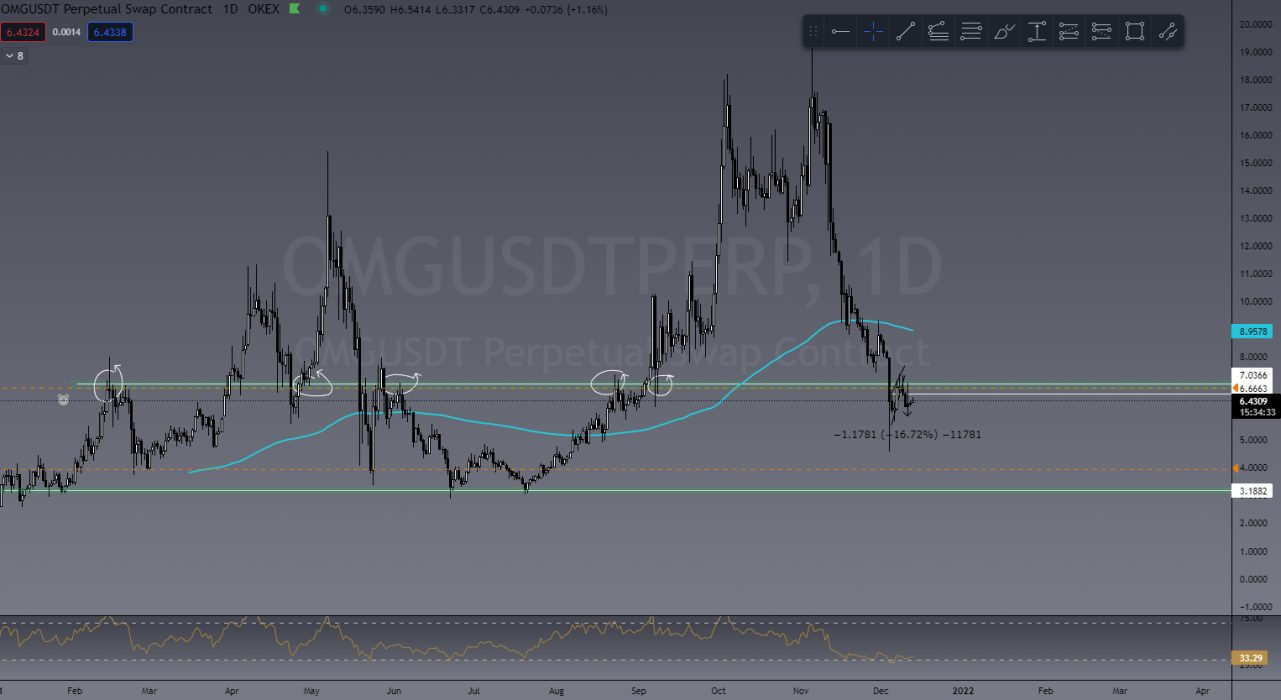

MATIC Price Analysis

At the time of writing, MATIC is ranked the 14th cryptocurrency globally and the current price is US$2.18. Let’s take a look at the chart below for price analysis:

Q4 2021 marked a turning point for MATIC, with the price rocketing up almost 125% from its lows to probable resistance beginning near $2.45.

The price is currently struggling with the area between $1.88 and $2.23. This region could provide support after a close above, or resistance after a close below.

A retracement could reach into the daily gap and possible support around $2.08. A more bearish shift in the marketplace will likely aim for the relatively equal lows near $1.92, and the potential support just below that begins around $1.85.

Continuation to the upside will likely target the recent monthly highs near $2.30. However, probable resistance beginning at $2.36 and $2.42 could cap or slow down this move.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.